Platinum Industries Adjusts Valuation Grade Amid Strong Financial Metrics and Market Position

2025-04-03 08:00:57Platinum Industries, a small-cap player in the chemicals sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 28.22, while its price-to-book value is noted at 4.20. Additionally, the enterprise value to EBITDA ratio is recorded at 20.93, indicating a robust valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of performance, Platinum Industries showcases a return on capital employed (ROCE) of 32.11% and a return on equity (ROE) of 14.46%, suggesting effective utilization of capital and shareholder equity. The company's recent stock performance has shown a weekly return of 0.42% and a monthly return of 7.84%, contrasting with the Sensex's performance during the same periods. When compared to its peers, Platinum Industries maintains a competitive edge...

Read MorePlatinum Industries Faces Technical Trend Challenges Amidst Strong Yearly Performance

2025-04-02 08:10:46Platinum Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 273.20, showing a slight increase from the previous close of 268.00. Over the past year, Platinum Industries has demonstrated a notable return of 52.88%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the moving averages indicate a bearish sentiment on a daily basis. The Bollinger Bands suggest a mildly bearish trend on a weekly basis, indicating some volatility in the stock's performance. The KST and Dow Theory metrics show no definitive trend, reflecting a period of uncertainty. Despite recent fluctuations, the company's performance over the past month has been positive, with a return of 6.08%, compared to...

Read MorePlatinum Industries Adjusts Valuation Grade Amid Competitive Chemicals Market Dynamics

2025-03-28 08:00:57Platinum Industries, a small-cap player in the chemicals sector, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings (PE) ratio stands at 27.76, while its price-to-book value is recorded at 4.14. Other key metrics include an enterprise value to EBITDA ratio of 20.55 and a return on capital employed (ROCE) of 32.11%, indicating a robust operational efficiency. In comparison to its peers, Platinum Industries presents a relatively competitive valuation. For instance, Gujarat Alkalies is currently facing challenges with a loss-making status, while Neogen Chemicals is positioned at a significantly higher valuation level. Balaji Amines and Grauer & Weil are also in the mix, with their respective valuations reflecting a range of market conditions. Despite recent fluctuations in its stock price, which has seen a 52-week high of 502.00 and a low of...

Read MorePlatinum Industries Faces Bearish Technical Trends Amid Market Volatility

2025-03-26 08:05:15Platinum Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 284.80, down from a previous close of 297.50, with a notable 52-week high of 502.00 and a low of 169.00. Today's trading saw a high of 300.90 and a low of 282.80, indicating some volatility. The technical summary for Platinum Industries reveals a bearish sentiment across several indicators. The MACD and Bollinger Bands on both weekly and monthly charts signal a bearish trend, while the daily moving averages also reflect this sentiment. The KST indicator aligns with the bearish outlook, and the Dow Theory shows a mildly bullish trend on a weekly basis, but no clear trend on a monthly basis. The On-Balance Volume (OBV) presents a mixed picture, being mildly bullish weekly but mildly bearish monthly. In terms of performance, Pl...

Read MorePlatinum Industries Shows Resilience Amid Mixed Technical Indicators and Market Dynamics

2025-03-25 08:06:41Platinum Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 297.50, showing a notable increase from the previous close of 288.60. Over the past year, Platinum Industries has demonstrated a strong performance with a return of 65.46%, significantly outpacing the Sensex, which recorded a return of 7.07% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly indicators show no clear signal. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, and moving averages also reflect a mildly bearish stance. The KST and OBV metrics suggest a lack of upward momentum, with the OBV showing no trend on a weekly basis and mildly bearish on a monthly basis. Despite the recent evaluation adjustment, Platinum Industries has shown resilie...

Read More

Platinum Industries Surges Amid Mixed Long-Term Performance Indicators in Chemicals Sector

2025-03-21 14:20:29Platinum Industries, a small-cap chemicals company, experienced notable trading activity, gaining 7.03% on March 21, 2025. The stock has outperformed its sector and demonstrated strong performance metrics, including an 18.76% increase over the past week and a 60.94% rise over the past year, despite year-to-date challenges.

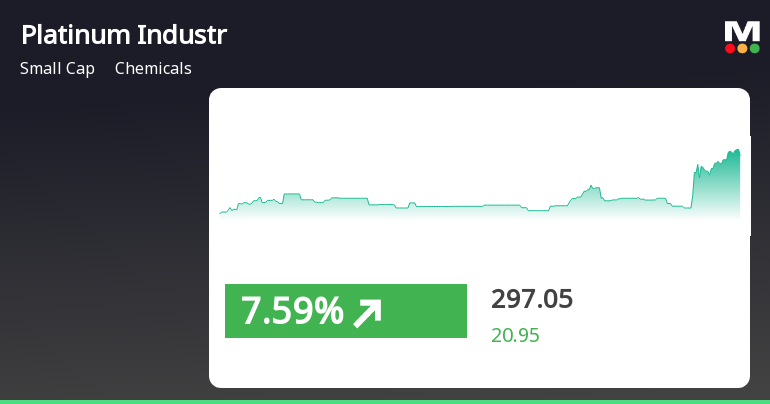

Read MorePlatinum Industries Adjusts Valuation Grade Amid Strong Financial Performance and Competitive Positioning

2025-03-20 08:01:11Platinum Industries, a small-cap player in the chemicals sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company reports a price-to-earnings (P/E) ratio of 28.24 and an enterprise value to EBITDA ratio of 20.95, indicating its valuation relative to earnings and cash flow generation capabilities. Additionally, Platinum's return on capital employed (ROCE) stands at a robust 32.11%, while its return on equity (ROE) is recorded at 14.46%. In comparison to its peers, Platinum Industries maintains a competitive edge, particularly when looking at its P/E ratio against companies like Neogen Chemicals and Fischer Medical, which exhibit significantly higher valuations. Other competitors, such as Grauer & Weil and Balaji Amines, show varied performance metrics, with some positioned more favorably in terms of valuation. The stock has demonstrate...

Read MorePlatinum Industries Faces Mixed Technical Trends Amid Strong Yearly Performance

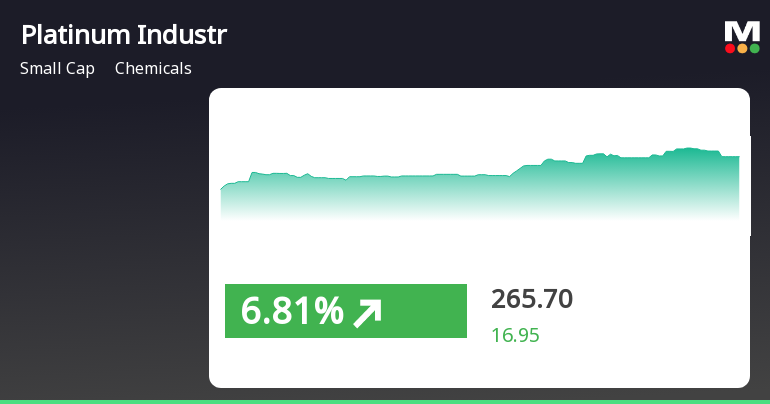

2025-03-19 08:05:17Platinum Industries, a small-cap player in the chemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 269.50, showing a notable increase from the previous close of 248.75. Over the past year, Platinum Industries has demonstrated a strong performance with a return of 47.35%, significantly outpacing the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the daily moving averages also reflect a bearish stance. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, and the On-Balance Volume (OBV) shows a mildly bearish sentiment as well. The Dow Theory presents a mildly bullish outlook on a weekly basis, but lacks a definitive trend on a monthly scale. Despite the recent challenges, Platinum Industries has...

Read More

Platinum Industries Shows Signs of Trend Reversal Amid Broader Small-Cap Gains

2025-03-18 11:35:29Platinum Industries, a small-cap chemicals company, experienced a notable increase in stock price today, following a series of declines. The stock has shown improved performance metrics over the past week and month, although it continues to face challenges in the longer term. The broader market also saw positive movement.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Trading window closure.

Announcement under Regulation 30 (LODR)-Investor Presentation

17-Feb-2025 | Source : BSEInvestor Presentation

Announcement under Regulation 30 (LODR)-Press Release / Media Release

17-Feb-2025 | Source : BSEPress Release

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available