Paul Merchants Adjusts Valuation Grade, Highlighting Competitive Position in Finance Sector

2025-04-02 08:01:03Paul Merchants, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's financial metrics reflect a price-to-earnings (P/E) ratio of 4.23 and a price-to-book value of 0.39, indicating a potentially favorable valuation relative to its earnings and assets. Additionally, the enterprise value to EBITDA stands at 5.37, while the enterprise value to EBIT is recorded at 5.66. In terms of performance, Paul Merchants has a return on capital employed (ROCE) of 11.17% and a return on equity (ROE) of 9.40%. These figures suggest a solid operational efficiency and profitability compared to its peers. When examining its position in the market, Paul Merchants appears more attractively valued than several competitors, which are categorized as very expensive. For instance, Colab Platforms and Oswal Green Tech exhibit significantly high...

Read More

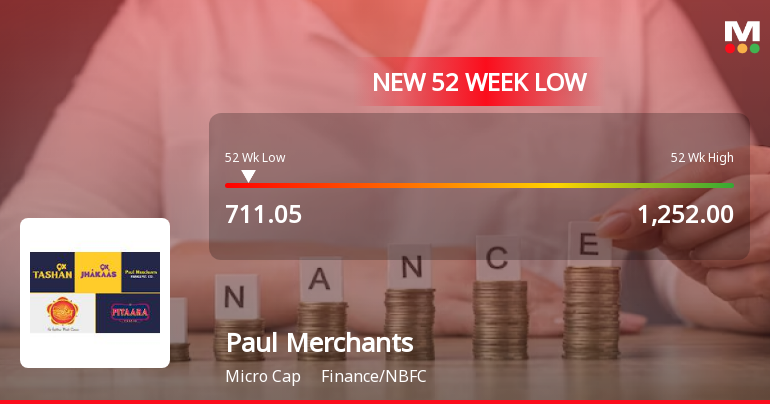

Paul Merchants Hits 52-Week Low Amid Weak Performance and Financial Strain

2025-03-27 09:49:45Paul Merchants, a microcap in the finance and NBFC sector, has reached a new 52-week low amid a two-day decline. The stock has underperformed significantly over the past year, with weak fundamentals, including low return on equity and negative sales growth, contributing to its bearish trend.

Read More

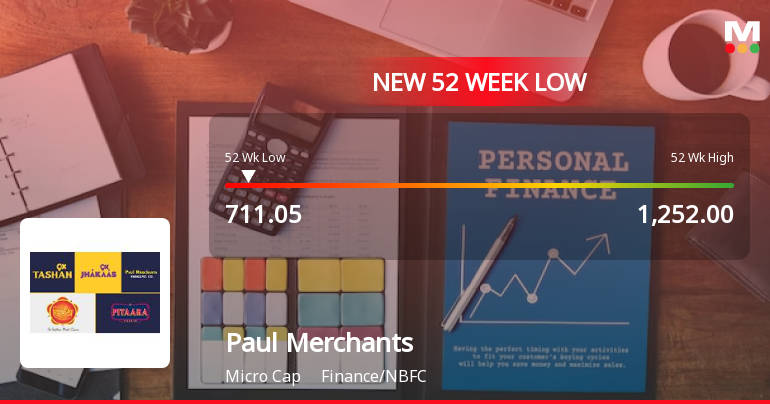

Paul Merchants Faces Continued Volatility Amid Weak Fundamentals and Market Underperformance

2025-03-27 09:49:42Paul Merchants, a microcap in the finance and NBFC sector, has hit a new 52-week low amid ongoing volatility. The stock has underperformed its sector and recorded a significant decline over the past year, with weak fundamentals and negative results for three consecutive quarters.

Read MorePaul Merchants Ltd Faces Stock Volatility Amidst Broader Market Trends

2025-03-18 18:00:22Paul Merchants Ltd, a microcap player in the Finance/NBFC sector, has experienced notable fluctuations in its stock performance today. With a market capitalization of Rs 239.00 crore, the company currently holds a price-to-earnings (P/E) ratio of 4.22, significantly lower than the industry average of 20.50. Over the past year, Paul Merchants has seen a decline of 9.90%, contrasting sharply with the Sensex, which has gained 3.51% during the same period. Today's trading reflects a decrease of 0.68%, while the Sensex rose by 1.53%. In the last week, the stock has dropped by 3.80%, and its performance over the month shows a decline of 10.14%. Year-to-date, the stock is down 19.58%, compared to the Sensex's decline of 3.63%. However, looking at a longer timeframe, Paul Merchants has shown resilience with a three-year performance increase of 87.98% and a five-year growth of 181.49%, outpacing the Sensex's res...

Read More

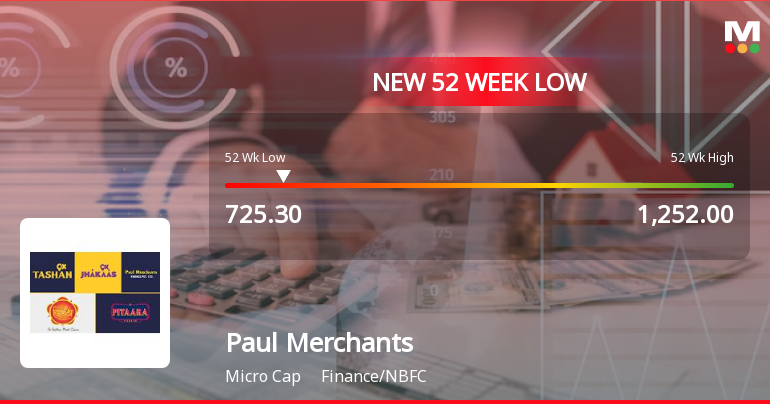

Paul Merchants Faces Significant Stock Volatility Amidst Sector Underperformance

2025-03-03 14:20:36Paul Merchants, a microcap company in the finance sector, has faced significant stock volatility, reaching a new 52-week low. The stock has declined over the past two days and is trading below multiple moving averages. Its performance over the past year contrasts sharply with the broader market.

Read More

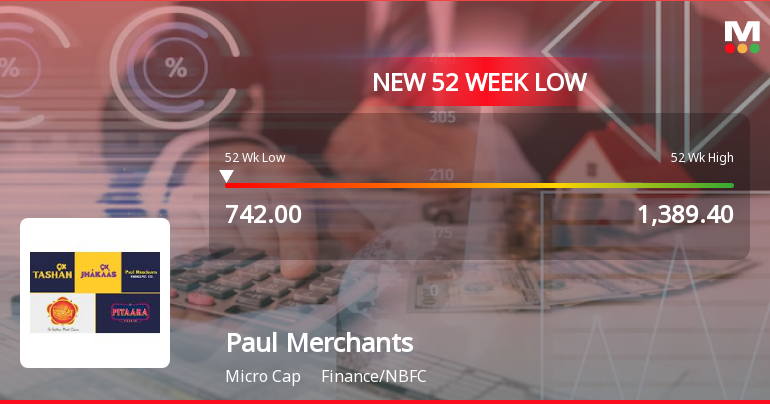

Paul Merchants Faces Significant Volatility Amid Broader Sector Challenges

2025-02-28 12:35:19Paul Merchants, a microcap in the Finance/NBFC sector, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The stock has declined 43.14% over the past year, contrasting with the Sensex's gains, indicating ongoing challenges in a competitive market.

Read More

Paul Merchants Reports December 2024 Results: Mixed Signals in Financial Performance

2025-02-13 19:33:19Paul Merchants has reported its financial results for the quarter ending December 2024, showcasing improvements in operating profit margin, operating profit, and earnings per share. However, the company faces challenges with a significant decline in net sales and an increased debt-equity ratio, indicating a growing reliance on borrowing.

Read MoreAnnouncement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

04-Apr-2025 | Source : BSEIntimation under regulation 30 of SEBI (LODR) Regulations 2015

Board Meeting Outcome for Enhancing Corporate Guarantee Limit And Commencement Of New Line Of Business

28-Mar-2025 | Source : BSEOutcome of the Board meeting held today 28.03.2025

Outcome Of The Board Meeting 28.03.2025

28-Mar-2025 | Source : BSEOutcome of the Board Meeting 28.03.2025

Corporate Actions

No Upcoming Board Meetings

Paul Merchants Ltd has declared 20% dividend, ex-date: 19 Aug 19

No Splits history available

Paul Merchants Ltd has announced 2:1 bonus issue, ex-date: 19 Dec 23

No Rights history available