Page Industries Adjusts Evaluation Amid Strong Financial Metrics and Market Positioning

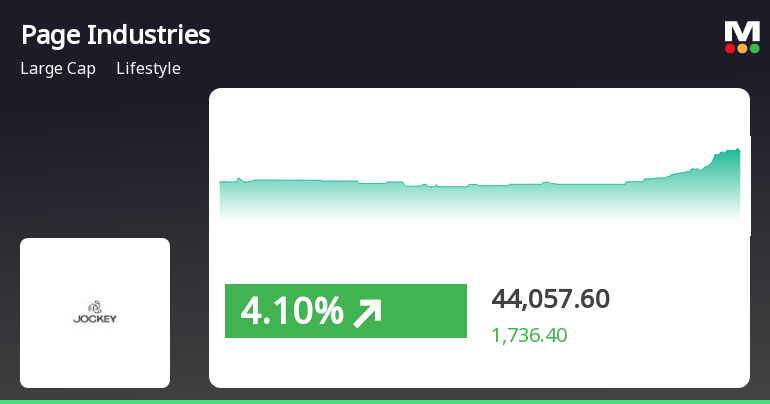

2025-04-03 08:10:09Page Industries has recently adjusted its evaluation score, reflecting changes in its financial metrics and market position within the lifestyle sector. The company reported record net sales and a strong operating profit margin, although its stock has shown a sideways technical trend despite outperforming the broader market over the past year.

Read MorePage Industries Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:05:34Page Industries, a prominent player in the lifestyle sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 43,109.80, showing a notable increase from the previous close of 41,960.05. Over the past year, Page Industries has demonstrated a robust performance with a return of 23.22%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. The technical summary indicates a mixed outlook, with various indicators showing differing trends. The MACD reflects a bearish stance on a weekly basis while signaling bullishness on a monthly scale. The Relative Strength Index (RSI) shows no signal weekly but is bullish monthly, suggesting varied momentum. Additionally, Bollinger Bands and KST present a similar divergence, with weekly indicators leaning mildly bearish and monthly indicators indicating bullish trends...

Read MoreSurge in Open Interest Signals Shift in Market Dynamics for Page Industries

2025-03-28 15:00:36Page Industries Ltd, a prominent player in the lifestyle sector, has experienced a notable increase in open interest today. The latest open interest stands at 15,090 contracts, reflecting a rise of 1,500 contracts or 11.04% from the previous open interest of 13,590. This surge in open interest comes alongside a trading volume of 5,960 contracts, indicating heightened activity in the derivatives market. In terms of price performance, Page Industries has underperformed its sector by 0.47%, with the stock reaching an intraday low of Rs 42,510.9, marking a decline of 3.15%. The stock's current price is positioned higher than its 5-day and 20-day moving averages, yet remains below the 50-day, 100-day, and 200-day moving averages, suggesting mixed momentum in the short to medium term. Additionally, the stock has seen a significant increase in delivery volume, which rose by 92.82% compared to the 5-day average, ...

Read More

Page Industries Shows Signs of Recovery Amid Broader Market Rebound

2025-03-27 15:20:27Page Industries saw a significant rise on March 27, 2025, reversing a two-day decline and outperforming the broader market. The stock is above several key moving averages, reflecting a complex performance landscape, with notable gains over the past year despite a year-to-date decline.

Read MorePage Industries Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-26 14:00:28Page Industries Ltd, a prominent player in the lifestyle sector, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 21,312 contracts, up from the previous 19,044, marking a change of 2,268 contracts or an 11.91% increase. The trading volume for the day reached 9,587 contracts, indicating robust market engagement. In terms of price performance, Page Industries has outperformed its sector by 0.38%, although it has faced a decline over the past two days, with a total return of -1.18%. The stock is currently trading above its 5-day and 20-day moving averages but remains below its 50-day, 100-day, and 200-day moving averages, suggesting mixed momentum in the short to medium term. Investor participation appears to be waning, with a delivery volume of 7,620 on March 25, reflecting a decrease of 33.8% compared to the 5-day aver...

Read MorePage Industries Sees Significant Open Interest Surge Amid Mixed Market Dynamics

2025-03-26 13:00:20Page Industries Ltd, a prominent player in the lifestyle sector, has experienced a significant increase in open interest today. The latest open interest stands at 21,037 contracts, reflecting a rise of 1,993 contracts or 10.47% from the previous open interest of 19,044. This uptick in open interest comes alongside a trading volume of 7,655 contracts, indicating active market participation. In terms of price performance, Page Industries has outperformed its sector by 0.42%. However, the stock has faced challenges recently, recording a decline of 0.7% over the past two days. Currently, the stock is trading above its 5-day and 20-day moving averages, yet remains below its 50-day, 100-day, and 200-day moving averages, suggesting mixed momentum in its price trajectory. Despite a recent drop in delivery volume, which has decreased by 33.8% compared to the 5-day average, the stock maintains sufficient liquidity ...

Read More

Page Industries Faces Shift in Market Sentiment Amidst Long-Term Growth Challenges

2025-03-25 08:19:22Page Industries has recently experienced a change in its evaluation, reflecting shifts in market sentiment as indicated by its technical indicators. Despite a strong annual return, the company faces challenges in long-term growth, with declining promoter confidence and a premium valuation compared to peers.

Read MorePage Industries Experiences Mixed Technical Trends Amid Strong Yearly Performance

2025-03-25 08:05:07Page Industries, a prominent player in the lifestyle sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 43,063.45, showing a notable increase from the previous close of 41,928.15. Over the past year, Page Industries has demonstrated a robust performance with a stock return of 25.01%, significantly outpacing the Sensex return of 7.07%. In terms of technical metrics, the weekly MACD and KST indicators are currently bearish, while the monthly readings for both suggest a bullish trend. The Relative Strength Index (RSI) shows no signal on a weekly basis but remains bullish monthly. Additionally, Bollinger Bands indicate a mildly bearish trend weekly, contrasting with a bullish monthly outlook. Moving averages reflect a mildly bearish sentiment on a daily basis. Despite the recent evaluation adjustment, Page Industries has s...

Read MorePage Industries Demonstrates Resilience Amidst Mixed Short-Term Performance Trends

2025-03-24 18:00:35Page Industries Ltd., a prominent player in the lifestyle sector, has shown significant stock activity today, reflecting its dynamic market position. With a market capitalization of Rs 47,092.00 crore, the company operates within a competitive landscape characterized by a P/E ratio of 71.33, notably lower than the industry average of 145.62. In terms of performance, Page Industries has outperformed the Sensex over various time frames. Over the past year, the stock has gained 25.01%, while the Sensex has risen by 7.07%. Today, Page Industries saw an increase of 2.71%, surpassing the Sensex's 1.40% rise. Additionally, the stock has shown a weekly gain of 7.12% compared to the Sensex's 5.14%. However, the three-month performance indicates a decline of 11.81%, contrasting with the Sensex's minor drop of 0.62%. Year-to-date, Page Industries is down 9.29%, while the Sensex has remained relatively stable with a ...

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSETrading Window Closure

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

10-Feb-2025 | Source : BSETranscript of Q3 Investor Call

Announcement under Regulation 30 (LODR)-Newspaper Publication

06-Feb-2025 | Source : BSENewspaper Publication of Financial Results

Corporate Actions

No Upcoming Board Meetings

Page Industries Ltd has declared 1500% dividend, ex-date: 13 Feb 25

No Splits history available

No Bonus history available

No Rights history available