Pee Cee Cosma Sope Shows Resilience Amid Broader Market Challenges in FMCG Sector

2025-03-04 11:08:07Pee Cee Cosma Sope Ltd, a microcap player in the FMCG sector, has shown notable activity in today's trading session, with a 1.90% increase in its stock price. This performance stands in contrast to the broader market, as the Sensex has experienced a slight decline of 0.11%. Over the past year, Pee Cee Cosma Sope has outperformed the Sensex, boasting a remarkable 34.46% increase compared to the index's drop of 1.18%. Despite this strong annual performance, the stock has faced challenges in the short term, with a 9.41% decline over the past week and a 14.16% drop in the last month. Year-to-date, the stock is down 11.83%, while the Sensex has decreased by 6.57%. Pee Cee Cosma Sope's market capitalization stands at Rs 138.32 crore, with a price-to-earnings ratio of 11.64, significantly lower than the industry average of 50.01. The company's long-term performance remains impressive, with a 354.32% increase ov...

Read More

Pee Cee Cosma Sope Reports Stable Performance Amid Broader Market Challenges

2025-03-03 18:55:39Pee Cee Cosma Sope, a microcap in the FMCG sector, has recently adjusted its evaluation amid flat financial performance for Q3 FY24-25. The company maintains a low debt-to-equity ratio and a strong return on equity, while its stock has generated a notable return over the past year.

Read More

Pee Cee Cosma Reports Highest Operating Profit in Five Quarters, Signals Positive Trend

2025-02-13 19:36:16Pee Cee Cosma Sope has announced its financial results for the quarter ending December 2024, revealing its highest operating profit in five quarters at Rs 4.22 crore. Despite a flat overall performance, a recent score revision indicates a significant change in the company's evaluation within the FMCG sector.

Read More

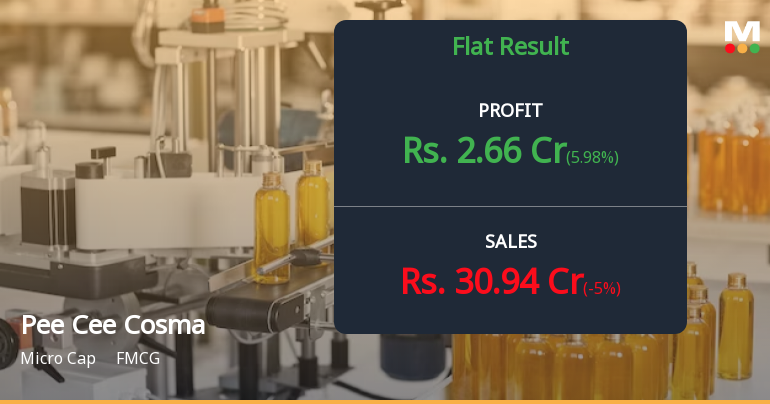

Pee Cee Cosma Sope Faces Sales Contraction Amidst Stable Financial Structure in October 2023

2025-02-12 18:52:41Pee Cee Cosma Sope, a microcap in the FMCG sector, has experienced a recent evaluation adjustment amid challenging market conditions. The company reported Q2 FY24-25 net sales of Rs 30.94 crore and a low PBDIT of Rs 3.15 crore, while maintaining a low debt-to-equity ratio and a strong return on equity of 24.9%.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECERTIFICATE UNDER REGULATION 74(5) OF THE SEBI (DEPOSITORY AND PARTICIPANT) REGULATIONS 2018 FOR THE QUARTER ENDED 31ST MARCH 2025.

Closure of Trading Window

24-Mar-2025 | Source : BSETHE TRADING WINDOW OF THE COMPANY SHALL REMAIN CLOSED FOR ALL DIRECTORS DESIGNATED PERSONS THEIR IMMEDIATE RELATIVES FROM 1ST APRIL 2025 TILL COMPLETION OF 48 HOURS FROM INTIMATION OF AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31.03.2025 TO STOCK EXCHANGES.

Compliances-Reg. 39 (3) - Details of Loss of Certificate / Duplicate Certificate

17-Feb-2025 | Source : BSEissue of duplicate share certificates folio 11900 3142 267

Corporate Actions

No Upcoming Board Meetings

Pee Cee Cosma Sope Ltd has declared 30% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available