Permanent Magnets Adjusts Valuation Amidst Competitive Engineering Sector Landscape

2025-03-20 08:00:27Permanent Magnets, a microcap company in the engineering sector, has recently undergone a valuation adjustment. The company's current price stands at 618.05, reflecting a slight increase from the previous close of 607.70. Over the past year, Permanent Magnets has experienced a stock return of -34.63%, contrasting with a 4.77% return from the Sensex during the same period. Key financial metrics for Permanent Magnets include a PE ratio of 31.99 and an EV to EBITDA ratio of 17.76. The company also reports a return on capital employed (ROCE) of 17.72% and a return on equity (ROE) of 11.84%. In comparison to its peers, Permanent Magnets presents a higher PE ratio than several competitors, such as BMW Industries and Gensol Engineering, which have significantly lower valuations. This indicates a relative premium in its market positioning. However, the company’s valuation metrics suggest a more favorable standi...

Read More

Permanent Magnets Faces Declining Performance Amidst Bearish Market Sentiment

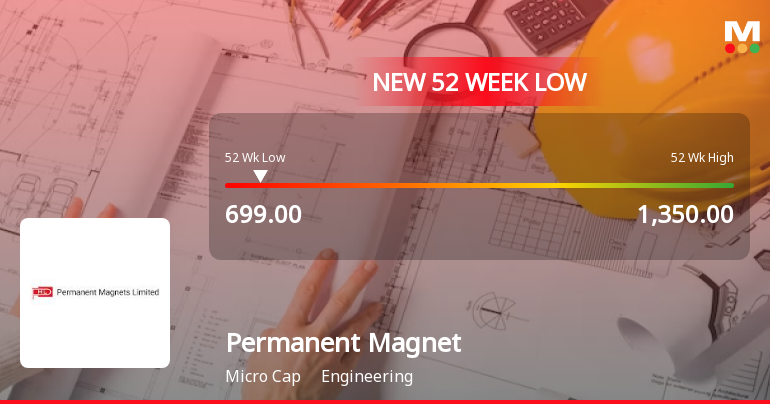

2025-03-17 10:09:48Permanent Magnets, a microcap engineering firm, has seen notable stock activity, nearing a 52-week low. The company has struggled financially, with a significant decline in operating profit and quarterly PAT. Additionally, it lacks domestic mutual fund investment, raising concerns about its valuation and market prospects.

Read More

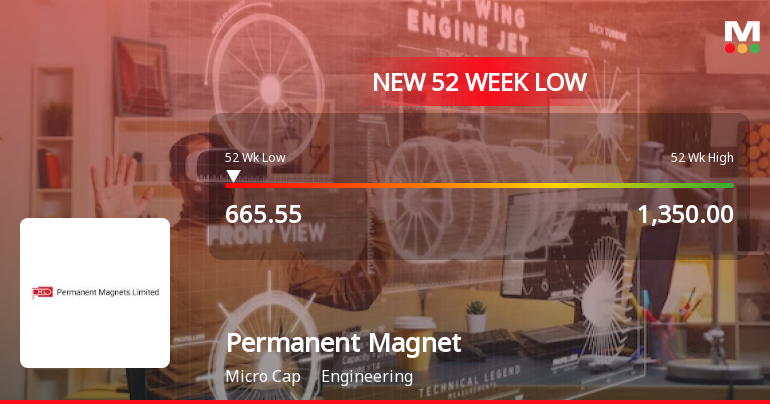

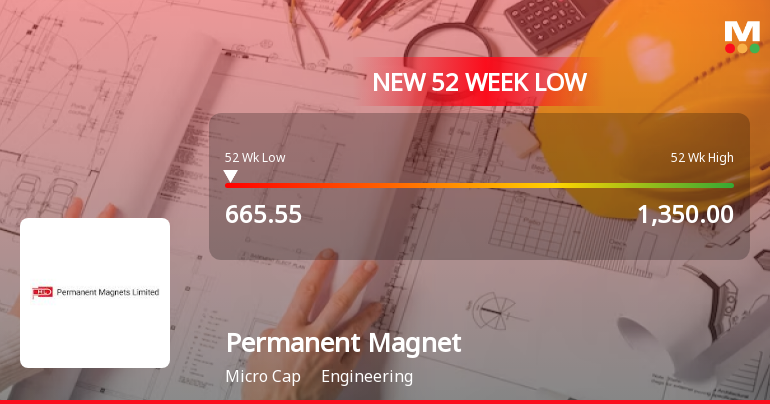

Permanent Magnets Hits 52-Week Low Amid Broader Market Decline and Weak Financials

2025-03-12 12:35:42Permanent Magnets, a microcap engineering firm, reached a new 52-week low amid a broader market decline, with the Sensex dropping significantly. The company has experienced a 32.60% decline over the past year and reported a 46.9% decrease in profit after tax, reflecting ongoing financial challenges.

Read More

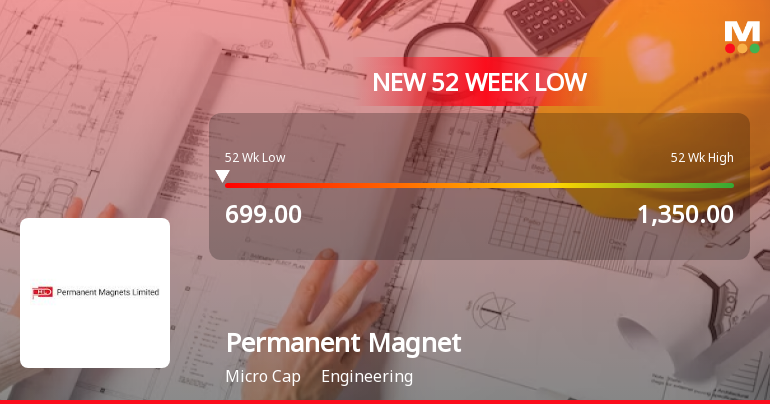

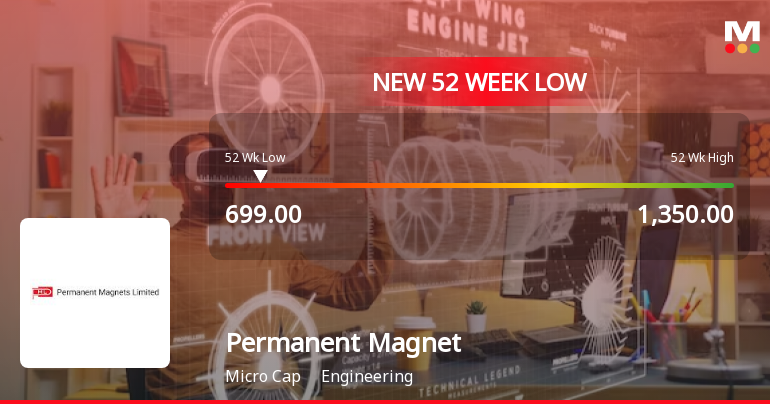

Permanent Magnets Faces Market Challenges Amid Significant Stock Volatility and Declining Profits

2025-03-11 09:41:43Permanent Magnets, a microcap engineering firm, has hit a new 52-week low amid ongoing volatility, with a notable decline over the past year. The company faces financial challenges, including a significant drop in profit after tax and a high price-to-book ratio, indicating a premium valuation compared to peers.

Read More

Permanent Magnets Faces Stock Volatility Amid Declining Financial Performance and Market Sentiment

2025-03-11 09:41:36Permanent Magnets, a microcap engineering firm, has faced notable stock volatility, hitting a 52-week low and experiencing a two-day decline. The company has underperformed the market with a significant annual loss and declining operating profit, while its technical indicators suggest a bearish trend. Domestic mutual funds hold no stake in the firm.

Read More

Permanent Magnets Faces Significant Challenges Amidst Broader Market Stability

2025-03-10 10:35:46Permanent Magnets, a microcap engineering firm, has faced notable volatility, reaching a 52-week low and underperforming its sector. Over the past year, the company has seen a significant decline in profit metrics and lacks interest from domestic mutual funds, raising concerns about its valuation compared to peers.

Read More

Permanent Magnets Faces Significant Market Challenges Amidst Volatile Trading Conditions

2025-03-06 15:35:53Permanent Magnets, a microcap engineering firm, hit a new 52-week low today after a brief period of gains. The stock closed lower, underperforming its sector. Over the past year, it has declined significantly, facing challenges such as negative profit growth and low return on capital employed, with limited investor confidence.

Read More

Permanent Magnets Faces Challenges Amid Declining Stock Performance and Profitability Concerns

2025-03-05 09:44:40Permanent Magnets, a microcap engineering firm, has reached a new 52-week low amid a challenging year, with its stock down significantly. Despite a recent slight recovery, it remains below key moving averages. The company has reported declining profits and lacks domestic mutual fund investment, indicating potential concerns about its future.

Read More

Permanent Magnets Faces Decline Amidst Weak Financial Performance and Market Position Challenges

2025-03-05 09:44:31Permanent Magnets, a microcap engineering company, has reached a new 52-week low amid a challenging year, with a 27.91% decline in stock performance. The company reported a significant drop in operating profit and has a low return on capital employed, indicating ongoing financial difficulties.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025

Quarterly Disclosures By Listed Entities Of Defaults On Payment Of Interest/ Repayment Of Principal Amount On Loans From Banks / Financial Institutions And Unlisted Debt Securities

04-Apr-2025 | Source : BSEQuarterly Disclosures by listed entities of defaults on payment of interest/ repayment of principal amount on loans from banks / financial institutions and unlisted debt securities

Closure of Trading Window

29-Mar-2025 | Source : BSEIntimation of Closure of Trading Window for the quarter and year ended March 31 2025.

Corporate Actions

No Upcoming Board Meetings

Permanent Magnets Ltd has declared 18% dividend, ex-date: 01 Aug 24

No Splits history available

No Bonus history available

No Rights history available