POCL Enterprises Shows Resilience Amid Market Volatility and Sector Underperformance

2025-04-03 10:05:52POCL Enterprises, a microcap in the non-ferrous metal sector, recently reached a 52-week high but is currently trading slightly below that peak. Despite a recent dip, the stock remains above key moving averages, reflecting a generally positive long-term trend. Over the past year, it has significantly outperformed the Sensex.

Read More

POCL Enterprises Reaches All-Time High Amidst Market Volatility and Strong Growth Metrics

2025-04-03 10:01:22POCL Enterprises, a microcap in the non-ferrous metal sector, has shown notable volatility today, opening lower after reaching an all-time high earlier this month. Despite recent fluctuations, the stock has demonstrated impressive growth over various periods, significantly outperforming the Sensex and trading above key moving averages.

Read More

POCL Enterprises Reaches All-Time High, Signaling Strong Market Momentum in Non-Ferrous Metals

2025-04-02 09:31:13POCL Enterprises, a microcap in the non-ferrous metal sector, reached an all-time high on April 2, 2025. The stock has shown significant momentum, outperforming its sector and demonstrating strong gains over various time frames, reflecting its robust market position and performance indicators.

Read MorePOCL Enterprises Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-24 08:02:06POCL Enterprises, a microcap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 196.30, showing a notable increase from the previous close of 192.00. Over the past year, POCL has demonstrated impressive performance, with a return of 249.29%, significantly outpacing the Sensex's 5.87% return. The technical summary indicates a mixed outlook, with the MACD showing a bullish trend on a monthly basis, while the weekly perspective remains mildly bearish. The Bollinger Bands and daily moving averages suggest a bullish sentiment, indicating potential strength in price movements. However, the KST and Dow Theory metrics present a more cautious view, with weekly readings leaning towards mild bearishness. In terms of stock performance, POCL has shown remarkable returns over various periods, including...

Read More

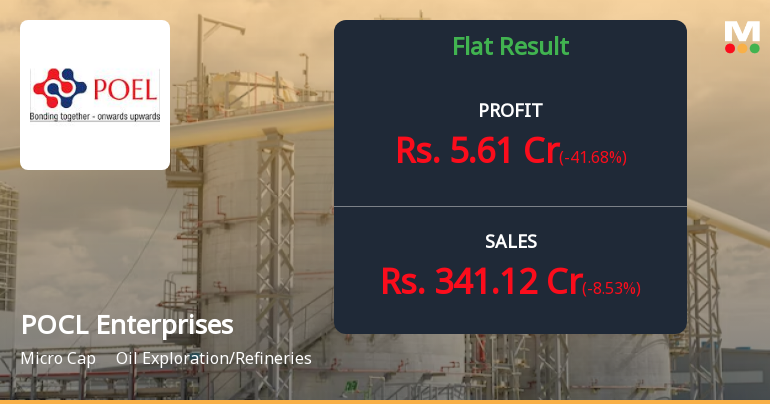

POCL Enterprises Reports December 2024 Results Highlighting Sales Growth Amid Rising Costs

2025-02-13 22:55:19POCL Enterprises has announced its financial results for the quarter ending December 2024, showing a 32.60% year-on-year growth in net sales, totaling Rs 1,077.74 crore. However, the company faces challenges with a declining profit after tax and rising interest expenses, indicating potential financial pressures ahead.

Read More

POCL Enterprises Reports Strong Q2 FY24-25 Growth Amid Debt Challenges

2025-01-27 18:51:56POCL Enterprises, a microcap in the oil sector, recently adjusted its evaluation following strong second-quarter results for FY24-25. The company reported significant annual growth in operating profit and net profit, alongside robust financial metrics, despite facing challenges with a high debt to EBITDA ratio.

Read MoreAnnouncement under Regulation 30 (LODR)-Newspaper Publication

07-Apr-2025 | Source : BSEIntimation regarding the News paper publication after the dispatch of the Notice for convening the Extra-Ordinary General Meeting on April 28 2025

Announcement under Regulation 30 (LODR)-Change in Management

05-Apr-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015 regarding the resignation of Senior Management Personnel

Notice Of The Extra-Ordinary General Meeting Of The Company

04-Apr-2025 | Source : BSENotice of the Extra-Ordinary General Meeting of the Company to be held on Monday April 28 2025 through Video Conferencing (VC) / Other Audio Visual Means (OAVM) is enclosed.

Corporate Actions

No Upcoming Board Meetings

POCL Enterprises Ltd has declared 25% dividend, ex-date: 30 Aug 24

POCL Enterprises Ltd has announced 2:10 stock split, ex-date: 25 Oct 24

No Bonus history available

No Rights history available