Onelife Capital Advisors Ltd Demonstrates Resilience Amid Broader Market Decline

2025-04-03 11:00:11Onelife Capital Advisors Ltd, a microcap player in the Finance/NBFC sector, has shown significant activity today, hitting its upper circuit limit with a high price of Rs 10.43. The stock experienced a positive change of Rs 0.49, translating to a 4.93% increase. This performance notably outpaced the sector, which recorded a mere 0.01% return today. The stock's trading range was between Rs 9.57 and Rs 10.43, with a total traded volume of approximately 0.06385 lakh shares, resulting in a turnover of Rs 0.00654 crore. The stock's last traded price (LTP) stands at Rs 10.43, reflecting a 1D return of 4.63%, while the broader market, represented by the Sensex, saw a decline of 0.19%. In terms of moving averages, Onelife Capital Advisors is currently above its 5-day and 20-day averages but below the 50-day, 100-day, and 200-day averages. Despite a noted decrease in investor participation, with delivery volume fal...

Read MoreOnelife Capital Advisors Sees Strong Buying Activity Amid Market Decline

2025-04-03 10:45:06Onelife Capital Advisors Ltd is currently witnessing significant buying activity, with a notable 4.95% increase in its stock price today, contrasting sharply with the Sensex, which has declined by 0.29%. Over the past week, Onelife has gained 7.29%, while the Sensex has dropped 1.56%. This trend of consecutive gains highlights a strong upward momentum for the microcap finance company. In terms of price performance, Onelife Capital Advisors opened with a gap up and reached an intraday high, reflecting robust buyer interest. Despite a challenging year-to-date performance of -36.14% compared to the Sensex's -2.23%, the stock has shown resilience in the short term, outperforming its sector by 4.71% today. Factors contributing to the buying pressure may include recent developments within the company or broader market dynamics favoring microcap stocks. While Onelife's longer-term performance remains under press...

Read MoreOnelife Capital Advisors Ltd Experiences Surge Amid Declining Investor Participation

2025-04-02 10:00:45Onelife Capital Advisors Ltd, a microcap player in the Finance/NBFC sector, has shown significant activity today, hitting its upper circuit limit with a high price of Rs 9.96. The stock experienced a notable change of Rs 0.47, translating to a percentage increase of 4.95%. This performance marks a continuation of positive momentum, as the stock has gained 9.59% over the past two days. Today's trading saw a total volume of 0.0335 lakh shares, resulting in a turnover of Rs 0.0032629 crore. The stock's performance today outpaced its sector by 4.49%, while the broader market, represented by the Sensex, recorded a modest gain of 0.39%. In terms of moving averages, Onelife Capital Advisors is currently above its 5-day and 20-day averages, although it remains below the 50-day, 100-day, and 200-day averages. Notably, investor participation has seen a decline, with delivery volume dropping by 68.2% compared to th...

Read MoreOnelife Capital Advisors Experiences Notable Stock Rebound Amid Mixed Long-Term Trends

2025-04-01 15:00:07Onelife Capital Advisors Ltd, a microcap company in the Finance/NBFC sector, has shown significant activity today as its stock reached the upper circuit limit, closing at a high price of Rs 9.96. This marks a notable change of Rs 0.47, translating to a 4.95% increase. The stock's performance today outperformed its sector by 6.45%, indicating a positive shift after five consecutive days of decline. The intraday trading range saw a low of Rs 9.26, with a total traded volume of approximately 0.02442 lakh shares, resulting in a turnover of Rs 0.002358972 crore. Despite the upward movement, Onelife Capital is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a mixed trend in its longer-term performance. Investor participation appears to be declining, with delivery volume dropping by 58.61% compared to the 5-day average. Nevertheless, the stock remains liquid en...

Read More

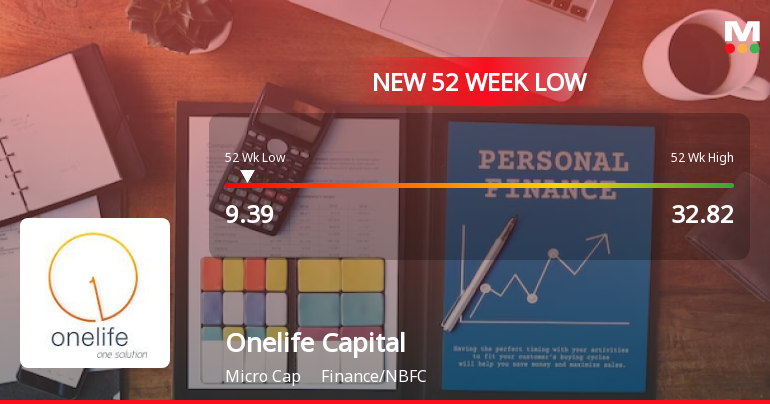

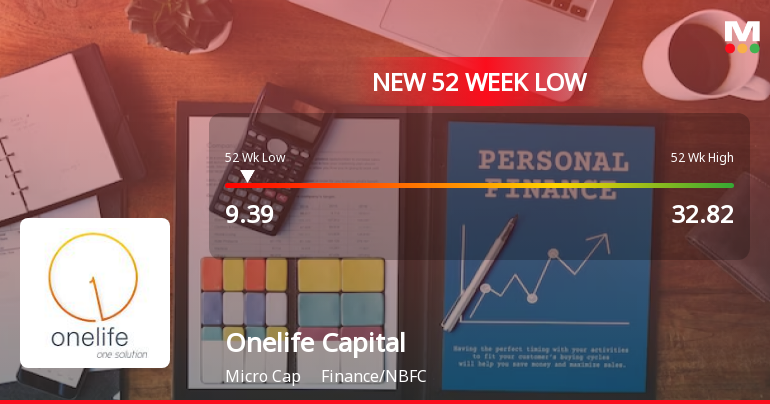

Onelife Capital Faces Significant Volatility Amid Broader Market Challenges and Declining Fundamentals

2025-03-28 09:47:41Onelife Capital Advisors, a microcap in the finance sector, reached a new 52-week low amid significant volatility, following a four-day loss streak. Despite a slight rebound, the company has faced a 65.28% decline over the past year, raising concerns about its operating losses and long-term fundamentals.

Read More

Onelife Capital Faces Scrutiny Amid Significant Stock Volatility and Declining Performance

2025-03-28 09:47:41Onelife Capital Advisors, a microcap in the finance sector, reached a new 52-week low amid significant volatility, following a four-day loss streak. Over the past year, the stock has declined sharply, contrasting with the Sensex's growth, while its financial health raises concerns due to operating losses and pledged shares.

Read More

Onelife Capital Advisors Faces Operational Challenges Amidst Significant Stock Volatility

2025-03-28 09:47:40Onelife Capital Advisors, a microcap in the finance sector, has reached a new 52-week low, reflecting a challenging year with a significant performance decline. The company faces operational difficulties, including substantial losses and a sharp drop in operating profit, while over half of its promoter shares are pledged.

Read MoreOnelife Capital Advisors Faces Trading Challenges Amid Declining Investor Participation

2025-03-13 15:00:05Onelife Capital Advisors Ltd, a microcap company in the Finance/NBFC sector, experienced significant trading activity today as its stock hit the lower circuit limit. The stock closed at a last traded price of Rs 10.1, reflecting a decline of Rs 0.28 or 2.7%. The stock's performance was notably below sector averages, underperforming by 4.28%. During the trading session, Onelife Capital Advisors reached an intraday high of Rs 10.59 and a low of Rs 9.86, indicating a price band of 5%. The total traded volume was approximately 0.26453 lakh shares, resulting in a turnover of Rs 0.026453 crore. The stock has been trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a downward trend in its performance. Additionally, investor participation has decreased, with delivery volume falling by 2.67% compared to the 5-day average. In summary, Onelife Capital Advisors Ltd's stock has ...

Read MoreOnelife Capital Advisors Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-13 14:55:06Onelife Capital Advisors Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive losses over the past two days, with a decline of 0.67% during this period. In terms of daily performance, Onelife Capital Advisors Ltd has decreased by 0.29%, slightly underperforming the Sensex, which fell by 0.25%. Over the past month, the stock has seen a substantial drop of 26.62%, while the Sensex has only declined by 3.01%. This trend continues over longer periods, with a staggering 43.36% decrease in the last three months compared to the Sensex's 10.09% drop. Year-to-date, Onelife Capital Advisors Ltd is down 37.05%, contrasting sharply with the Sensex's decline of 5.49%. The stock's performance relative to the Sensex highlights a troubling trend, particularly over the past year, where it has lost 31.88% against the Sensex's modest gain o...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulations for Quarter ended 31 March 2025

Non Applicability Of SEBI Circular SEBI/HO/DDHS/CIR/P/2018/144 Dated November 26 2018 - Fund Raising By Issuance Of Debt Securities By Large Entities

04-Apr-2025 | Source : BSENon Applicability of SEBI Circular on Large Entities

Announcement Under Regulation 30 - SEBI Final Order No. WTM/AB/CFID-SEC2/30890/2024-25 Dated March 28 2025

29-Mar-2025 | Source : BSEAs per Regulation 30 of SEBI LODR 2015 please find enclosed herewith the Final order of SEBI dated 28th March 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available