Orient Electric Faces Mixed Technical Trends Amidst Competitive Market Challenges

2025-04-03 08:06:08Orient Electric, a player in the consumer durables and electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 211.35, showing a slight increase from the previous close of 209.85. Over the past year, Orient Electric has experienced a stock return of -1.9%, contrasting with a 3.67% return from the Sensex, indicating a lag in performance relative to the broader market. The technical summary reveals a mixed outlook, with the MACD indicating bearish trends on both weekly and monthly scales. The Bollinger Bands also reflect a mildly bearish stance, while the daily moving averages suggest a bearish trend. Notably, the KST shows a bullish signal on a monthly basis, which may indicate some underlying strength. In terms of stock performance, Orient Electric has faced challenges over various time frames. For instance, over the past t...

Read MoreOrient Electric Adjusts Valuation Amidst Competitive Consumer Durables Landscape

2025-03-28 08:00:47Orient Electric, a player in the consumer durables and electronics sector, has recently undergone a valuation adjustment. The company's current price stands at 210.15, reflecting a decline from its previous close of 217.25. Over the past year, Orient Electric has shown a return of 8.63%, which is notably higher than the Sensex's return of 6.32% during the same period. However, its year-to-date performance indicates a decline of 9.44%, contrasting with the Sensex's slight decrease of 0.68%. Key financial metrics for Orient Electric include a PE ratio of 69.25 and an EV to EBITDA ratio of 27.04, which position it distinctly within its industry. In comparison to its peers, Orient Electric's valuation metrics reveal a significant disparity; for instance, Electronics Mart has a PE ratio of 29.11, while Wonder Electric's PE ratio is substantially higher at 162.81. This evaluation revision highlights the competit...

Read MoreOrient Electric Faces Technical Challenges Amid Mixed Market Sentiment and Volatility

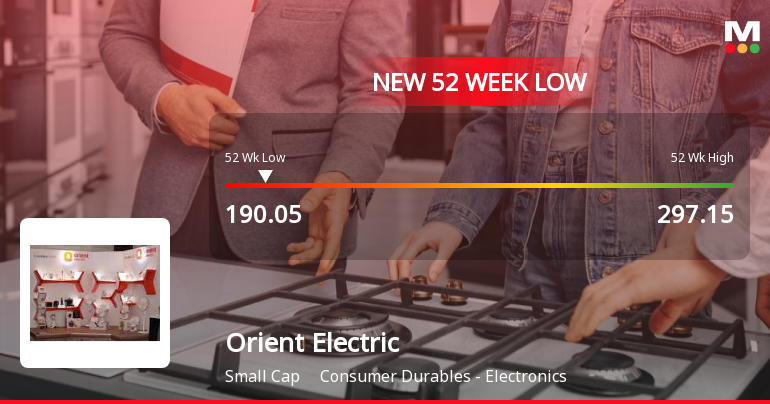

2025-03-27 08:03:53Orient Electric, a player in the consumer durables and electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 217.25, slightly down from the previous close of 220.00. Over the past year, Orient Electric has shown a return of 11.64%, outperforming the Sensex, which recorded a return of 6.65% in the same period. However, the stock has faced challenges in the longer term, with a notable decline of 32.59% over the past three years, while the Sensex has risen by 34.74%. The technical summary indicates a bearish sentiment across various indicators, including MACD and moving averages, which suggest a cautious outlook. The Bollinger Bands and KST also reflect a mixed picture, with some indicators showing mild bearish tendencies. In terms of price performance, Orient Electric reached a 52-week high of 297.15 and a low of 190.05, h...

Read MoreOrient Electric Faces Mixed Technical Trends Amid Competitive Market Evaluation

2025-03-26 08:04:39Orient Electric, a player in the Consumer Durables - Electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 220.00, showing a slight increase from the previous close of 219.00. Over the past year, Orient Electric has demonstrated a return of 12.04%, outperforming the Sensex, which recorded a return of 7.12% in the same period. In terms of technical indicators, the stock's MACD signals are bearish on both weekly and monthly charts, while the Relative Strength Index (RSI) shows no significant signals. The Bollinger Bands indicate a mildly bearish trend on both weekly and monthly bases, and moving averages also reflect a mildly bearish stance. The KST presents a mixed picture, being bearish weekly but bullish monthly. Despite some challenges, Orient Electric's performance over the past month has been notable, with a return of...

Read More

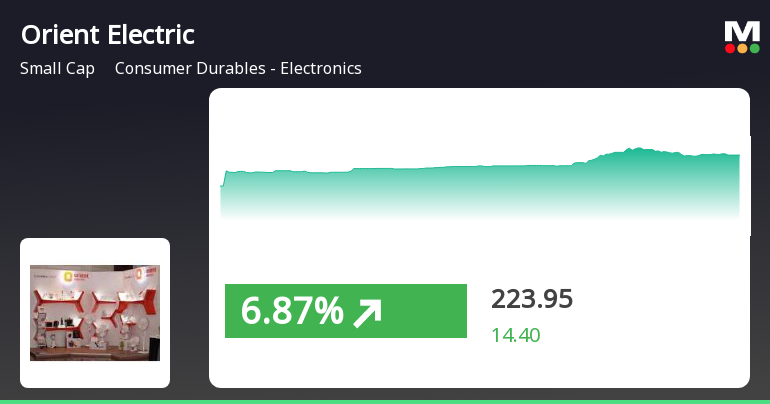

Orient Electric Experiences Notable Short-Term Gains Amid Broader Market Positivity

2025-03-07 11:35:55Orient Electric has experienced notable activity, gaining significantly and outperforming its sector. The stock has shown consecutive gains over three days, with high volatility reflected in intraday fluctuations. While it has delivered positive returns over the past year, longer-term performance metrics indicate declines. The broader market remains positive, led by small-cap stocks.

Read MoreOrient Electric Adjusts Valuation Amidst Competitive Landscape in Consumer Durables Sector

2025-03-05 08:01:03Orient Electric, a small-cap player in the Consumer Durables - Electronics sector, has recently undergone a valuation adjustment. The company's current price stands at 197.50, reflecting a decline from its previous close of 204.20. Over the past year, Orient Electric has experienced a stock return of -5.3%, which contrasts with a modest gain of -1.19% in the Sensex during the same period. Key financial metrics for Orient Electric include a PE ratio of 65.08 and an EV to EBITDA ratio of 25.43. The company's return on capital employed (ROCE) is reported at 12.56%, while the return on equity (ROE) is at 9.96%. The dividend yield is relatively low at 0.76%. In comparison to its peers, Orient Electric's valuation metrics appear elevated, particularly when juxtaposed with Electronics Mart, which has a PE ratio of 28.45 and an EV to EBITDA of 14.07. Other competitors like Avalon Tech and Wonder Electric exhibit...

Read More

Orient Electric Faces Ongoing Challenges Amidst Persistent Stock Decline and Market Volatility

2025-03-03 09:37:46Orient Electric, a small-cap company in the consumer durables sector, has hit a new 52-week low, continuing a downward trend. The stock has underperformed its sector and experienced a cumulative drop over the past week, indicating ongoing challenges in a competitive market environment.

Read More

Orient Electric Reports Strong Q3 FY24-25 Results Amid Long-Term Growth Concerns

2025-02-10 19:02:30Orient Electric has recently adjusted its evaluation amid positive third-quarter financial results, reporting net sales of Rs 816.82 crore and a PBDIT of Rs 61.17 crore. Despite strong operational efficiency and management, concerns about long-term growth persist due to a decline in operating profit over five years.

Read More

Orient Electric Reports Record Quarterly Sales Amid Long-Term Growth Challenges

2025-02-05 18:55:30Orient Electric recently adjusted its evaluation, highlighting its strong quarterly performance with net sales of Rs 816.82 crore and a peak PBDIT of Rs 61.17 crore. However, the company faces long-term growth challenges, evidenced by a decline in operating profit over five years, despite efficient management and low debt levels.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEPlease find enclosed herewith intimation of Closure of Trading Window for the quarter and year ending March 2025

Appointment of Company Secretary and Compliance Officer

07-Mar-2025 | Source : BSEPursuant to Regulation 30 of SEBI Listing Regulations please find enclosed herewith disclosure regarding approval of Board on recommendation of NRC designating MS. Dipti Mishra as the Compliance Officer of the Company wef March 07 2025

Announcement under Regulation 30 (LODR)-Change in Management

05-Mar-2025 | Source : BSEPursuant to Regulation 30 and PARA A of PART A of Schedule III of SEBI (Listing Obligations and Disclosure Requirements) please find enclosed herewith required disclosure of Change in Management- General

Corporate Actions

No Upcoming Board Meetings

Orient Electric Ltd. has declared 75% dividend, ex-date: 04 Feb 25

No Splits history available

No Bonus history available

No Rights history available