Pakka Adjusts Valuation Grade Amid Competitive Industry Landscape and Performance Challenges

2025-04-01 08:00:36Pakka, a microcap player in the Paper & Paper Products industry, has recently undergone a valuation adjustment, reflecting shifts in its financial metrics. The company currently exhibits a price-to-earnings (P/E) ratio of 17.60 and an enterprise value to EBITDA ratio of 11.89. Its return on capital employed (ROCE) stands at 14.41%, while return on equity (ROE) is reported at 14.16%. In comparison to its peers, Pakka's valuation metrics indicate a competitive position, particularly when juxtaposed with companies like Pudumjee Paper and Kuantum Papers, which have lower P/E ratios. Notably, while Pakka's valuation has been adjusted, its performance over the past three years shows a significant return of 112.68%, outpacing the Sensex's 34.42% during the same period. However, the company has faced challenges recently, with a year-to-date return of -46.79%, contrasting sharply with the Sensex's slight decline o...

Read More

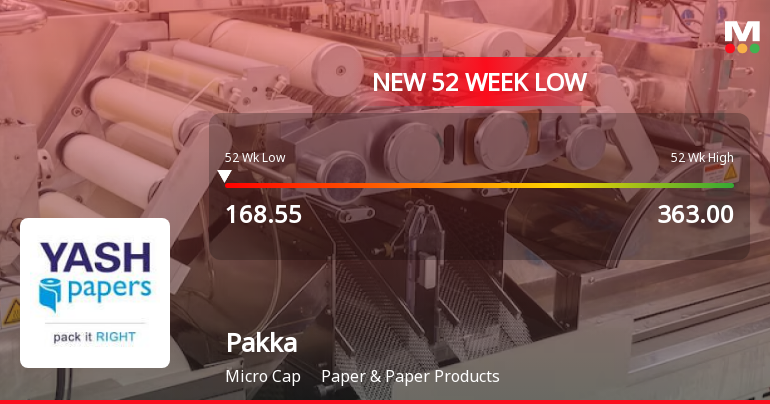

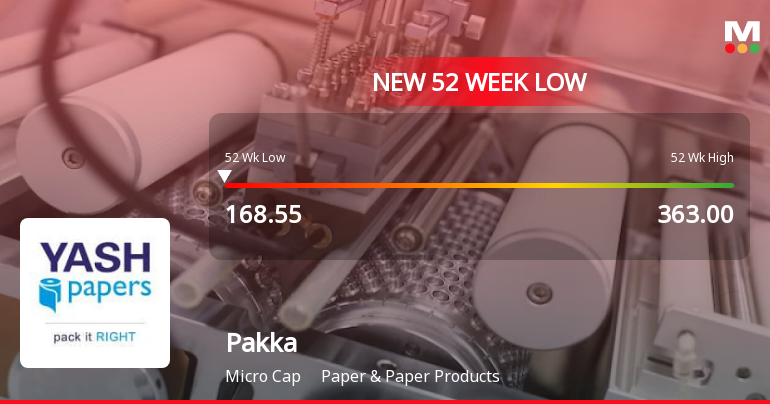

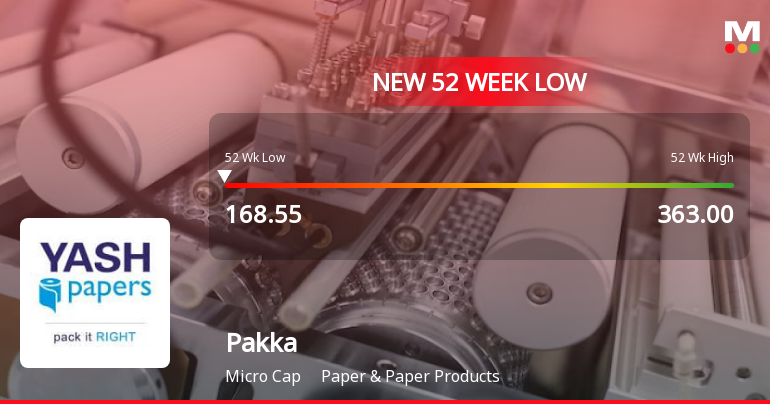

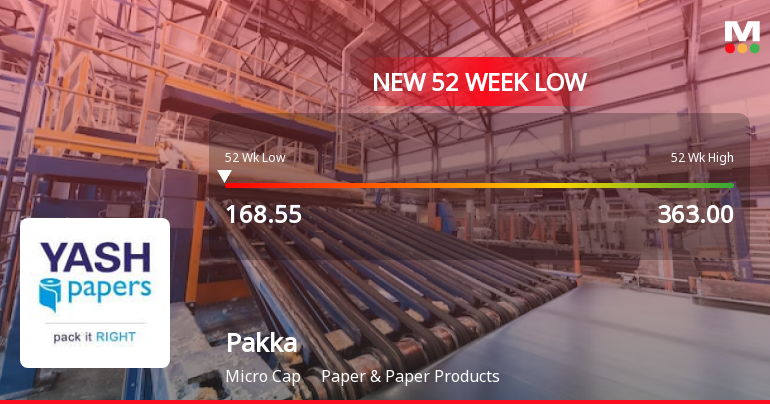

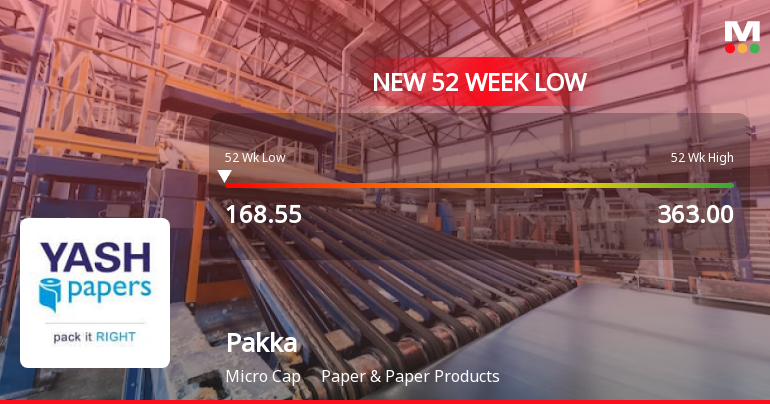

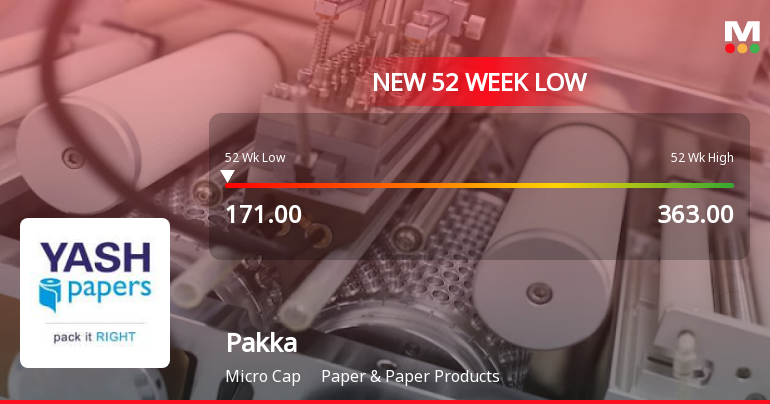

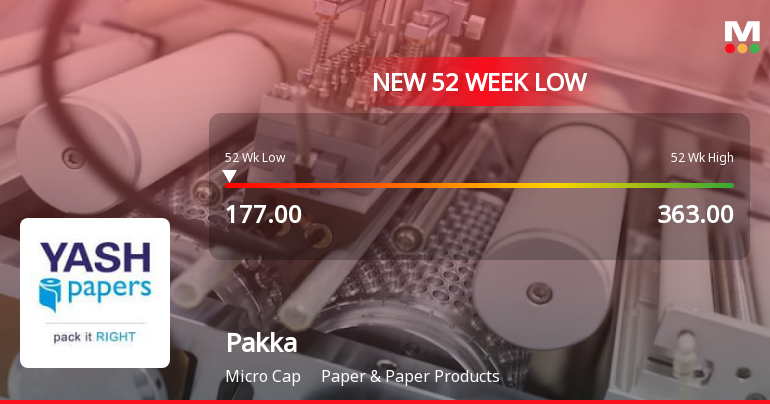

Pakka Faces Significant Challenges Amid Broader Market Recovery and Declining Performance

2025-03-27 10:02:53Pakka, a microcap in the Paper & Paper Products sector, has reached a new 52-week low amid significant volatility, with a three-day decline totaling 7.66%. The company's financial metrics reveal challenges, including stagnant profit growth and a recent PAT decline, while a high percentage of pledged shares raises concerns.

Read More

Pakka Faces Significant Challenges Amidst Declining Stock Performance and Pledged Shares

2025-03-27 10:02:48Pakka, a microcap in the Paper & Paper Products sector, has faced significant volatility, reaching a new 52-week low. The company has underperformed its sector and experienced a notable decline over the past year, with stagnant operating profit and a decrease in profit after tax. A high percentage of pledged promoter shares adds to its challenges.

Read More

Pakka Faces Significant Challenges Amidst Declining Stock Performance and High Pledged Shares

2025-03-27 10:02:46Pakka, a microcap in the Paper & Paper Products sector, has faced significant volatility, reaching a new 52-week low. The company has struggled over the past year, with a notable decline in profit after tax and a high percentage of pledged promoter shares, despite maintaining efficient management.

Read More

Pakka Faces Continued Volatility Amid Declining Stock Performance and High Pledged Shares

2025-03-27 10:02:42Pakka, a microcap in the Paper & Paper Products sector, has hit a new 52-week low, continuing a downward trend with a significant decline over the past year. The company faces challenges, including a drop in profit after tax and a high percentage of pledged promoter shares, despite maintaining strong management efficiency.

Read More

Pakka Faces Significant Challenges Amidst Declining Stock Performance and Pledged Shares

2025-03-27 10:02:39Pakka, a microcap in the Paper & Paper Products sector, has faced notable volatility, reaching a new 52-week low. The company has struggled over the past year, with a significant decline in profit after tax and a high percentage of pledged promoter shares, despite maintaining a low debt-to-EBITDA ratio.

Read More

Pakka Hits 52-Week Low Amidst Declining Profit and Pledged Shares Concerns

2025-03-26 15:07:48Pakka, a microcap company in the Paper & Paper Products sector, has reached a new 52-week low, reflecting a significant decline over the past year. The stock has underperformed its sector, with technical indicators showing a bearish trend. Despite challenges, the company demonstrates strong management efficiency and low debt levels.

Read More

Pakka Faces Continued Volatility Amid Declining Profit and High Pledged Shares

2025-03-17 13:37:47Pakka, a microcap in the Paper & Paper Products sector, has faced notable volatility, reaching a new 52-week low and experiencing a six-day decline. Its one-year performance is significantly negative, with a decrease in operating profit and a recent drop in profit after tax. A high percentage of pledged promoter shares adds to the challenges.

Read More

Pakka Faces Significant Volatility Amidst Declining Performance and High Promoter Pledging

2025-03-13 15:39:07Pakka, a microcap in the Paper & Paper Products sector, has faced notable volatility, reaching a new 52-week low. The company has underperformed its sector and reported a decline in quarterly profit. A significant portion of promoter shares is pledged, while management efficiency metrics indicate some financial resilience.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI (DP) Regulation

Board Meeting Intimation for Notice Of Board Meeting

01-Apr-2025 | Source : BSEPakka Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 24/05/2025 inter alia to consider and approve 1. The Audited Standalone Financial Results of the Company for the 4th quarter and financial year ended 31 March 2025; 2. The Audited Consolidated Financial Results of the Company for the 4th quarter and financial year ended 31 March 2025; 3. Recommend the final Dividend if any for the financial year ended 31s March 2025; 4. Recommend the re-appointment of Mrs. Manjula Jhunjhunwala (DIN: 00192901) Director (Promoter) of the Company who is retiring by rotation; 5. Recommend the re-appointment of Mrs. Kimberly Ann McArthur (DIN: 05206436) Director (Promoters Group) of the Company who is retiring by rotation; 6. Appoint Secretarial Auditor of the Company for the financial year 2025-26; 7. Appoint Internal Auditor of the Company for the financial year 2025-26; 8. The date of 45th Annual General Meeting of the Company; 9. Any other matter with the permission of the Chairman and with the consent of majority of Directors present in the meeting which shall include Independent Director.

Closure of Trading Window

26-Mar-2025 | Source : BSEKindly find attached herewith disclosure for Closure of Trading Window for Q4 (2024-25).

Corporate Actions

24 May 2025

Pakka Ltd has declared 24% dividend, ex-date: 22 Sep 23

No Splits history available

No Bonus history available

No Rights history available