Panth Infinity's Valuation Adjustments Reflect Mixed Financial Performance and Market Challenges

2025-03-25 08:05:52Panth Infinity, a microcap company, has recently adjusted its evaluation, reflecting significant changes in financial metrics and market position. The revised valuation grade indicates an attractive standing based on key ratios, despite facing challenges such as declining net sales and underperformance against benchmarks over the past year.

Read MorePanth Infinity Adjusts Valuation Grade Amidst Competitive Metrics and Market Lagging

2025-03-19 08:00:03Panth Infinity, a microcap company in the miscellaneous sector, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company's price-to-earnings (PE) ratio stands at 10.08, while its price-to-book value is notably low at 0.66. Additionally, the enterprise value to EBITDA ratio is recorded at 9.63, indicating a competitive valuation relative to its earnings potential. Despite these favorable metrics, Panth Infinity's stock performance has lagged behind broader market indices. Over the past year, the company has experienced a return of -15.29%, contrasting sharply with a 3.51% gain in the Sensex. This trend is further highlighted by a significant decline over the past five years, where the stock has dropped by 83.45%, while the Sensex has surged by 160.83%. In comparison to its peers, Panth Infinity's valuation metrics appear more attractive, particularly w...

Read More

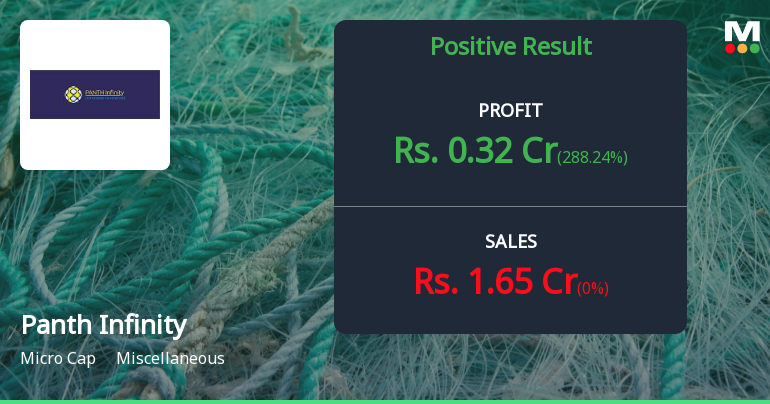

Panth Infinity Reports Strong Quarterly Performance Amid Mixed Long-Term Fundamentals

2025-03-11 08:04:55Panth Infinity, a microcap company, recently adjusted its evaluation, reflecting a strong third quarter performance with notable financial metrics. However, long-term fundamentals show mixed results, including declining net sales and modest Return on Equity. The stock's valuation appears attractive, yet concerns about growth prospects persist.

Read MorePanth Infinity Adjusts Valuation Grade Amidst Competitive Market Positioning

2025-03-05 08:00:03Panth Infinity, a microcap company in the miscellaneous industry, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company's price-to-earnings (PE) ratio stands at 10.14, while its price-to-book value is recorded at 0.67. Additionally, the enterprise value to EBITDA ratio is 9.68, indicating a competitive position in the market. Despite the recent valuation revision, Panth Infinity has faced challenges in its stock performance. Over the past week, the stock has returned -10.61%, and its year-to-date return is -13.63%. In comparison to the Sensex, which has shown a return of -6.59% in the same period, Panth Infinity's performance has lagged behind. When examining its peers, Panth Infinity's valuation metrics appear favorable. For instance, companies like Sh.Pushkar Chem. and Taneja Aerospace exhibit significantly higher PE ratios, suggesting that Pant...

Read More

Panth Infinity Faces Mixed Results Amid Valuation Adjustments and Operational Challenges

2025-03-03 18:35:09Panth Infinity, a microcap company in the miscellaneous sector, has recently adjusted its evaluation, reflecting its current market position. While the latest quarter showed positive financial outcomes, challenges persist, including a low Return on Equity and declining net sales, contributing to underperformance against market benchmarks.

Read MorePanth Infinity Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-02-24 12:56:24Panth Infinity, a microcap company in the miscellaneous industry, has recently undergone a valuation adjustment. The company's current price stands at 7.84, reflecting a slight increase from the previous close of 7.70. Over the past week, Panth Infinity has shown a stock return of 3.16%, contrasting with a decline of 1.90% in the Sensex. Key financial metrics for Panth Infinity include a PE ratio of 11.29 and an EV to EBITDA ratio of 10.80, indicating a competitive position within its sector. The company's price-to-book value is recorded at 0.74, suggesting potential undervaluation relative to its assets. However, its return on equity (ROE) is at 6.56%, which may warrant further scrutiny in comparison to peers. When examining peer performance, Panth Infinity's valuation metrics are notably lower than those of several competitors, such as Control Print and Mallcom (India), which exhibit higher PE ratios an...

Read More

Panth Infinity Reports Strong Q3 FY24-25 Results Amid Long-Term Challenges

2025-02-07 18:51:31Panth Infinity, a microcap in the miscellaneous sector, has recently adjusted its evaluation following strong third-quarter FY24-25 results, with significant increases in PBDIT, PBT, and PAT. However, the company struggles with long-term fundamentals, including low ROE and declining net sales, while underperforming the broader market.

Read More

Panth Infinity Reports Strong Q4 Results, Signaling Positive Financial Trajectory

2025-02-06 22:15:35Panth Infinity has announced its financial results for the quarter ending December 2024, revealing significant improvements in key metrics. Profit Before Tax reached Rs 1.50 crore, while Profit After Tax was Rs 1.11 crore. Earnings per Share also increased to Rs 0.60, indicating enhanced profitability for the company.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window for Insiders of the Company

Announcement under Regulation 30 (LODR)-Change in Management

25-Mar-2025 | Source : BSEAppointment of M/s. ALAP & Co. LLP Company Secretaries as Secretarial Auditor for issuing Secretarial Audit Report for F.Y 2024-25

Board Meeting Outcome for Outcome Of Board Meeting Held Today I.E. On March 25 2025

25-Mar-2025 | Source : BSEIn reference to captioned subject we hereby inform you that the Board of Directors of the Company in their Board Meeting held on today i.e. on March 25 2025 at the Registered Office of the Company which was commenced at 11:30 A.M. and concluded at 12:00 P.M. have apart from other businesses 1) Appointed M/s. ALAP & Co. LLP Company Secretaries as Secretarial Auditor for issuing Secretarial Audit Report for F.Y. 2024-25. In this regards relevant information of M/s. ALAP & Co. LLP Company Secretaries as required under Regulation 30 of SEBI Listing Regulations w.r.t. SEBI circular SEBI/HO/CFD/CFD-PoD1/P/CIR/2023/123 dated July 13 2023) are attached as Annexure I. Kindly take the same on your record and oblige us.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Panth Infinity Ltd has announced 1:2 bonus issue, ex-date: 19 Jul 22

No Rights history available