Piccadily Sugar Shows Mixed Technical Trends Amid Strong Long-Term Growth Performance

2025-02-25 10:27:53Piccadily Sugar & Allied Industries, a microcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 63.70, slightly down from the previous close of 64.10. Over the past year, Piccadily Sugar has shown a notable return of 16.26%, significantly outperforming the Sensex, which recorded a return of 2.05% in the same period. In terms of technical indicators, the company's performance has been mixed. The MACD and KST indicators suggest a bearish trend on a weekly basis, while the monthly outlook shows a mildly bearish sentiment. Conversely, the Bollinger Bands indicate a bullish trend on both weekly and monthly scales, suggesting some volatility in price movements. The moving averages present a mildly bearish stance on a daily basis, reflecting short-term challenges. Looking at the company's returns compar...

Read More

Piccadily Sugar Hits 52-Week Low Amid Broader Sugar Industry Challenges

2025-02-18 11:53:54Piccadily Sugar & Allied Industries has hit a new 52-week low, continuing a downward trend over the past three days with a notable loss. The stock is trading below all major moving averages and has declined significantly over the past year, reflecting ongoing challenges in the sugar industry.

Read More

Piccadily Sugar Faces Persistent Challenges Amid Significant Trading Volatility

2025-02-17 09:37:24Piccadily Sugar & Allied Industries has faced notable volatility, recently hitting a 52-week low amid ongoing challenges in the microcap sugar sector. The stock has underperformed its sector and is trading below multiple moving averages, reflecting persistent bearish sentiment and a significant decline over the past year.

Read More

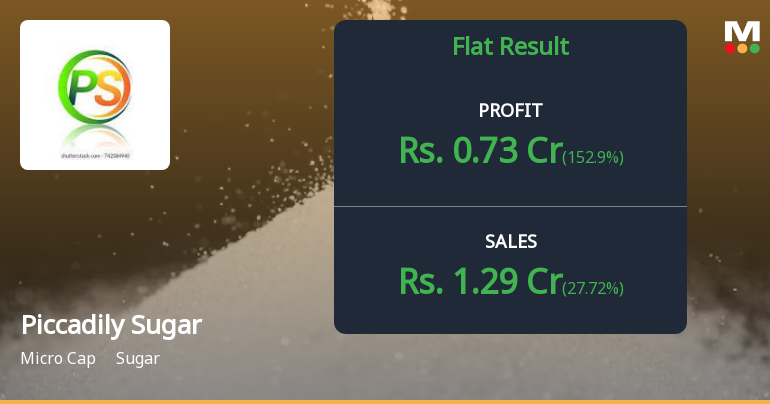

Piccadily Sugar Reports Steady Q3 FY24-25 Results Amid Evaluation Adjustments

2025-02-05 15:31:28Piccadily Sugar & Allied Industries has announced its financial results for the quarter ending February 2025, showcasing consistent performance in the third quarter of FY24-25. The company has experienced a revision in its stock evaluation, reflecting changes in its market standing over the past three months.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECompliance for the quarter ended on 31.03.2025

Closure of Trading Window

21-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Integrated Filing (Financial)

03-Mar-2025 | Source : BSEIntegrated filing for the third quarter and nine months ended 31.12.2024

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available