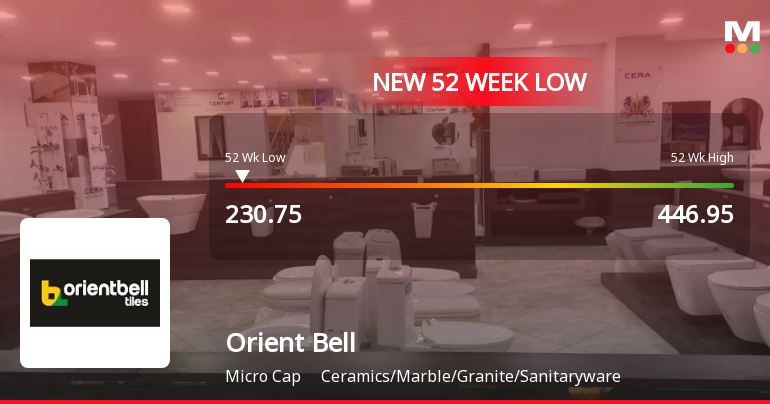

Orient Bell Hits New Low Amid Broader Market Resilience and Declining Growth Prospects

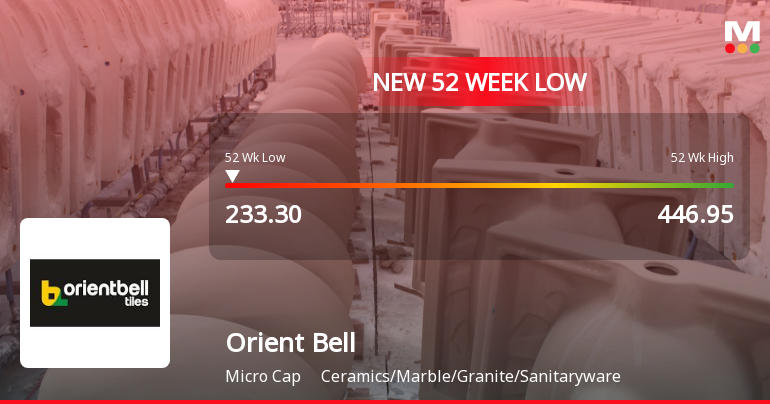

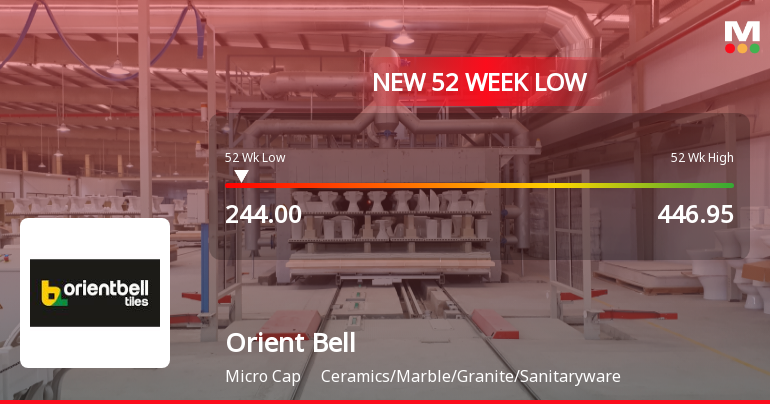

2025-03-27 09:59:43Orient Bell, a microcap in the ceramics and sanitaryware sector, reached a new 52-week low today, continuing a downward trend with a significant one-year decline. Despite a low debt-to-equity ratio and a recent profit increase, the company's long-term growth prospects remain limited, with declining operating profits.

Read More

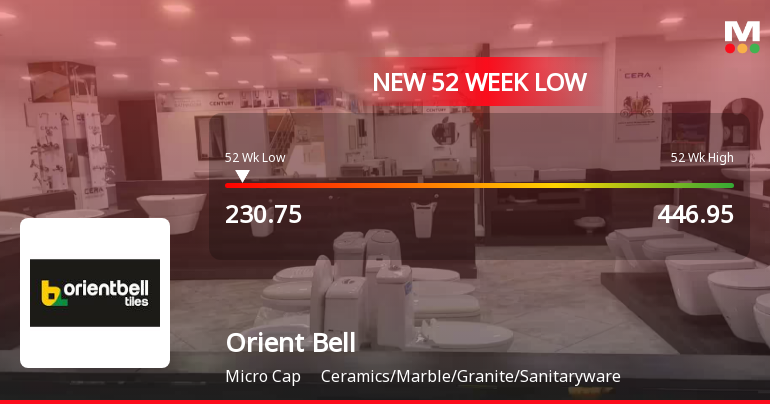

Orient Bell Faces Significant Stock Volatility Amidst Declining Long-Term Growth Outlook

2025-03-27 09:59:41Orient Bell, a microcap in the ceramics and sanitaryware sector, has faced significant stock volatility, reaching a new 52-week low. Despite a recent profit increase, the company has struggled with a declining long-term growth outlook and underperformed compared to broader market indices over the past year.

Read More

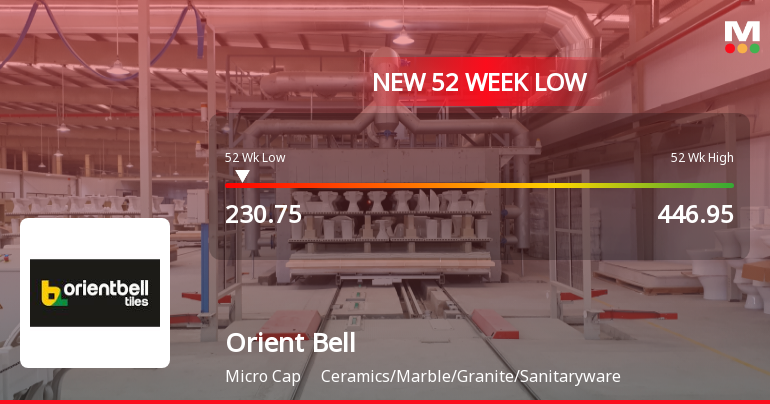

Orient Bell Faces Significant Volatility Amidst Declining Stock Performance and Bearish Indicators

2025-03-27 09:59:35Orient Bell, a microcap in the ceramics and sanitaryware sector, has hit a new 52-week low amid significant volatility. The stock has underperformed its sector and is trading below key moving averages, reflecting a bearish trend. Despite a recent profit increase, its annual operating profit has declined.

Read More

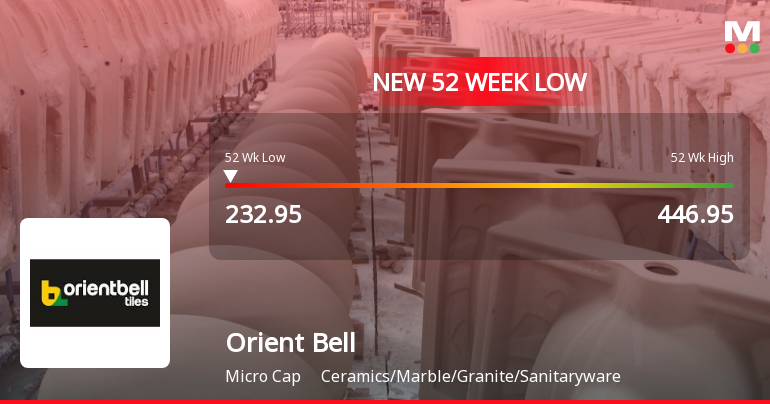

Orient Bell Faces Significant Volatility Amid Broader Market Resilience and Long-Term Growth Challenges

2025-03-27 09:59:32Orient Bell, a microcap in the ceramics and sanitaryware sector, has hit a new 52-week low amid significant volatility. The company's stock has underperformed its sector, with a notable decline over the past year. Despite low debt and a recent profit increase, long-term growth challenges persist.

Read More

Orient Bell Hits New Low Amidst Declining Long-Term Growth Prospects

2025-03-26 10:38:15Orient Bell, a microcap in the ceramics and sanitaryware sector, reached a new 52-week low today, despite a modest intraday gain. The company has faced a significant one-year return decline and challenges in operating profit, although it maintains a low debt-to-equity ratio and reported a substantial increase in half-year profits.

Read More

Orient Bell Faces Continued Volatility Amid Broader Market Resilience and Profit Growth

2025-03-18 14:36:20Orient Bell, a microcap in the ceramics and sanitaryware sector, has faced significant volatility, hitting a new 52-week low. Despite a recent profit increase, the stock has underperformed its sector and the broader market, reflecting ongoing challenges in long-term growth and market performance.

Read More

Orient Bell Hits 52-Week Low Amidst Declining Stock Performance and Mixed Financial Results

2025-03-17 11:37:52Orient Bell, a microcap in the ceramics and sanitaryware sector, has reached a new 52-week low, underperforming its sector and experiencing a three-day decline. Despite a low debt-to-equity ratio and a significant increase in half-year profits, the stock has seen a notable annual performance drop.

Read MoreOrient Bell Adjusts Valuation Amidst Competitive Landscape in Ceramics Industry

2025-03-11 08:00:23Orient Bell, a microcap player in the ceramics, marble, granite, and sanitaryware industry, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of 74.11 and an EV to EBITDA ratio of 13.13, indicating a complex financial landscape. The price to book value stands at 1.19, while the dividend yield is relatively low at 0.20%. Return on capital employed (ROCE) and return on equity (ROE) are reported at 0.63% and 0.21%, respectively. In comparison to its peers, Orient Bell's valuation reflects a more favorable position than some competitors, such as Nitco and Regency Ceramics, which are categorized as risky due to their loss-making status. On the other hand, companies like Asian Granito and Asi Industries are noted for their attractive valuations, showcasing a diverse competitive landscape within the industry. Despite recent stock performance showing a decline over v...

Read More

Orient Bell Faces Significant Market Challenges Amidst Declining Stock Performance

2025-03-03 10:07:23Orient Bell, a microcap in the ceramics and sanitaryware sector, has faced significant volatility, hitting a new 52-week low. The stock has underperformed its sector and recorded a notable decline over the past year, reflecting ongoing challenges within the industry and a difficult market position.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulations 2018.

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Mahendra K Daga

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Sarla Daga

Corporate Actions

No Upcoming Board Meetings

Orient Bell Ltd. has declared 5% dividend, ex-date: 30 Jul 24

No Splits history available

Orient Bell Ltd. has announced 5:4 bonus issue, ex-date: 15 Jan 07

No Rights history available