Piramal Pharma Shows Strong Momentum Amid Broader Market Trends in Pharmaceuticals

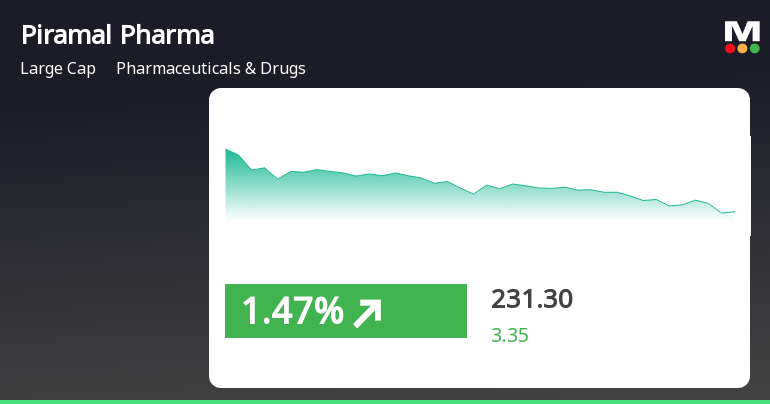

2025-04-03 09:35:32Piramal Pharma experienced notable activity on April 3, 2025, with a significant intraday rise and strong performance over the past week. The stock is trading above multiple moving averages, reflecting a solid market position. The Pharmaceuticals & Drugs sector also showed positive movement, contributing to the overall market dynamics.

Read More

Piramal Pharma Faces Market Sentiment Shift Amid Debt and Profit Decline Concerns

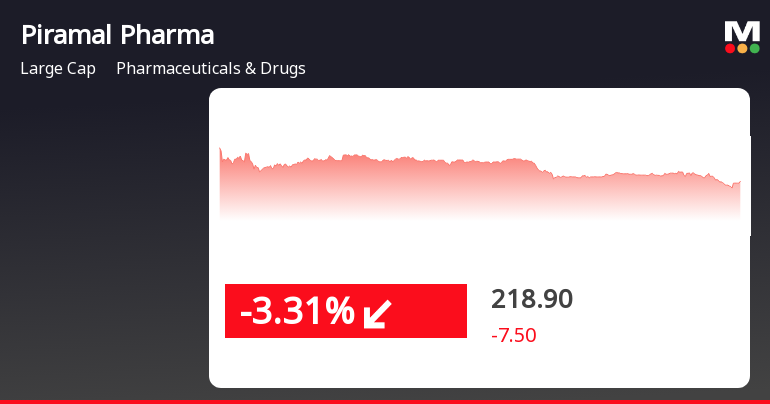

2025-04-02 08:40:58Piramal Pharma has experienced a recent evaluation adjustment, reflecting changes in market sentiment. The company faces challenges with a high Debt to EBITDA ratio and low Return on Equity. Despite a significant decline in quarterly profits, it has shown strong long-term growth and outperformed the broader market over the past year.

Read MorePiramal Pharma Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-04-02 08:10:11Piramal Pharma, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 225.25, showing a slight increase from the previous close of 224.50. Over the past year, Piramal Pharma has demonstrated a notable performance with a return of 73.47%, significantly outperforming the Sensex, which recorded a return of 2.72% during the same period. In terms of technical indicators, the weekly MACD is currently bearish, while the monthly indicators show no clear signal. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish outlook on a monthly scale. Daily moving averages also reflect a mildly bearish sentiment. The KST and OBV indicators are showing no definitive trends at this time. Piramal Pharma's performance over various time frames highlights its resil...

Read MorePiramal Pharma Shows Resilience Amidst Market Fluctuations and Premium Valuation

2025-04-01 18:00:33Piramal Pharma, a prominent player in the Pharmaceuticals & Drugs industry, has shown notable activity today, reflecting its current market dynamics. With a market capitalization of Rs 29,505.00 crore, the company operates within the large-cap segment. The stock's price-to-earnings (P/E) ratio stands at an elevated 568.95, significantly higher than the industry average of 35.20, indicating a premium valuation relative to its peers. Over the past year, Piramal Pharma has delivered a robust performance, gaining 73.47%, in stark contrast to the Sensex, which has only increased by 2.72%. On a daily basis, the stock has seen a slight uptick of 0.33%, while the Sensex has declined by 1.80%. However, the stock's performance over the past week has been slightly negative, down 0.51%, compared to the Sensex's 2.55% drop. In terms of technical indicators, the weekly MACD suggests a bearish trend, while the monthly B...

Read More

Piramal Pharma Faces Short-Term Challenges Amid Broader Market Fluctuations

2025-03-26 15:35:27Piramal Pharma saw a decline on March 26, 2025, underperforming the sector despite remaining above several key moving averages. The broader market, represented by the Sensex, also fell, closing lower but showing resilience over the past three weeks. Yearly performance for Piramal Pharma remains strong, despite short-term challenges.

Read MorePiramal Pharma Sees Surge in Trading Activity Amid Strong Sector Performance

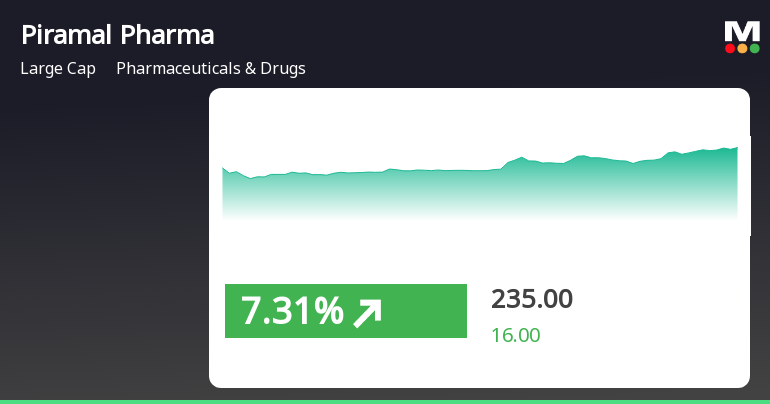

2025-03-25 13:00:06Piramal Pharma Ltd (PPLPHARMA) has emerged as one of the most active stocks today, with a total traded volume of 33,910,044 shares and a total traded value of approximately Rs 78.33 crore. The stock opened at Rs 221.59 and reached an intraday high of Rs 237.70, reflecting an increase of 8.52% from the previous close of Rs 219.04. The day's low was recorded at Rs 220.35, while the last traded price stands at Rs 226.89. In terms of performance, Piramal Pharma has outperformed its sector by 5.08%, while the broader market, represented by the Sensex, saw a modest return of 0.09%. The stock's one-day return is noted at 3.59%, contrasting with a sector return of -1.37%. Investor participation has also seen a notable rise, with a delivery volume of 1.65 lakh shares on March 24, marking a 24.26% increase compared to the five-day average delivery volume. Additionally, the stock remains liquid enough for a trade s...

Read MorePiramal Pharma Shows Strong Trading Activity Amidst Market Challenges

2025-03-25 11:00:07Piramal Pharma Ltd, a prominent player in the Pharmaceuticals & Drugs industry, has emerged as one of the most active equities today, with a total traded volume of 16,542,775 shares and a total traded value of approximately Rs 38,390.82 lakhs. The stock opened at Rs 221.59 and reached a day high of Rs 237.70, reflecting a notable intraday increase of 7.61%. As of the latest update, the last traded price stands at Rs 233.97, marking a 7.93% return for the day, significantly outperforming its sector, which reported a decline of 1.01%. Piramal Pharma's performance is further underscored by its liquidity, with a trading capacity sufficient for a trade size of Rs 2.44 crore, based on 2% of the five-day average traded value. The stock's weighted average price indicates that more volume was traded closer to its low price, while it remains above its 5-day, 20-day, 50-day, and 200-day moving averages, although it i...

Read More

Piramal Pharma Outperforms Sector Amid Broader Market Gains and Mixed Trends

2025-03-25 10:05:30Piramal Pharma experienced notable trading activity, outperforming its sector and reaching an intraday high. The stock is positioned above several key moving averages, indicating a mixed trend. In the broader market, the Sensex continued to rise, reflecting strong performance from mega-cap stocks, while Piramal's year-to-date performance shows volatility.

Read More

Piramal Pharma Faces Potential Trend Reversal Amid Broader Market Resilience

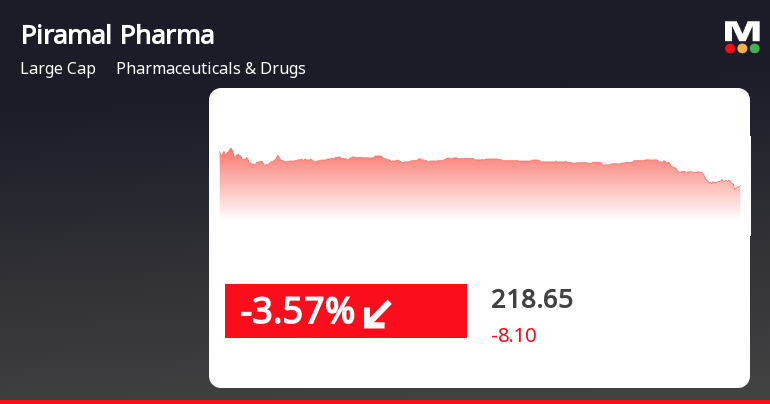

2025-03-24 15:20:27Piramal Pharma's stock declined on March 24, 2025, after a six-day gain streak, reaching an intraday low. Despite this drop, it remains above several moving averages, indicating mixed short to medium-term performance. In contrast, the broader market, represented by the Sensex, showed resilience with notable gains.

Read MoreDisclosure Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations)

01-Apr-2025 | Source : BSEDisclosure under Regulation 30 of the securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) regulations 2015 (SEBI Listing Regaultions)

Shareholder Meeting / Postal Ballot-Scrutinizers Report

21-Mar-2025 | Source : BSEE-voting Results and Scrutinizers Report on Postal Ballot

Announcement under Regulation 30 (LODR)-Press Release / Media Release

20-Mar-2025 | Source : BSEPress Release - Piramal Critical Care and BrePco announces MHRA approval for Neoatricon in the UK.

Corporate Actions

No Upcoming Board Meetings

Piramal Pharma Ltd has declared 1% dividend, ex-date: 12 Jul 24

No Splits history available

No Bonus history available

Piramal Pharma Ltd has announced 5:46 rights issue, ex-date: 02 Aug 23