Panama Petrochem Adjusts Valuation Grade Amid Strong Financial Performance and Market Position

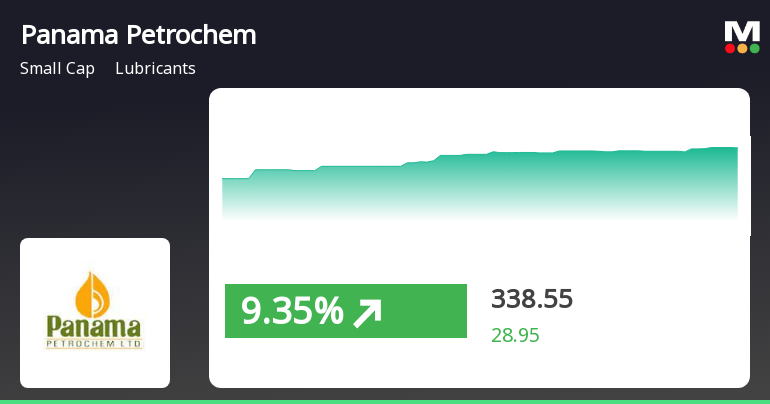

2025-04-02 08:00:08Panama Petrochem, a small-cap player in the lubricants industry, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company currently boasts a price-to-earnings (P/E) ratio of 11.28 and an impressive return on capital employed (ROCE) of 22.73%. Additionally, its return on equity (ROE) stands at 16.75%, indicating effective management of shareholder funds. In terms of valuation metrics, Panama Petrochem shows a price-to-book value of 1.96 and an enterprise value to EBITDA ratio of 8.37, which positions it favorably compared to its peers. Notably, while Panama Petrochem has been recognized for its valuation, competitors like Savita Oil Tech and Veedol Corporation also maintain attractive metrics, albeit at higher P/E ratios. Over the past year, Panama Petrochem has outperformed the Sensex, achieving a return of 13.35% compared to the index's 2.72...

Read MorePanama Petrochem Faces Mixed Technical Trends Amid Strong Historical Performance

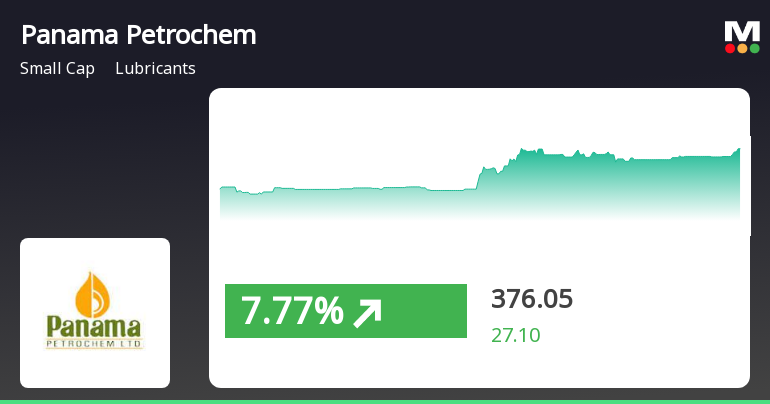

2025-03-17 08:00:08Panama Petrochem, a small-cap player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 363.75, showing a notable increase from the previous close of 355.00. Over the past year, Panama Petrochem has demonstrated a strong performance, with a return of 19.56%, significantly outperforming the Sensex, which recorded a return of 1.47% in the same period. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate a sideways trend weekly, contrasting with a bullish monthly perspective. Moving averages reflect a mildly bearish sentiment on a daily basis, while the On-Balance Volume (OBV) shows a mildly bullish trend month...

Read MorePanama Petrochem Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-13 08:00:10Panama Petrochem, a small-cap player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 355.00, down from a previous close of 365.75. Over the past year, Panama Petrochem has shown a return of 9.43%, outperforming the Sensex, which recorded a return of 0.49% during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The stock's moving averages also reflect a bearish stance, indicating a cautious outlook. Notably, the On-Balance Volume (OBV) shows a mildly bullish trend on a monthly basis, suggesting some underlying strength despite the overall bearish indicators. When comparing Panama Petrochem's performance to the Sensex, the company has demonstrated significant resilience over longer peri...

Read MorePanama Petrochem Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-13 08:00:10Panama Petrochem, a small-cap player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 355.00, down from a previous close of 365.75. Over the past year, Panama Petrochem has shown a return of 9.43%, outperforming the Sensex, which recorded a return of 0.49% during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The stock's moving averages also reflect a bearish stance, indicating a cautious outlook. Notably, the On-Balance Volume (OBV) shows a mildly bullish trend on a monthly basis, suggesting some underlying strength despite the overall bearish indicators. When comparing Panama Petrochem's performance to the Sensex, the company has demonstrated significant resilience over longer peri...

Read MorePanama Petrochem Experiences Technical Trend Adjustments Amidst Market Resilience

2025-03-05 08:00:06Panama Petrochem, a small-cap player in the lubricants industry, has recently undergone a technical trend adjustment. The company's current price stands at 354.90, reflecting a slight increase from the previous close of 351.25. Over the past year, Panama Petrochem has shown resilience with a stock return of 0.55%, outperforming the Sensex, which recorded a decline of 1.19% during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands suggest a mildly bearish trend weekly, with a sideways movement monthly. Moving averages indicate a bearish stance on a daily basis, while the KST reflects a bearish trend weekly and mildly bearish monthly. Interestingly, the On-Balance Volume (OBV) shows a mildly b...

Read More

Panama Petrochem's Stock Rebounds After Extended Decline, Signaling Market Dynamics Shift

2025-02-19 10:00:13Panama Petrochem experienced a notable rebound on February 19, 2025, after a prolonged decline, marking a significant trend reversal. Despite earlier losses, the stock reached an intraday high, outperforming its sector. However, it remains below key moving averages, indicating ongoing challenges in its longer-term performance.

Read More

Panama Petrochem Shows Resilience with Notable Stock Performance Amid Market Challenges

2025-01-31 14:30:11Panama Petrochem has demonstrated notable performance in the lubricants industry, significantly outperforming the broader market and its sector. The stock has shown a positive short-term trend, although it remains below longer-term moving averages. Over the past month, it has outperformed the Sensex, reflecting its resilience in a challenging market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find attached herewith Certificate under Regulation 74(5) of SEBI (DP) Regulations.

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation of Closure of Trading Window is attached herewith.

Announcement under Regulation 30 (LODR)-Credit Rating

21-Feb-2025 | Source : BSECredit Rating issued by ICRA Limited is enclosed herewith.

Corporate Actions

No Upcoming Board Meetings

Panama Petrochem Ltd has declared 100% dividend, ex-date: 22 Nov 24

Panama Petrochem Ltd has announced 2:10 stock split, ex-date: 19 Sep 14

Panama Petrochem Ltd has announced 1:2 bonus issue, ex-date: 03 Oct 17

No Rights history available