Orient Beverages Adjusts Valuation Grade Amidst Competitive FMCG Landscape

2025-04-03 08:00:35Orient Beverages, a microcap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (PE) ratio of 9.73 and an EV to EBITDA ratio of 17.87, indicating its market valuation relative to earnings and operational performance. Notably, the return on equity (ROE) stands at a robust 31.46%, showcasing effective management of shareholder equity. In comparison to its peers, Orient Beverages presents a lower PE ratio than several competitors, such as Vadilal Enterprises, which has a significantly higher valuation. Other companies in the sector, like Sarveshwar Foods and Foods & Inns, display varied valuation metrics, with some positioned more attractively in terms of EV to EBITDA ratios. The stock has experienced fluctuations, with a current price of 254.00, reflecting a recent high of 254.00 and a low...

Read MoreOrient Beverages Adjusts Valuation Amidst Competitive FMCG Market Dynamics

2025-03-27 08:00:36Orient Beverages, a microcap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting shifts in its financial metrics and market positioning. The company's price-to-earnings (PE) ratio stands at 10.36, while its price-to-book value is recorded at 2.85. Additionally, the enterprise value to EBITDA ratio is 18.37, indicating the company's valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of performance, Orient Beverages has shown a notable return of 12.37% over the past week, significantly outperforming the Sensex, which returned 2.44% in the same period. However, the year-to-date performance reveals a decline of 16.33%, contrasting with the Sensex's slight drop of 1.09%. Over a longer horizon, the company has demonstrated impressive growth, with a 265.20% return over three years and a remarkable 388.26% over five years. When comp...

Read More

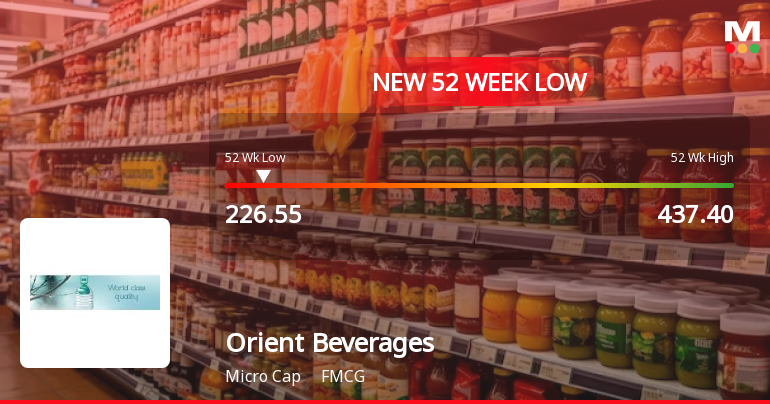

Orient Beverages Faces Significant Volatility Amid Broader FMCG Sector Challenges

2025-02-28 16:05:19Orient Beverages, a microcap in the FMCG sector, has faced notable volatility, hitting a new 52-week low. The stock has consistently traded below key moving averages and has experienced a significant decline over the past year, contrasting with the broader market's performance. Today's trading session saw substantial intraday fluctuations.

Read More

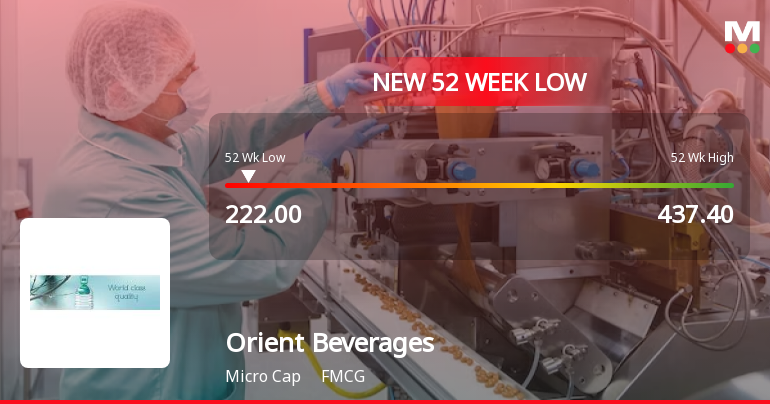

Orient Beverages Faces Significant Volatility Amidst Ongoing Performance Challenges in FMCG Sector

2025-02-18 11:55:54Orient Beverages, a microcap in the FMCG sector, hit a new 52-week low today, reflecting significant volatility. The stock has struggled over the past year, declining nearly 20%, and is currently trading below multiple moving averages, indicating a persistent downward trend in its performance.

Read More

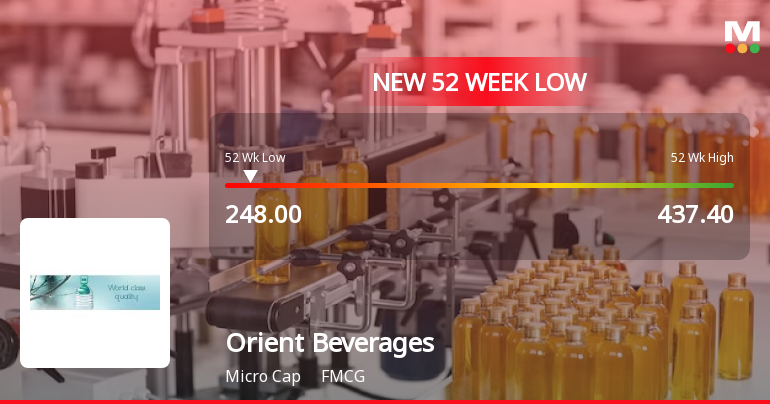

Orient Beverages Hits 52-Week Low Amidst Signs of Potential Trend Reversal

2025-02-17 14:10:44Orient Beverages, a microcap in the FMCG sector, hit a new 52-week low today, reflecting a year-long underperformance against the Sensex. Despite recent declines, the stock gained 8.71% today, indicating a potential trend reversal, though it remains below key moving averages, highlighting ongoing market challenges.

Read More

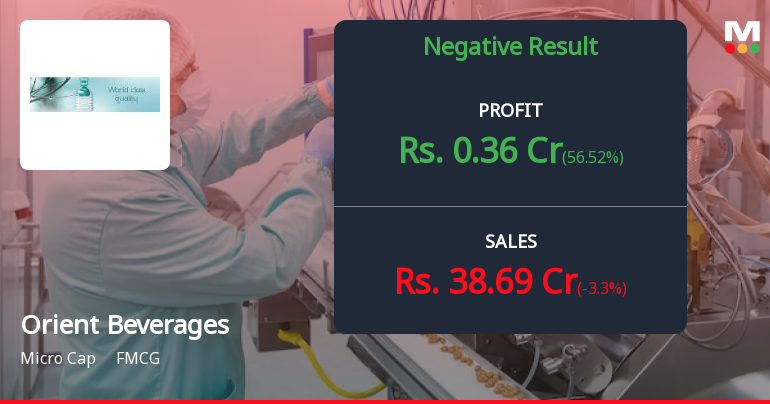

Orient Beverages Reports Q3 FY24-25 Results Amidst Financial Challenges in FMCG Sector

2025-02-08 17:33:54Orient Beverages has announced its financial results for the quarter ending February 2025, revealing a significant shift in performance. The company's score has adjusted from 7 to -6 over the past three months, indicating challenges faced in the competitive FMCG sector, prompting interest from stakeholders on its market adaptation strategies.

Read MoreBoard Meeting Outcome for Outcome Of Board Meeting Held On 28.03.2025

28-Mar-2025 | Source : BSEThis is to inform you that the Board of Directors at their meeting held on 28th March 2025 on the recommendation of Nomination and Remuneration Committee approved the re-appointment and payment of remuneration to the following directors: Sri Narendra Kumar Poddar(DIN- 00304291) as Chairman Sri Akshat Poddar(DIN- 03187840) as Managing Director; and Sri Ballabha Das Mundhra(DIN- 01162223) as Executive Director Since the terms of appointment of aforesaid Directors shall expired on 31.03.2025. The new terms shall be for a period of 5 consecutive years with effective from 01.04.2025 to 31.03.2030 subject to approval of the shareholders of the Company. The Board Meeting commenced at 12.00 PM and concluded at 3.00 P.M. This is for your kind information and records.

Re-Appointment And Payment Remuneration Of Directors W.E.F. 01.04.2025

28-Mar-2025 | Source : BSERe-appointment and payment of remuneration of Directors w.e.f. 01.04.2025

Closure of Trading Window

24-Mar-2025 | Source : BSENotice for Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Orient Beverages Ltd has declared 5% dividend, ex-date: 22 Dec 20

No Splits history available

No Bonus history available

No Rights history available