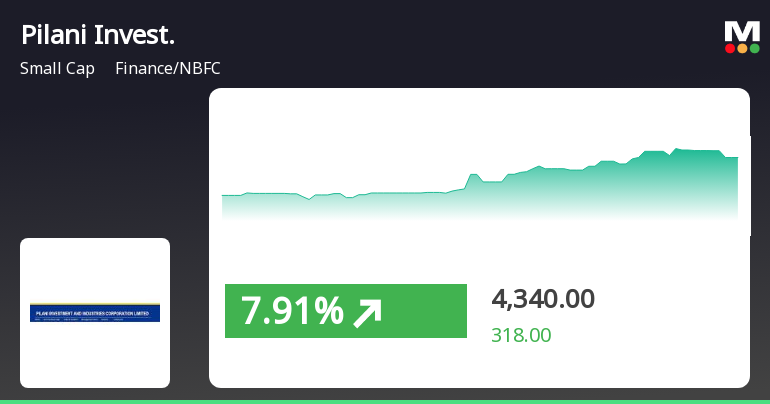

Pilani Investment & Industries Corporation Surges Amid Broader Market Fluctuations

2025-04-03 10:30:15Pilani Investment & Industries Corporation has experienced notable stock activity, achieving a significant gain and outperforming its sector. The stock is currently above several short-term moving averages but below longer-term ones. Despite recent gains, it has faced challenges over the past three months. The broader market shows mixed performance.

Read More

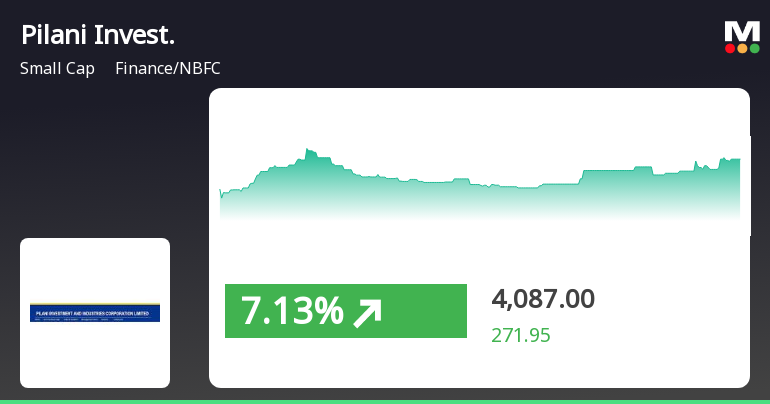

Pilani Investment Shows Strong Rebound Amid Broader Market Decline

2025-04-01 15:45:14Pilani Investment & Industries Corporation experienced a notable uptick on April 1, 2025, reversing a five-day decline. The stock outperformed the broader market, achieving significant returns over the past month and demonstrating impressive long-term growth, despite a year-to-date decline compared to the Sensex.

Read More

Pilani Investment Faces Bearish Outlook Amid Declining Financial Performance and Market Sentiment

2025-03-27 08:00:13Pilani Investment & Industries Corporation has experienced a recent evaluation adjustment due to shifts in its technical indicators and a decline in financial performance. Despite facing challenges, the company maintains strong long-term fundamentals and a fair valuation compared to peers, prompting interest from investors regarding future trends.

Read MorePilani Investment Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-26 08:00:11Pilani Investment & Industries Corporation, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,128.95, having closed at 4,288.00 previously. Over the past year, the stock has shown a return of 25.35%, significantly outperforming the Sensex, which recorded a return of 7.12% in the same period. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the monthly indicators show a mildly bearish stance. The Bollinger Bands present a mixed picture, with weekly readings indicating bearishness and monthly readings suggesting bullishness. The daily moving averages also reflect a bearish trend, indicating a cautious outlook in the short term. Despite the recent evaluation adjustment, Pilani Investment has demonstrated resilience over longer periods, particu...

Read More

Pilani Investment Faces Technical Shift Amid Declining Financial Performance and Strong Fundamentals

2025-03-24 08:00:16Pilani Investment & Industries Corporation has recently experienced an evaluation adjustment reflecting changes in its technical indicators, now showing a mildly bearish trend. Despite strong long-term fundamentals and a notable annual return, the company reported a decline in quarterly profits and net sales, raising concerns about its market position.

Read MorePilani Investment Experiences Technical Trend Shifts Amid Market Volatility

2025-03-24 08:00:10Pilani Investment & Industries Corporation, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,332.00, showing a notable increase from the previous close of 4,006.25. Over the past year, the stock has reached a high of 8,265.95 and a low of 3,125.00, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment, while the KST presents a mixed view with a bearish weekly and bullish monthly stance. When comparing the company's performance to the Sense...

Read More

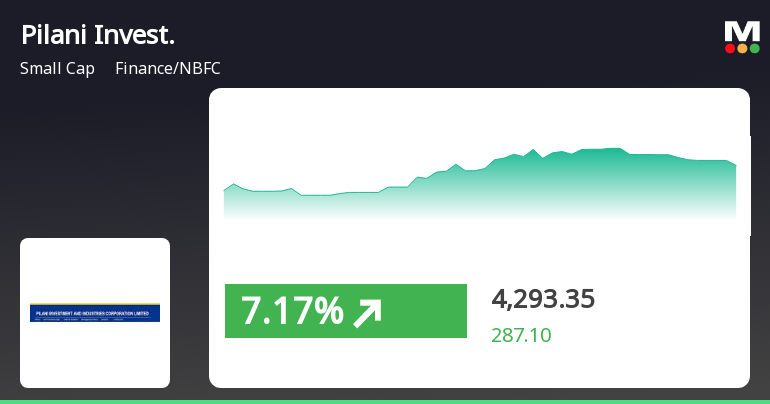

Pilani Investment Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-21 10:00:19Pilani Investment & Industries Corporation has experienced notable stock activity, gaining 8.61% on March 21, 2025, and outperforming its sector. The stock has shown a strong upward trend over the past five days, with a total return of 25.39%, despite a year-to-date decline.

Read More

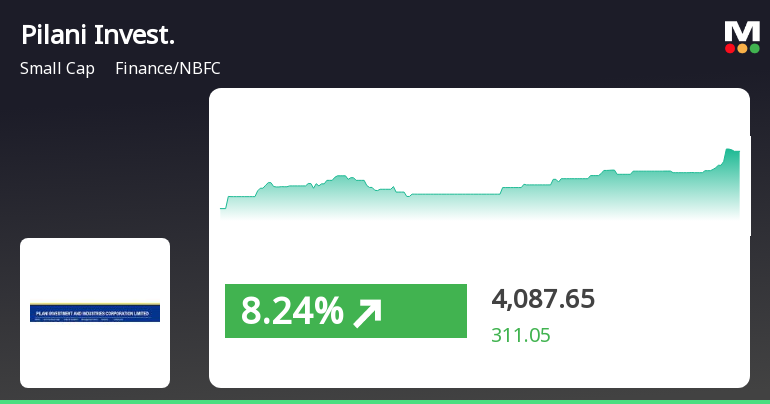

Pilani Investment & Industries Corporation Shows Resilience Amid Market Volatility

2025-03-20 12:30:13Pilani Investment & Industries Corporation has experienced notable activity, gaining 8.24% on March 20, 2025, and outperforming its sector. The stock has shown a consistent upward trend over four days, reaching an intraday high and reflecting mixed momentum in moving averages amid broader market fluctuations.

Read More

Pilani Investment Faces Profit Decline Amid Strong Long-Term Growth Metrics in September 2023

2025-02-13 18:40:55Pilani Investment & Industries Corporation, a small-cap finance/NBFC firm, recently experienced a score adjustment amid declining Q3 FY24-25 performance indicators, including a drop in profit after tax and net sales. Despite these setbacks, the company maintains strong long-term fundamentals, with significant growth rates in operating profits and net sales.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

Closure of Trading Window

21-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Credit Rating

12-Feb-2025 | Source : BSECredit Rating

Corporate Actions

No Upcoming Board Meetings

Pilani Investment & Industries Corporation Ltd has declared 150% dividend, ex-date: 20 Sep 24

No Splits history available

Pilani Investment & Industries Corporation Ltd has announced 2:5 bonus issue, ex-date: 31 Dec 20

No Rights history available