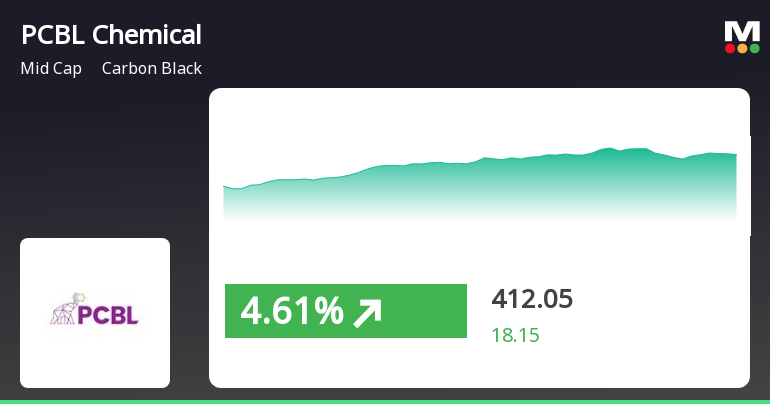

PCBL Chemical Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:04:07PCBL Chemical, a midcap player in the carbon black industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 434.70, showing a slight increase from the previous close of 423.80. Over the past year, PCBL has demonstrated significant resilience, with a return of 56.25%, notably outperforming the Sensex, which recorded a return of 3.67% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bullish signals on a weekly basis, while the monthly perspective remains mildly bearish. Bollinger Bands reflect bullish trends in both weekly and monthly evaluations, suggesting potential volatility in price movements. The On-Balance Volume (OBV) also indicates bullish momentum, reinforcing the stock's positive activity in the market. In terms of returns, PCBL has shown remarkable growth over ...

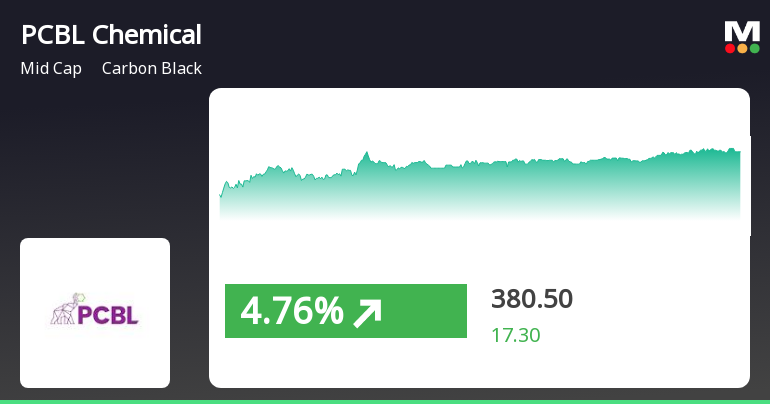

Read MorePCBL Chemical Experiences Technical Indicator Shifts Amid Strong Long-Term Performance

2025-04-02 08:06:20PCBL Chemical, a midcap player in the carbon black industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 423.80, slightly above the previous close of 423.35. Over the past year, PCBL has demonstrated a notable return of 53.97%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical metrics, the MACD indicates a mildly bullish stance on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) shows no signals for both weekly and monthly evaluations, suggesting a neutral momentum. Bollinger Bands reflect a bullish trend on both weekly and monthly charts, indicating potential price stability. The moving averages present a mildly bearish trend on a daily basis, while the KST shows mixed signals with a m...

Read MorePCBL Chemical Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-25 08:03:34PCBL Chemical, a midcap player in the carbon black industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 430.40, showing a slight increase from the previous close of 423.05. Over the past year, PCBL has demonstrated significant resilience, achieving a remarkable 64.02% return compared to the Sensex's 7.07% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans mildly bearish. The Bollinger Bands indicate a bullish trend on both weekly and monthly charts, suggesting potential stability in price movements. The stock's performance has also been notable over longer periods, with a staggering 1462.25% return over the last five years, significantly outpacing the Sensex's 192.36%. PCBL's recent performance highlights its strong market position and...

Read More

PCBL Chemical Shows Strong Performance Amid Broader Market Rebound and Sector Gains

2025-03-21 10:05:24PCBL Chemical, a midcap carbon black company, has shown strong performance with a 5.53% increase on March 21, 2025, and a total return of 10.98% over five days. The stock is trading above key moving averages and has outperformed both its sector and the broader market over the past year.

Read More

PCBL Chemical Shows Strong Short-Term Gains Amid Broader Market Rally

2025-03-05 15:50:35PCBL Chemical, a midcap carbon black company, gained 5.04% on March 5, 2025, marking a two-day total return of 7.84%. The stock is above its 5-day moving average but below longer-term averages. Over the past year, it has increased by 34.50%, while year-to-date, it has declined by 15.44%.

Read More

PCBL Chemical Faces Financial Setback Amidst Strong Management Efficiency and Growth Outlook

2025-03-05 08:09:07PCBL Chemical, a midcap carbon black manufacturer, has recently adjusted its evaluation following a challenging third quarter in FY24-25, marked by negative financial results. Despite this, the company showcases strong management efficiency and a stable long-term growth outlook, while trading at a discount compared to historical peer valuations.

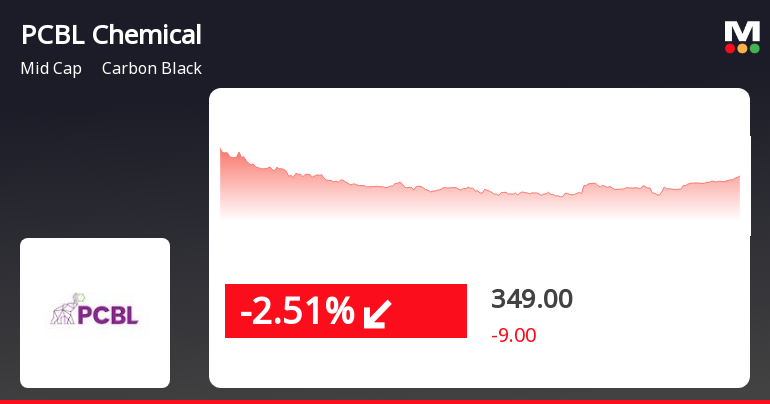

Read MorePCBL Chemical Experiences Technical Indicator Shifts Amid Mixed Market Performance

2025-03-05 08:02:04PCBL Chemical, a midcap player in the carbon black industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 363.20, showing a notable increase from the previous close of 353.75. Over the past year, the stock has experienced a return of 25.24%, significantly outperforming the Sensex, which recorded a return of -1.19% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish tendencies on a weekly basis while remaining mildly bearish monthly. The Relative Strength Index (RSI) currently presents no signal for both weekly and monthly assessments. Bollinger Bands reflect a mildly bearish trend weekly, contrasting with a bullish stance monthly. Daily moving averages are bearish, and the KST indicates a bearish trend weekly but a bullish one monthly. In terms of stock performance, PCBL Chemical has ...

Read MorePCBL Chemical Shows Resilience Amid Broader Market Decline and Short-Term Challenges

2025-03-04 18:00:33PCBL Chemical Ltd, a mid-cap player in the carbon black industry, has shown notable activity today, with its stock rising by 2.67%. This performance contrasts with the broader market, as the Sensex experienced a slight decline of 0.13%. Over the past year, PCBL Chemical has outperformed the Sensex, achieving a return of 25.24% compared to the index's -1.19%. Despite this positive annual performance, the stock has faced challenges in the short term, with a 5.89% decline over the past week and a 10.94% drop in the last month. Year-to-date, the stock is down 19.28%, while the Sensex has decreased by 6.59%. However, looking at longer-term metrics, PCBL Chemical has delivered impressive returns, with a staggering 275.01% increase over three years and an extraordinary 579.20% rise over five years. The company's current market capitalization stands at Rs 13,575.00 crore, with a price-to-earnings ratio of 30.73. ...

Read More

PCBL Chemical Faces Significant Stock Decline Amid Broader Market Challenges

2025-03-03 11:15:50PCBL Chemical, a midcap carbon black manufacturer, has seen its shares decline significantly, underperforming both its sector and the broader market. Over the past month, the stock has dropped 15.51%, reflecting ongoing challenges, with recent trading showing it below key moving averages and experiencing consecutive losses.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulation 2018 for the month of March 2025

Disclosure Under Regulation 30 Of The SEBI Listing Regulations

29-Mar-2025 | Source : BSEDisclosure under Regulation 30 of the SEBI Listing Regulations - Demand Notice received from the Income Tax Department.

Closure of Trading Window

24-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

PCBL Chemical Ltd has declared 550% dividend, ex-date: 16 Jan 25

PCBL Chemical Ltd has announced 1:2 stock split, ex-date: 11 Apr 22

No Bonus history available

No Rights history available