Pix Transmission Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-04-03 08:04:50Pix Transmission, a small-cap player in the rubber products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1609.00, down from the previous close of 1625.30. Over the past year, Pix Transmission has shown a return of 16.32%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands reflect a bearish stance on a weekly basis, contrasting with a mildly bullish outlook monthly. Notably, the stock's performance has been volatile, with a 52-week high of 2,796.45 and a low of 1,185.55. In terms of returns, Pix Transmission has demonstrated resilience over longer periods, with a remarkable 1839.72% return over five years, compared ...

Read MorePix Transmission Shows Diverging Technical Trends Amid Strong Long-Term Performance

2025-04-01 08:02:43Pix Transmission, a small-cap player in the rubber products industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 1622.45, slightly down from the previous close of 1627.00. Over the past year, Pix Transmission has shown a notable performance, with a return of 21.32%, significantly outpacing the Sensex's 5.11% return. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis while remaining bullish on a monthly scale. The Bollinger Bands also reflect a bearish stance weekly, contrasting with a bullish monthly outlook. Moving averages signal a bearish trend, and the KST aligns with this sentiment on a weekly basis, although it is bullish monthly. The Dow Theory presents a mildly bullish view weekly, while the OBV shows no trend weekly but leans mildly bearish monthly. Despite the recent eva...

Read MorePix Transmission Shows Resilience Amid Recent Volatility in Rubber Products Sector

2025-03-28 18:00:21Pix Transmission Ltd, a small-cap player in the rubber products industry, has shown a mixed performance in recent trading sessions. With a market capitalization of Rs 2,260.00 crore, the company currently has a price-to-earnings (P/E) ratio of 19.28, which is slightly below the industry average of 21.57. Over the past year, Pix Transmission has outperformed the Sensex, achieving a return of 21.32% compared to the index's 5.11%. However, the stock has faced challenges in the short term, with a decline of 0.28% today, while the Sensex fell by 0.25%. The stock's performance over the past week has been notably weaker, down 8.31%, contrasting with the Sensex's modest gain of 0.66%. In terms of longer-term performance, Pix Transmission has delivered impressive returns, with a staggering 1860.66% increase over the past five years and a remarkable 3469.75% rise over the last decade. Despite recent volatility, the...

Read MorePix Transmission Adjusts Valuation Grade Amid Strong Long-Term Performance in Rubber Sector

2025-03-28 08:00:36Pix Transmission, a small-cap player in the rubber products industry, has recently undergone a valuation adjustment. The company's current price stands at 1,627.00, reflecting a slight decline from the previous close of 1,635.75. Over the past year, Pix Transmission has shown a stock return of 21.86%, significantly outperforming the Sensex, which recorded a return of 6.32% during the same period. Key financial metrics for Pix Transmission include a PE ratio of 19.33 and an EV to EBITDA ratio of 14.01. The company also boasts a robust return on capital employed (ROCE) of 29.83% and a return on equity (ROE) of 20.74%. In comparison to its peers, Pix Transmission's valuation metrics indicate a competitive position, particularly when contrasted with companies like Cupid and Tinna Rubber, which exhibit higher PE ratios and EV to EBITDA figures. Despite recent fluctuations in stock price, Pix Transmission's lon...

Read MorePix Transmission Adjusts Valuation Grade Amid Strong Market Performance and Competitive Metrics

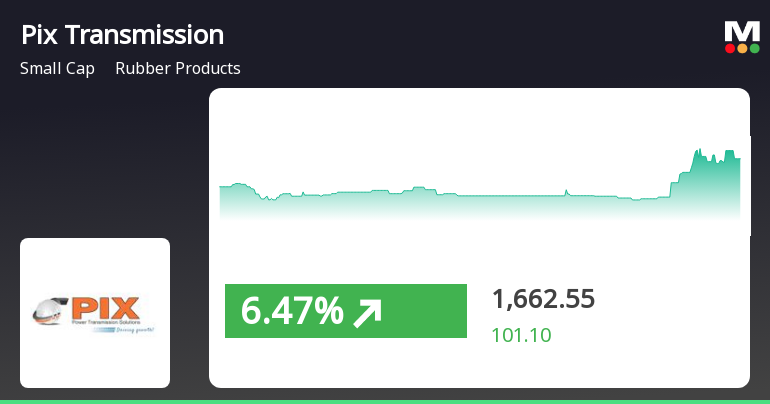

2025-03-19 08:00:41Pix Transmission, a small-cap player in the rubber products industry, has recently undergone a valuation adjustment. The company's current price stands at 1,663.30, reflecting a notable increase from the previous close of 1,561.45. Over the past year, Pix Transmission has demonstrated a stock return of 28.51%, significantly outperforming the Sensex, which returned 3.51% during the same period. Key financial metrics for Pix Transmission include a PE ratio of 19.77 and an EV to EBITDA ratio of 14.35. The company also boasts a robust return on capital employed (ROCE) of 29.83% and a return on equity (ROE) of 20.74%. These figures highlight its strong operational efficiency and profitability. In comparison to its peers, Pix Transmission's valuation metrics indicate a competitive position within the industry. For instance, while Cupid and Tinna Rubber are also positioned at elevated valuation levels, Pix Trans...

Read More

Pix Transmission Shows Signs of Trend Reversal Amid Broader Small-Cap Gains

2025-03-18 15:16:02Pix Transmission, a small-cap rubber products company, experienced a significant rise on March 18, 2025, following two days of decline. The stock's performance surpassed the broader sector, showcasing high volatility. Over the past year, it has outperformed the Sensex, reflecting strong growth in the small-cap segment.

Read More

Pix Transmission Shows Strong Financial Stability Amidst Mixed Growth Outlook

2025-03-18 08:17:08Pix Transmission, a small-cap rubber products company, has recently adjusted its evaluation, showcasing strong debt management and consistent performance with six consecutive quarters of positive results. The latest half-year Profit After Tax grew significantly, while institutional investor participation has increased, indicating growing confidence in the company's fundamentals.

Read MorePix Transmission's Technical Indicators Reflect Mixed Trends Amid Market Volatility

2025-03-12 08:02:15Pix Transmission, a small-cap player in the rubber products industry, has recently undergone an evaluation adjustment reflecting its current market dynamics. The stock is currently priced at 1,538.00, showing a notable increase from the previous close of 1,465.25. Over the past week, the stock has reached a high of 1,549.90 and a low of 1,454.20, indicating some volatility. In terms of technical indicators, the weekly MACD is bearish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) does not signal any significant movement in either timeframe. Bollinger Bands present a mixed picture, with a bearish outlook weekly and a bullish stance monthly. Moving averages indicate a mildly bullish trend on a daily basis, while the KST shows a mildly bearish trend weekly but bullish monthly. When comparing the stock's performance to the Sensex, Pix Transmission has demonstrat...

Read More

Pix Transmission Reports Strong Profit Growth Amid Long-Term Growth Concerns and High Valuation Metrics

2025-03-11 08:15:37Pix Transmission has recently adjusted its evaluation, reflecting a positive third-quarter performance with a 47.7% profit increase year-over-year. While the company shows strong return on equity and effective debt management, its long-term growth appears limited, and institutional investor interest has slightly increased.

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEIntimation regarding closure of trading window

Announcement under Regulation 30 (LODR)-Credit Rating

19-Mar-2025 | Source : BSEUpgradation in Credit Rating

Announcement under Regulation 30 (LODR)-Newspaper Publication

17-Feb-2025 | Source : BSENewspaper publication of Un-audited Financial Results for the quarter ended 31st Dec 2024

Corporate Actions

No Upcoming Board Meetings

Pix Transmission Ltd has declared 70% dividend, ex-date: 16 Jul 24

No Splits history available

No Bonus history available

No Rights history available