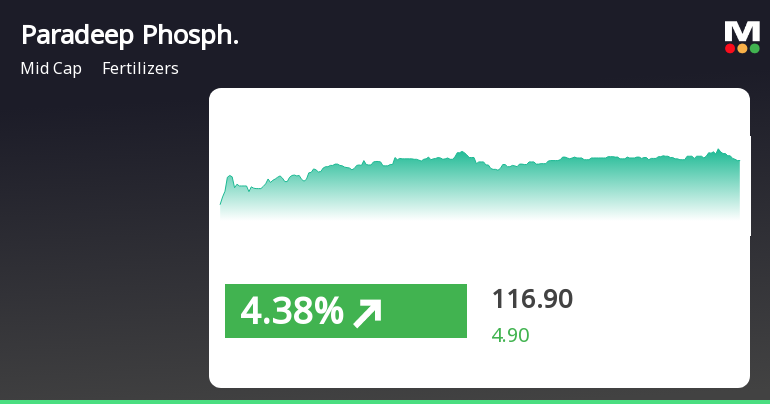

Paradeep Phosphates Shows Strong Momentum Amid Broader Market Resilience

2025-04-03 12:50:28Paradeep Phosphates has demonstrated strong performance in the fertilizers sector, gaining 5.04% on April 3, 2025, and achieving a total return of 16.39% over four consecutive days. The stock is trading above multiple moving averages, indicating positive momentum, while the broader market shows mixed signals.

Read More

Paradeep Phosphates Adjusts Valuation Amid Stable Performance and High Debt Concerns

2025-04-02 08:40:38Paradeep Phosphates, a midcap fertilizer company, has experienced a change in its valuation grade, now reflecting a fair standing. Despite maintaining stable financial metrics, including a PE ratio of 21.81, the company faces challenges with a high debt to EBITDA ratio of 5.04 times.

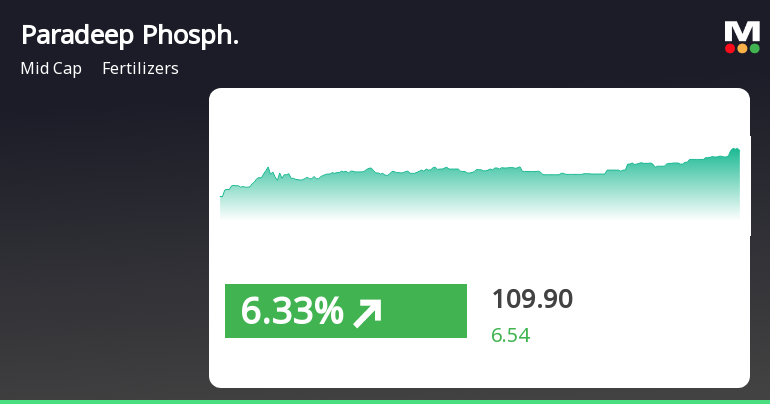

Read MoreParadeep Phosphates Adjusts Valuation Grade Amid Strong Yearly Performance in Fertilizers Sector

2025-04-02 08:03:10Paradeep Phosphates, a midcap player in the fertilizers industry, has recently undergone a valuation adjustment. The company's current price stands at 110.55, reflecting a notable increase from the previous close of 103.36. Over the past year, Paradeep Phosphates has demonstrated a strong performance, with a return of 58.09%, significantly outpacing the Sensex's 2.72% return during the same period. Key financial metrics for Paradeep Phosphates include a price-to-earnings (PE) ratio of 21.81 and an EV to EBITDA ratio of 11.47. The company's return on capital employed (ROCE) is reported at 11.16%, while the return on equity (ROE) stands at 9.67%. The dividend yield is relatively modest at 0.45%. In comparison to its peers, Paradeep Phosphates' valuation metrics indicate a competitive position within the industry. For instance, Deepak Fertilizers holds a more attractive valuation, while GNFC is categorized a...

Read More

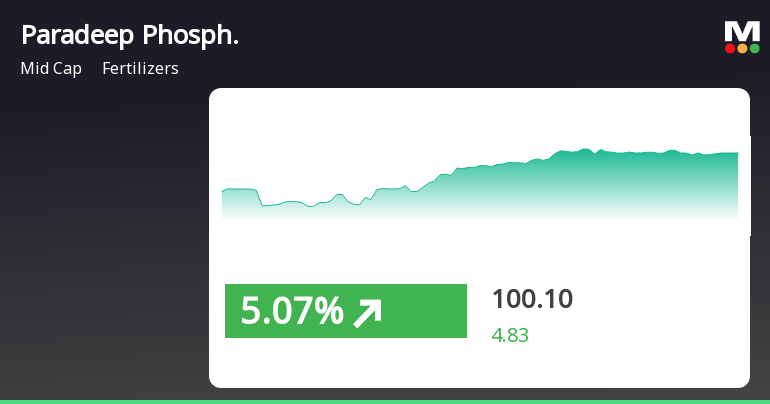

Paradeep Phosphates Exhibits Strong Resilience Amid Market Volatility and Sector Challenges

2025-04-01 14:20:27Paradeep Phosphates has demonstrated strong performance, gaining 5.36% on April 1, 2025, and outperforming its sector amid a declining market. The stock has increased 7.19% over two days and shows significant annual growth of 56.01%, highlighting its resilience in a challenging environment.

Read More

Paradeep Phosphates Shows Strong Financial Growth Amid Evolving Market Dynamics

2025-03-25 08:26:00Paradeep Phosphates, a midcap fertilizer company, has recently adjusted its evaluation, reflecting positive financial trends. The company reported a 6.79% increase in net sales for Q3 FY24-25, alongside significant profit growth, indicating strong operational efficiency and an attractive position within its sector.

Read More

Paradeep Phosphates Shows Strong Performance Amid Positive Market Trends

2025-03-24 10:20:27Paradeep Phosphates has experienced notable gains, marking its fourth consecutive day of increases and outperforming its sector. The stock is currently above several key moving averages, reflecting strong performance amid a positive market environment. Over the past year, it has significantly outperformed the broader market index.

Read More

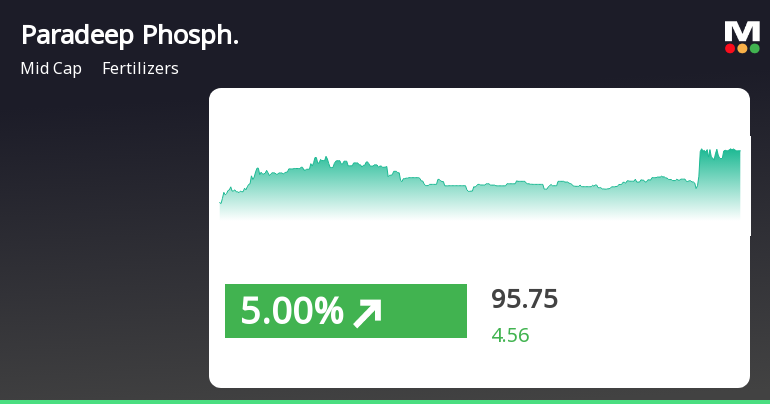

Paradeep Phosphates Outperforms Sector Amid Broader Market Recovery in Fertilizers

2025-03-21 15:35:31Paradeep Phosphates has experienced significant gains, outperforming its sector and achieving a notable total return over the past three days. The stock is currently above several moving averages, while the broader fertilizers sector also shows positive movement. Year-to-date, Paradeep Phosphates has a contrasting performance compared to the Sensex.

Read MoreParadeep Phosphates Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-20 08:04:12Paradeep Phosphates, a midcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 90.87, showing a slight increase from the previous close of 90.15. Over the past year, Paradeep Phosphates has demonstrated a notable return of 35.28%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the company exhibits a mixed performance. The Moving Averages indicate a mildly bullish sentiment on a daily basis, while the MACD and Bollinger Bands present contrasting signals across weekly and monthly assessments. The On-Balance Volume (OBV) shows a mildly bullish trend weekly, suggesting some positive momentum in trading activity. Despite recent fluctuations, Paradeep Phosphates has shown resilience, particularly in its yearly performance compar...

Read More

Paradeep Phosphates Reports Strong Financial Growth Amidst Sideways Market Trends

2025-03-18 08:24:27Paradeep Phosphates has recently experienced a revision in its evaluation following a strong financial performance in Q3 FY24-25, with net sales growth of 6.79%. Key metrics include a return on capital employed of 10.36% and significant increases in profit before and after tax, indicating robust operational results.

Read MoreAnnouncement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

01-Apr-2025 | Source : BSEAllotment of Equity share pursuant to exercise of options under PPL- Employee Stock Option Plan- 2021

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on March 31 2025 for Zuari Maroc Phosphates Pvt Ltd

Closure of Trading Window

31-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Paradeep Phosphates Ltd has declared 5% dividend, ex-date: 17 Sep 24

No Splits history available

No Bonus history available

No Rights history available