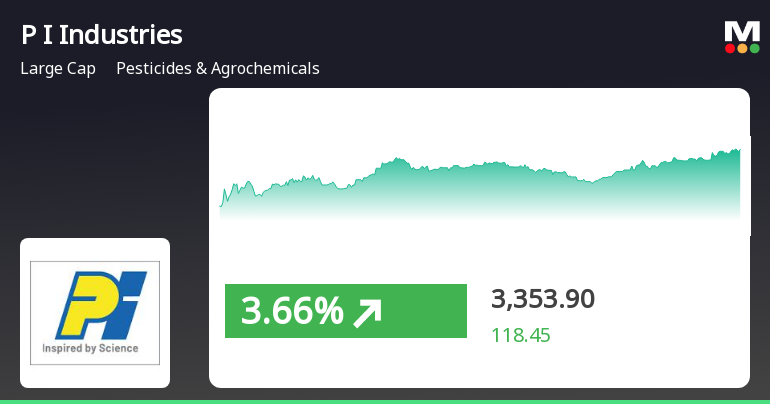

P I Industries Sees Significant Open Interest Surge Amid Active Market Participation

2025-04-02 10:00:19P I Industries Ltd, a prominent player in the Pesticides & Agrochemicals sector, has experienced a significant increase in open interest today. The latest open interest stands at 14,218 contracts, reflecting a rise of 1,295 contracts or 10.02% from the previous open interest of 12,923. This uptick in open interest coincides with a trading volume of 6,877 contracts, indicating active participation in the market. In terms of price performance, P I Industries has outperformed its sector by 0.67%, although it recorded a slight decline of 0.13% in its stock price today. The stock is currently trading above its 20-day and 50-day moving averages, but below its 5-day, 100-day, and 200-day moving averages. Notably, the delivery volume on April 1 reached 230,000 shares, marking a 49.12% increase compared to the 5-day average delivery volume, suggesting heightened trading activity. With a market capitalization of Rs...

Read MoreP I Industries Sees Surge in Open Interest Amidst Market Activity Shift

2025-03-25 15:00:59P I Industries Ltd, a prominent player in the Pesticides & Agrochemicals sector, has experienced a significant increase in open interest today. The latest open interest stands at 23,572 contracts, reflecting a rise of 2,518 contracts or 11.96% from the previous open interest of 21,054. The trading volume for the day reached 15,706 contracts, indicating robust activity in the derivatives market. In terms of price performance, P I Industries has shown a slight decline, with the stock touching an intraday low of Rs 3,413.8, representing a decrease of 2.25%. The stock's performance today aligns closely with the sector, which recorded a 1D return of -0.80%. Notably, the stock remains above its 5-day, 20-day, and 50-day moving averages, although it is trading below its 100-day and 200-day moving averages. Investor participation has seen a decline, with delivery volume dropping by 54.59% compared to the 5-day av...

Read MoreP I Industries Sees Significant Open Interest Surge Amid Increased Trading Activity

2025-03-24 15:00:46P I Industries Ltd, a prominent player in the Pesticides & Agrochemicals sector, has experienced a significant increase in open interest today. The latest open interest stands at 23,621 contracts, reflecting a rise of 2,678 contracts or 12.79% from the previous open interest of 20,943. This uptick coincides with a trading volume of 18,471 contracts, indicating heightened activity in the derivatives market. In terms of price performance, P I Industries has outperformed its sector by 0.44%, with a one-day return of 1.52%. The stock has shown consistent gains over the past three days, accumulating a total return of 2.99% during this period. Notably, the stock's current price is above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Investor participation has also seen a notable increase, with delivery volume reaching 184,000 shares on March 21,...

Read MoreP I Industries Sees Significant Open Interest Surge Amid Increased Trading Activity

2025-03-24 14:00:31P I Industries Ltd, a prominent player in the Pesticides & Agrochemicals sector, has experienced a significant increase in open interest today. The latest open interest stands at 23,229 contracts, reflecting a rise of 2,286 contracts or 10.92% from the previous open interest of 20,943. This uptick in open interest coincides with a trading volume of 16,870 contracts, indicating heightened activity in the derivatives market. In terms of price performance, P I Industries has shown resilience, gaining 0.67% today, while the sector overall has returned 0.89%. The stock has been on an upward trajectory for the past three days, accumulating a total return of 2.29% during this period. Notably, the stock's price is currently above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Additionally, the delivery volume on March 21 reached 184,000 shares, ma...

Read MoreP I Industries Faces Mixed Technical Trends Amidst Recent Stock Performance Shift

2025-03-18 08:03:23P I Industries, a prominent player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,376.90, showing a notable increase from the previous close of 3,290.20. Over the past week, the stock has demonstrated a return of 4.37%, significantly outperforming the Sensex, which recorded a mere 0.07% return. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on both timeframes, and moving averages also reflect a mildly bearish sentiment on a daily basis. The KST and On-Balance Volume (OBV) metrics present a bearish outlook on the monthly scale, with the Dow Theory indicating no trend on a weekly basis. Look...

Read More

P I Industries Shows Resilience Amid Broader Market Recovery and Mixed Momentum

2025-03-11 14:50:21P I Industries has demonstrated strong performance in the Pesticides & Agrochemicals sector, gaining 3.37% today and achieving consecutive gains over the past two days. While the stock is above its short-term moving averages, it remains below longer-term averages, indicating mixed momentum. Over five years, it has significantly outperformed the Sensex.

Read MoreP I Industries has emerged as one of the most active stock puts today amid rising investor interest.

2025-03-10 10:00:07P I Industries Ltd, a prominent player in the Pesticides & Agrochemicals sector, has emerged as one of the most active stocks in the market today, particularly in the options arena. The company’s underlying stock, trading at Rs 3225.0, has seen significant activity in put options, with 8,127 contracts traded at a premium turnover of approximately Rs 33.47 crore. The put options have a strike price of Rs 3200 and are set to expire on March 27, 2025, indicating a strategic interest among traders. In terms of price performance, P I Industries has shown resilience, touching an intraday high of Rs 3285, reflecting a 2.05% increase. The stock's performance today aligns closely with sector trends, with a one-day return of 0.88%, outperforming the sector's return of 0.11% and the Sensex's return of 0.39%. The stock's moving averages indicate a mixed trend, being higher than the 5-day and 20-day averages but lowe...

Read MoreP I Industries Ltd has emerged as one of the most active stock puts today amid notable market activity.

2025-03-07 13:00:34P I Industries Ltd, a prominent player in the Pesticides & Agrochemicals sector, has emerged as one of the most active stocks in the options market today, particularly in put options. The company’s underlying stock, PIIND, is currently valued at Rs 3269.25. Notably, there were 4,617 put contracts traded with a premium turnover of approximately Rs 17.55 crores, indicating significant activity in this segment. The put options have a strike price of Rs 3000 and are set to expire on March 27, 2025, with an open interest of 698 contracts. In terms of price performance, P I Industries has underperformed its sector by 1.94%, following a trend reversal after three consecutive days of gains. The stock reached an intraday low of Rs 3044.7, reflecting a decline of 6.48%. The weighted average price suggests that more volume was traded closer to this low price. While the stock remains above its 5-day moving averages, i...

Read MoreP I Industries has emerged as one of the most active stock calls today amid fluctuating trading dynamics.

2025-03-07 13:00:34P I Industries Ltd, a prominent player in the Pesticides & Agrochemicals sector, has emerged as one of the most active stocks today, particularly in the options market. The company’s underlying stock, PIIND, saw significant activity with 8,649 call contracts traded at a strike price of Rs 3,200, resulting in a premium turnover of Rs 35.93 crore. The open interest stands at 840 contracts, indicating ongoing interest in this option. Despite this activity, P I Industries has underperformed its sector by 1.94%, reflecting a day’s return of -1.24%. The stock reached an intraday low of Rs 3,044.70, marking a decline of 6.48% from previous levels. The weighted average price suggests that more volume was traded closer to this low price, highlighting a shift in trading dynamics. Currently, the stock is trading at an underlying value of Rs 3,249.35, which is above its 5-day moving average but below the 20, 50, 100,...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulation 2018 for the quarter ended March 31 2025.

Authorization To Key Managerial Personnel (KMP) For Determination Of Materiality Of Events/ Information Pursuant To Regulation 30(5) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

31-Mar-2025 | Source : BSEIntimation for authorization of KMP for determination of materiality of events/ information pursuant to Regulation 30(5) and Companys policy on determination of materiality

Announcement under Regulation 30 (LODR)-Change in Management

31-Mar-2025 | Source : BSEIntimation for appointment of Company Secretary (KMP) and Compliance Officer.

Corporate Actions

No Upcoming Board Meetings

P I Industries Ltd has declared 600% dividend, ex-date: 14 Feb 25

P I Industries Ltd has announced 1:5 stock split, ex-date: 12 Apr 13

P I Industries Ltd has announced 1:2 bonus issue, ex-date: 08 Jul 10

No Rights history available