Plaza Wires Experiences Valuation Grade Change Amid Competitive Cable Industry Landscape

2025-04-03 08:00:56Plaza Wires, a microcap player in the cable industry, has recently undergone a valuation adjustment. The company's current price stands at 55.00, reflecting a notable increase from the previous close of 52.00. Over the past week, Plaza Wires has shown a stock return of 6.9%, contrasting with a slight decline in the Sensex, which recorded a return of -0.87%. Key financial metrics for Plaza Wires include a PE ratio of 65.39 and an EV to EBITDA ratio of 25.62. The company's return on capital employed (ROCE) is reported at 6.33%, while the return on equity (ROE) is at 3.06%. These figures provide insight into the company's operational efficiency and profitability. In comparison to its peers, Plaza Wires presents a higher PE ratio than several competitors, such as Delton Cables and Bhagyanagar Ind, which have more favorable valuations. However, it lags behind Birla Cable, which boasts a significantly higher PE...

Read More

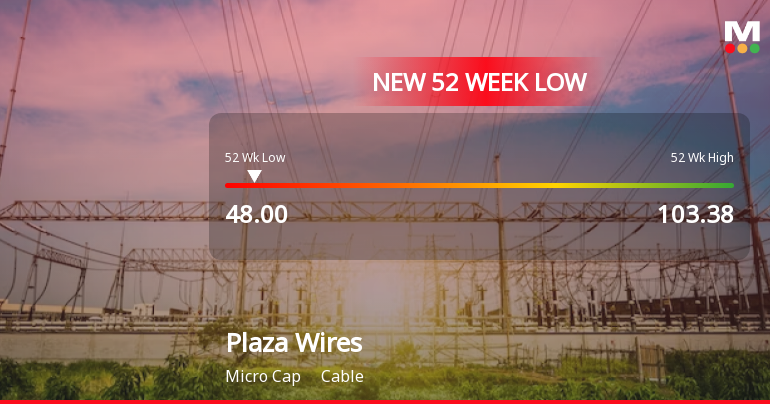

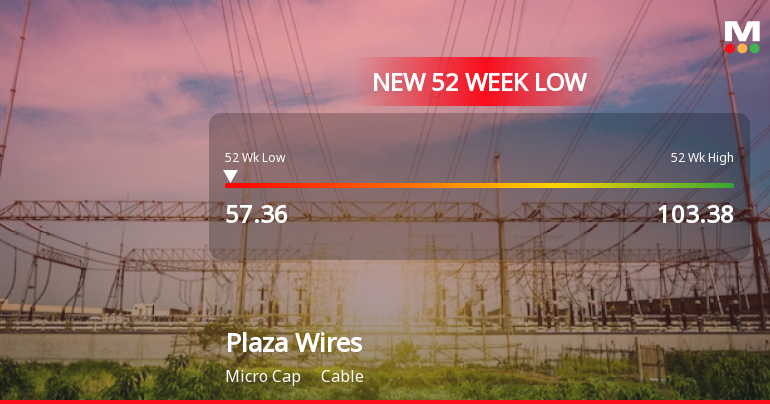

Plaza Wires Faces Ongoing Challenges Amid Significant Stock Volatility and Declining Profits

2025-03-28 10:41:48Plaza Wires, a microcap in the cable industry, has faced notable volatility, hitting a 52-week low. The stock has underperformed its sector and recorded a significant decline over recent days. Its financial metrics reveal weak long-term fundamentals, including a substantial drop in profit and low return on equity.

Read More

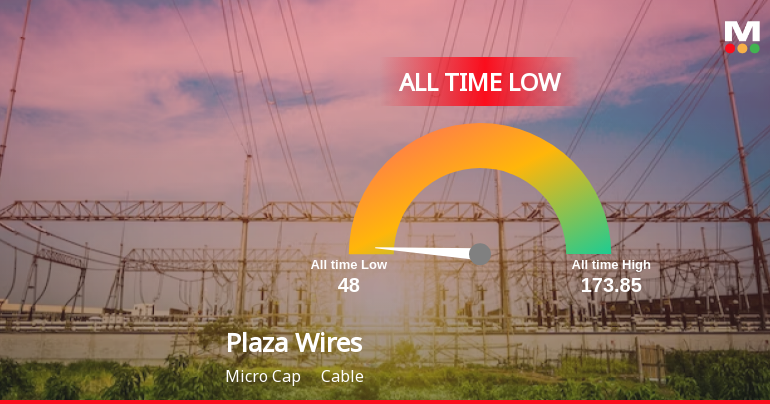

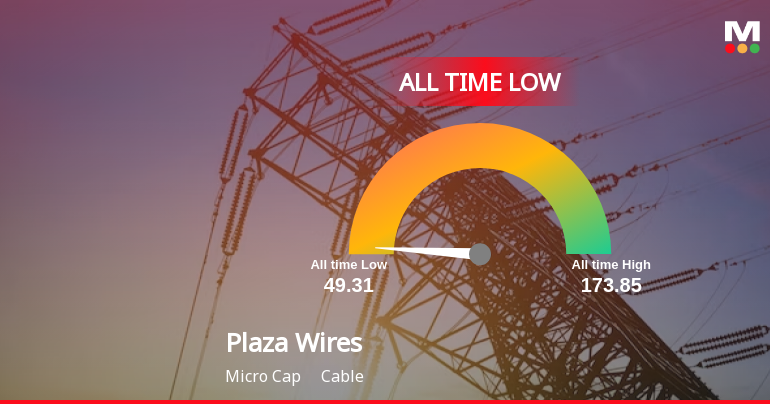

Plaza Wires Stock Hits All-Time Low Amid Weak Fundamentals and Market Underperformance

2025-03-28 10:22:17Plaza Wires, a microcap in the cable industry, has faced notable stock volatility, recently hitting an all-time low. The company shows weak long-term fundamentals, with declining operating profits and low return on equity. Over the past year, it has significantly underperformed the broader market.

Read More

Plaza Wires Hits All-Time Low Amid Weak Fundamentals and Market Volatility

2025-03-27 11:12:17Plaza Wires, a microcap in the cable industry, has faced notable volatility, reaching an all-time low. The stock has underperformed its sector and experienced significant declines over the past week and month. Weak long-term fundamentals, low profitability, and a bearish technical outlook further characterize the company's current situation.

Read More

Plaza Wires Faces Challenges Amid Significant Stock Decline and Weak Fundamentals

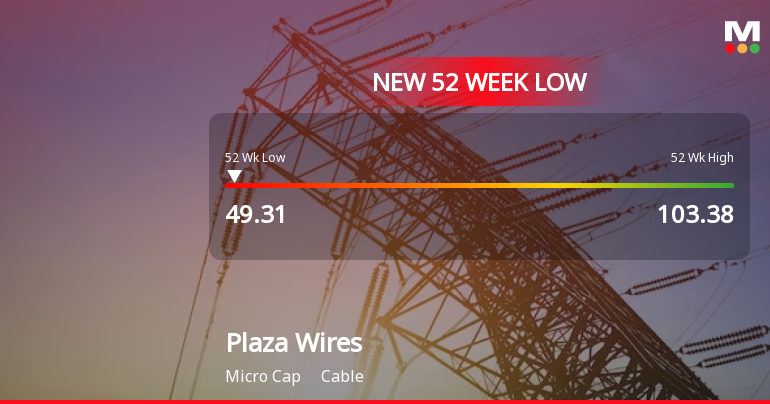

2025-03-27 10:41:02Plaza Wires, a microcap in the cable industry, has reached a new 52-week low, reflecting a 37.41% decline over the past year. The company faces weak long-term fundamentals, including a significant drop in operating profits and low return on equity, amid challenging market conditions.

Read More

Plaza Wires Faces Significant Challenges Amidst Broader Market Gains and Declining Profitability

2025-03-27 10:40:57Plaza Wires, a microcap in the cable industry, has reached a new 52-week low, reflecting a significant decline over the past year. The company faces challenges with a negative growth rate in operating profits and a substantial drop in profit after tax, indicating ongoing profitability pressures.

Read MorePlaza Wires Adjusts Valuation Grade Amid Competitive Cable Industry Landscape

2025-03-27 08:01:04Plaza Wires, a microcap player in the cable industry, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings (P/E) ratio stands at 61.17, while its price-to-book value is recorded at 1.87. Other key metrics include an enterprise value to EBITDA ratio of 24.05 and a return on capital employed (ROCE) of 6.33%. In comparison to its peers, Plaza Wires presents a relatively higher P/E ratio than Delton Cables, which is at 53.41, and Bhagyanagar Industries, noted for its attractive valuation at 19.91. However, it lags behind Birla Cable, which boasts a P/E ratio of 84.41. The enterprise value to EBITDA ratio of Plaza Wires is also higher than that of Delton Cables, indicating a different market perception. Despite recent performance challenges, with a year-to-date return of -32.83% compared to a slight decline in the Sensex, Plaza Wires continues ...

Read More

Plaza Wires Faces Financial Struggles Amid Broader Market Decline and Weak Fundamentals

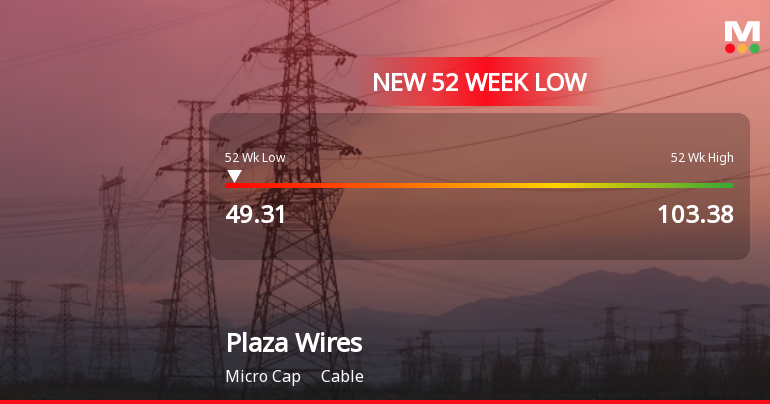

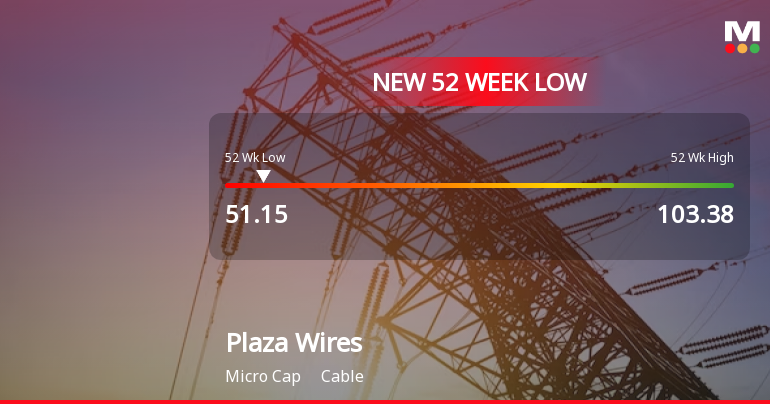

2025-03-04 11:39:33Plaza Wires, a microcap in the cable industry, has seen notable trading activity as it reached a 52-week low. Despite a slight rebound, the stock remains below key moving averages, reflecting a bearish trend. Over the past year, it has significantly underperformed compared to broader market indices.

Read More

Plaza Wires Faces Significant Volatility Amidst Sustained Market Downtrend

2025-02-28 10:06:28Plaza Wires, a microcap in the cable industry, has seen significant volatility, hitting a new 52-week low. The stock has underperformed its sector and experienced a notable decline over the past year. It is currently trading below multiple moving averages, indicating a sustained downward trend.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSESubmission of the Certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended on March 31 2025.

Intimation Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Regulations)-Cautionary Letter Issued By National Stock Exchange Of India Limited (NSE) And Bombay Stock Exchange (BSE).

03-Apr-2025 | Source : BSEIntimation under Regulation 30 of the SEBI Listing Obligation and Disclosure Requirements) Regulations 2015-Cautionery Letter issued by National Stock Exchange of India Limited (NSE) and Bombay Stock Exchange (BSE).

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available