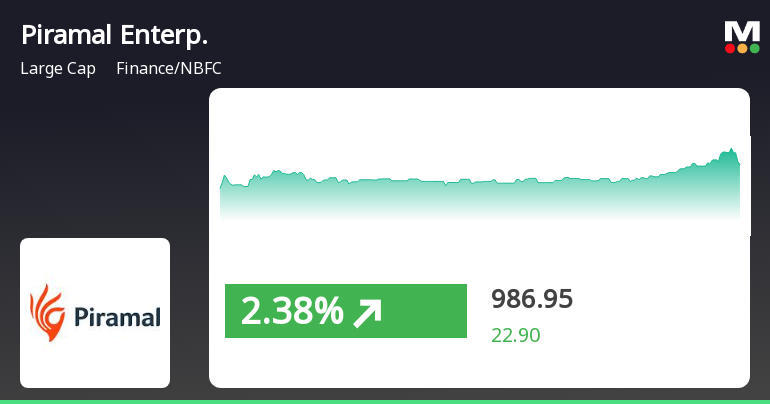

Piramal Enterprises Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-21 13:15:21Piramal Enterprises has shown strong performance, gaining 3.48% on March 21, 2025, with five consecutive days of increases totaling 11.15%. The stock reached an intraday high of Rs 987.6 and is currently above several moving averages, despite a year-to-date decline of 10.08%.

Read More

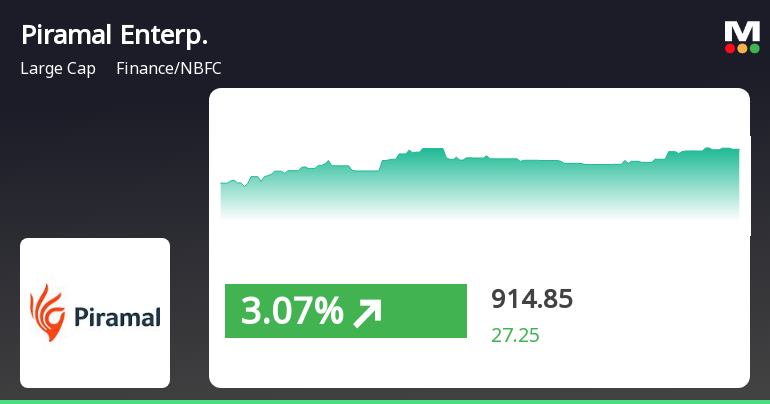

Piramal Enterprises Shows Strong Short-Term Gains Amid Broader Market Trends

2025-03-19 10:05:20Piramal Enterprises has demonstrated strong performance, gaining 3.26% on March 19, 2025, and achieving consecutive gains over three days. The stock has outperformed its sector and delivered a 15.75% return over the past year, significantly exceeding the Sensex's 4.70% return.

Read More

Piramal Enterprises Shows Mixed Performance Amid Broader Market Gains and Trends

2025-03-18 11:45:24Piramal Enterprises has demonstrated significant activity, gaining 3.04% on March 18, 2025, and outperforming its sector. The stock has shown consecutive gains over two days and reached an intraday high. Its moving averages reflect a mixed trend, while the broader market also shows positive movement, particularly in small-cap stocks.

Read MorePiramal Enterprises Faces Mixed Technical Trends Amid Market Volatility

2025-03-11 08:02:13Piramal Enterprises, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 899.15, down from a previous close of 915.00, with a 52-week high of 1,275.40 and a low of 736.60. Today's trading saw a high of 930.00 and a low of 894.20, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) is bullish weekly but shows no signal monthly, suggesting varied momentum. Bollinger Bands also reflect bearish conditions weekly and mildly bearish monthly. Moving averages indicate a bearish trend on a daily basis, while the KST presents a bullish outlook monthly. In terms of performance, Piramal Enterprises has faced challenges compared to the Se...

Read MorePiramal Enterprises Faces Mixed Technical Trends Amid Market Volatility

2025-03-11 08:02:13Piramal Enterprises, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 899.15, down from a previous close of 915.00, with a 52-week high of 1,275.40 and a low of 736.60. Today's trading saw a high of 930.00 and a low of 894.20, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) is bullish weekly but shows no signal monthly, suggesting varied momentum. Bollinger Bands also reflect bearish conditions weekly and mildly bearish monthly. Moving averages indicate a bearish trend on a daily basis, while the KST presents a bullish outlook monthly. In terms of performance, Piramal Enterprises has faced challenges compared to the Se...

Read MorePiramal Enterprises Faces Mixed Technical Trends Amid Market Volatility

2025-03-11 08:02:13Piramal Enterprises, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 899.15, down from a previous close of 915.00, with a 52-week high of 1,275.40 and a low of 736.60. Today's trading saw a high of 930.00 and a low of 894.20, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) is bullish weekly but shows no signal monthly, suggesting varied momentum. Bollinger Bands also reflect bearish conditions weekly and mildly bearish monthly. Moving averages indicate a bearish trend on a daily basis, while the KST presents a bullish outlook monthly. In terms of performance, Piramal Enterprises has faced challenges compared to the Se...

Read MorePiramal Enterprises Faces Mixed Technical Trends Amid Market Volatility

2025-03-11 08:02:13Piramal Enterprises, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 899.15, down from a previous close of 915.00, with a 52-week high of 1,275.40 and a low of 736.60. Today's trading saw a high of 930.00 and a low of 894.20, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) is bullish weekly but shows no signal monthly, suggesting varied momentum. Bollinger Bands also reflect bearish conditions weekly and mildly bearish monthly. Moving averages indicate a bearish trend on a daily basis, while the KST presents a bullish outlook monthly. In terms of performance, Piramal Enterprises has faced challenges compared to the Se...

Read MorePiramal Enterprises Faces Mixed Technical Trends Amid Market Volatility

2025-03-11 08:02:13Piramal Enterprises, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 899.15, down from a previous close of 915.00, with a 52-week high of 1,275.40 and a low of 736.60. Today's trading saw a high of 930.00 and a low of 894.20, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) is bullish weekly but shows no signal monthly, suggesting varied momentum. Bollinger Bands also reflect bearish conditions weekly and mildly bearish monthly. Moving averages indicate a bearish trend on a daily basis, while the KST presents a bullish outlook monthly. In terms of performance, Piramal Enterprises has faced challenges compared to the Se...

Read MorePiramal Enterprises Faces Mixed Technical Trends Amid Market Volatility

2025-03-11 08:02:13Piramal Enterprises, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 899.15, down from a previous close of 915.00, with a 52-week high of 1,275.40 and a low of 736.60. Today's trading saw a high of 930.00 and a low of 894.20, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) is bullish weekly but shows no signal monthly, suggesting varied momentum. Bollinger Bands also reflect bearish conditions weekly and mildly bearish monthly. Moving averages indicate a bearish trend on a daily basis, while the KST presents a bullish outlook monthly. In terms of performance, Piramal Enterprises has faced challenges compared to the Se...

Read MoreAnnouncement under Regulation 30 (LODR)-Scheme of Arrangement

09-Apr-2025 | Source : BSEPiramal Enterprises Limited has informed the Exchange about Modification to the Composite Scheme of Arrangement amongst the Company Piramal Finance Limited (Formerly known as Piramal Capital & Housing Finance Limited) and their respective shareholders and creditors.

Announcement under Regulation 30 (LODR)-Allotment

09-Apr-2025 | Source : BSEIntimation with respect to allotment of Secured rated listed Redeemable Non convertible debentures on private placement basis

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

07-Apr-2025 | Source : BSEIntimation regarding receipt of Non-Banking Financial Institution - Investment and Credit Company Certificate of Registration by Piramal Finance Limited a wholly-owned subsidiary of the Company

Corporate Actions

No Upcoming Board Meetings

Piramal Enterprises Ltd has declared 500% dividend, ex-date: 05 Jul 24

No Splits history available

No Bonus history available

Piramal Enterprises Ltd has announced 11:83 rights issue, ex-date: 30 Dec 19