Pitti Engineering Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:02:09Pitti Engineering, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,092.30, showing a notable increase from the previous close of 1,003.80. Over the past week, Pitti Engineering has demonstrated a strong performance with a return of 9.56%, significantly outperforming the Sensex, which recorded a decline of 0.87%. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish stance on a monthly scale. Moving averages also reflect a mildly bearish sentiment, while the Dow Theory presents a mildly bullish perspective on a weekly basis. Pitti Engineering's performance over various time frames highlights its resilience, particularly over the last th...

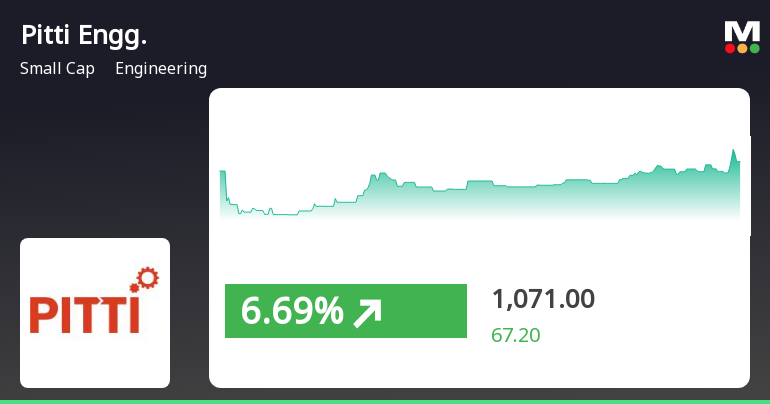

Read MorePitti Engineering Opens Strong with 5.59% Gain, Outperforming Sector Significantly

2025-04-02 15:05:10Pitti Engineering, a small-cap player in the engineering sector, has shown significant activity today, opening with a gain of 5.59%. The stock outperformed its sector by 6.86%, reaching an intraday high of Rs 1121, reflecting an increase of 11.68%. However, the stock has also exhibited high volatility, with an intraday fluctuation of 6.91%. In terms of performance metrics, Pitti Engineering's one-day performance stands at 8.54%, significantly surpassing the Sensex's 0.86%. Over the past month, the stock has gained 20.49%, compared to the Sensex's 4.75%. Technical indicators reveal that while the stock is currently above its 5-day, 20-day, and 50-day moving averages, it remains below the 100-day and 200-day moving averages. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The stock's beta of 1.35 indicates that it tends to experience larger price movements com...

Read More

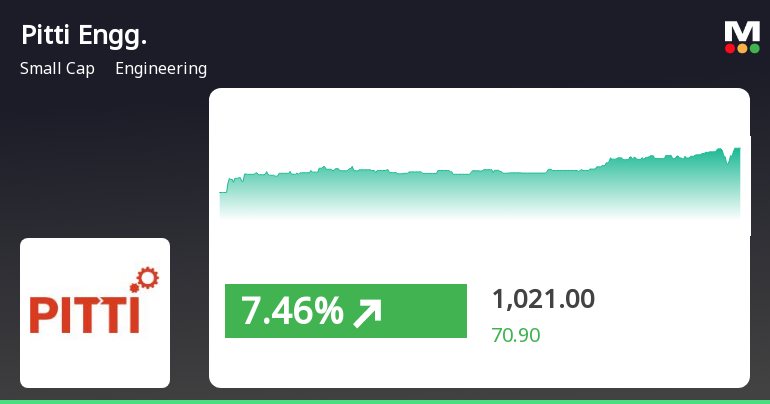

Pitti Engineering Outperforms Sector Amidst Notable Stock Activity and Long-Term Gains

2025-04-02 14:15:16Pitti Engineering experienced notable trading activity on April 2, 2025, with a significant intraday high and outperforming its sector. The stock is above several short-term moving averages but below longer-term ones. Over the past three and five years, it has shown remarkable growth, despite a year-to-date decline.

Read MorePitti Engineering Faces Bearish Technical Trends Amid Recent Market Volatility

2025-04-02 08:03:32Pitti Engineering, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1003.80, down from a previous close of 1042.15, with a notable 52-week high of 1,511.45 and a low of 773.85. Today's trading saw a high of 1048.05 and a low of 996.80, indicating some volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Bollinger Bands also reflect a bearish outlook weekly, although they are mildly bullish on a monthly basis. Moving averages and KST indicators align with the bearish sentiment, while the RSI and OBV show no significant trends. In terms of performance, Pitti Engineering's stock return over the past week has declined by 4.08%, contrasting with a 2.55% drop in th...

Read MorePitti Engineering Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:01:59Pitti Engineering, a small-cap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1047.05, showing a notable increase from the previous close of 1007.85. Over the past year, Pitti Engineering has demonstrated a robust performance with a return of 40.73%, significantly outpacing the Sensex, which recorded a return of 7.07% during the same period. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on a weekly basis while being mildly bearish on a monthly scale. The Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish stance monthly. Moving averages indicate a bearish trend daily, while the KST reflects a similar bearish sentiment on a weekly basis, transitioning to mildly bearish monthly. In terms of stock performance, Pitti Engineering has sh...

Read More

Pitti Engineering's Recent Gains Highlight Mixed Trends Amid Broader Market Surge

2025-03-18 15:45:47Pitti Engineering experienced notable activity on March 18, 2025, with a significant gain, outperforming its sector. The stock has shown consecutive gains over four days, reaching an intraday high. While its short-term performance is mixed, the broader market, particularly small-cap stocks, has seen substantial growth.

Read MorePitti Engineering Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-13 08:00:22Pitti Engineering has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics and market position within the engineering sector. The company's current price stands at 915.40, slightly up from the previous close of 915.20. Over the past year, Pitti Engineering has shown a return of 22.78%, significantly outperforming the Sensex, which returned only 0.49%. Key financial indicators for Pitti Engineering include a PE ratio of 27.25 and an EV to EBITDA ratio of 16.16. The company also boasts a PEG ratio of 0.67, suggesting a favorable growth outlook relative to its earnings. However, its dividend yield remains modest at 0.15%, and the return on equity (ROE) is reported at 13.01%. In comparison to its peers, Pitti Engineering's valuation metrics appear less favorable. Companies like Ashoka Buildcon and GMM Pfaudler are positioned with significantly lower PE ratios and more ...

Read MorePitti Engineering Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-13 08:00:22Pitti Engineering has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics and market position within the engineering sector. The company's current price stands at 915.40, slightly up from the previous close of 915.20. Over the past year, Pitti Engineering has shown a return of 22.78%, significantly outperforming the Sensex, which returned only 0.49%. Key financial indicators for Pitti Engineering include a PE ratio of 27.25 and an EV to EBITDA ratio of 16.16. The company also boasts a PEG ratio of 0.67, suggesting a favorable growth outlook relative to its earnings. However, its dividend yield remains modest at 0.15%, and the return on equity (ROE) is reported at 13.01%. In comparison to its peers, Pitti Engineering's valuation metrics appear less favorable. Companies like Ashoka Buildcon and GMM Pfaudler are positioned with significantly lower PE ratios and more ...

Read MorePitti Engineering Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-07 08:00:49Pitti Engineering has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics and market position within the engineering sector. The company's current price stands at 946.30, showing a slight increase from the previous close of 926.70. Over the past year, Pitti Engineering has demonstrated a stock return of 20.78%, significantly outperforming the Sensex, which recorded a modest gain of 0.34%. Key financial indicators for Pitti Engineering include a PE ratio of 28.17 and an EV to EBITDA ratio of 16.65, which provide insight into its valuation relative to earnings and operational performance. The company also boasts a return on capital employed (ROCE) of 12.12% and a return on equity (ROE) of 13.01%, indicating effective management of its resources. In comparison to its peers, Pitti Engineering's valuation metrics reveal a competitive landscape. For instance, GMM Pfaudl...

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Management

07-Apr-2025 | Source : BSEResignation of Senior Management Personnel

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Particpants) Regulations 2018

Updates On Capacity Addition

31-Mar-2025 | Source : BSEUpdates on Capacity Addition

Corporate Actions

No Upcoming Board Meetings

Pitti Engineering Ltd has declared 30% dividend, ex-date: 13 Sep 24

Pitti Engineering Ltd has announced 5:10 stock split, ex-date: 16 Apr 15

No Bonus history available

No Rights history available