Pennar Industries Reports Record Sales Amid Mixed Long-Term Growth Outlook

2025-03-18 08:09:35Pennar Industries has recently adjusted its evaluation following a strong third-quarter performance, reporting record net sales and a significant profit before tax. However, long-term fundamentals indicate mixed results, with concerns over capital efficiency and a high debt ratio, leading to a cautious outlook on future growth potential.

Read More

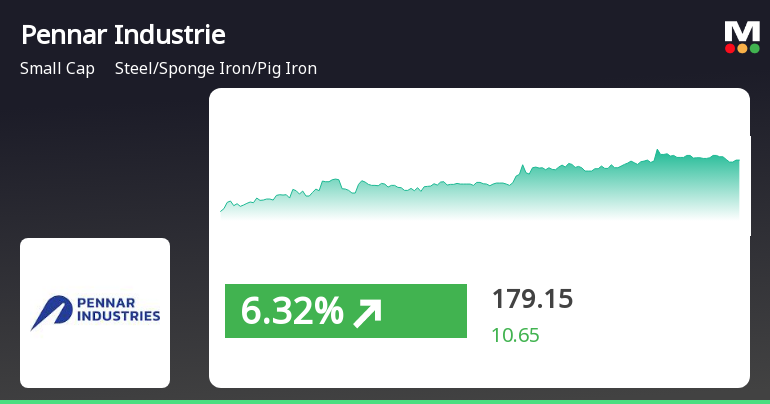

Pennar Industries Shows Resilience with Strong Performance Amid Market Fluctuations

2025-03-17 11:30:19Pennar Industries, a small-cap company in the steel sector, experienced notable activity on March 17, 2025, with a significant intraday gain. The stock has outperformed its sector and delivered impressive returns over the past year, showcasing resilience amid market fluctuations despite mixed moving average trends.

Read MorePennar Industries Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-13 08:00:26Pennar Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD showing bearish tendencies on a weekly basis while indicating a mildly bearish stance monthly. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments, suggesting a lack of significant momentum in either direction. Bollinger Bands indicate a bearish trend weekly, contrasting with a bullish outlook on a monthly basis. Daily moving averages lean mildly bearish, while the KST and On-Balance Volume (OBV) metrics also reflect a mildly bearish sentiment on a monthly scale. Notably, Dow Theory shows no discernible trend for both weekly and monthly evaluations. In terms of performance, Pennar Industries has demonstrated resilience compared to t...

Read MorePennar Industries Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-13 08:00:26Pennar Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD showing bearish tendencies on a weekly basis while indicating a mildly bearish stance monthly. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments, suggesting a lack of significant momentum in either direction. Bollinger Bands indicate a bearish trend weekly, contrasting with a bullish outlook on a monthly basis. Daily moving averages lean mildly bearish, while the KST and On-Balance Volume (OBV) metrics also reflect a mildly bearish sentiment on a monthly scale. Notably, Dow Theory shows no discernible trend for both weekly and monthly evaluations. In terms of performance, Pennar Industries has demonstrated resilience compared to t...

Read More

Pennar Industries Reports Strong Q3 Performance Amid Long-Term Financial Challenges

2025-03-12 08:03:07Pennar Industries has recently experienced a change in evaluation following its strong third-quarter performance, with net sales and PBDIT reaching notable highs. However, challenges persist, including a modest ROCE and a high Debt to EBITDA ratio, raising concerns about long-term financial stability despite consistent returns over recent years.

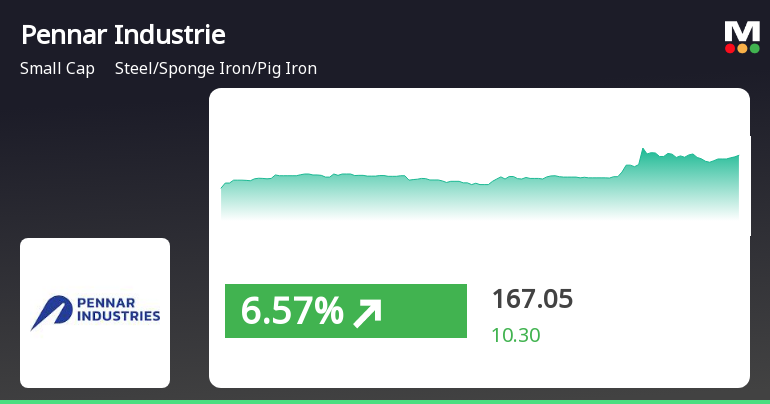

Read MorePennar Industries Experiences Technical Trend Shift Amid Strong Long-Term Performance

2025-03-12 08:00:29Pennar Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 167.40, reflecting a decline from the previous close of 173.15. Over the past year, Pennar Industries has shown a notable stock return of 37.38%, significantly outperforming the Sensex, which recorded a mere 0.82% return in the same period. In terms of technical indicators, the weekly MACD is currently bearish, while the monthly MACD shows a mildly bearish stance. The Bollinger Bands indicate a bearish trend on a weekly basis, contrasting with a bullish outlook on a monthly basis. Moving averages also reflect a bearish sentiment, and the KST aligns with this trend, showing bearish signals on a weekly basis and mildly bearish on a monthly basis. Despite the recent evaluation revision, Pennar Industries has demonstrated strong perfor...

Read More

Pennar Industries Reports Strong Q3 Performance Amid Long-Term Financial Challenges

2025-03-06 08:04:17Pennar Industries has recently adjusted its evaluation following a positive third-quarter performance, reporting net sales of Rs 839.72 crore and a profit before tax of Rs 33.05 crore. However, challenges persist with modest growth rates and concerns over capital efficiency and debt servicing capabilities, reflecting a complex financial landscape.

Read MorePennar Industries Shows Resilience Amid Mixed Technical Trend Indicators

2025-03-06 08:00:18Pennar Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 168.55, showing a notable increase from the previous close of 156.75. Over the past year, Pennar Industries has demonstrated a robust performance with a return of 25.46%, significantly outperforming the Sensex, which recorded a mere 0.07% return in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Daily moving averages are bearish, and the KST reflects a similar bearish sentiment on a weekly basis, with a mildly bearish stance mo...

Read More

Pennar Industries Shows Potential Trend Reversal Amid Broader Small-Cap Gains

2025-03-05 11:00:21Pennar Industries, a small-cap company in the Steel sector, experienced a notable increase in stock price after a series of declines. The stock outperformed its sector and has shown resilience over the past month, despite a negative three-month performance. The broader market also saw gains, particularly among small-cap stocks.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation for the Closure of Trading Window

Information Regarding Issuance Of Letter Of Confirmation In Lieu Of Share Certificate(S) Lost/ Misplaced

20-Feb-2025 | Source : BSEinformation regarding issuance of Letter of Confirmation in lieu of Share Certificate(s) lost/ Misplace

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

16-Feb-2025 | Source : BSEQ3FY25 Earnings Call Transcript.

Corporate Actions

No Upcoming Board Meetings

Pennar Industries Ltd has declared 20% dividend, ex-date: 19 Jul 13

No Splits history available

No Bonus history available

No Rights history available