Pokarna Ltd Faces Increased Volatility Amid Significant Trading Activity and Declining Investor Participation

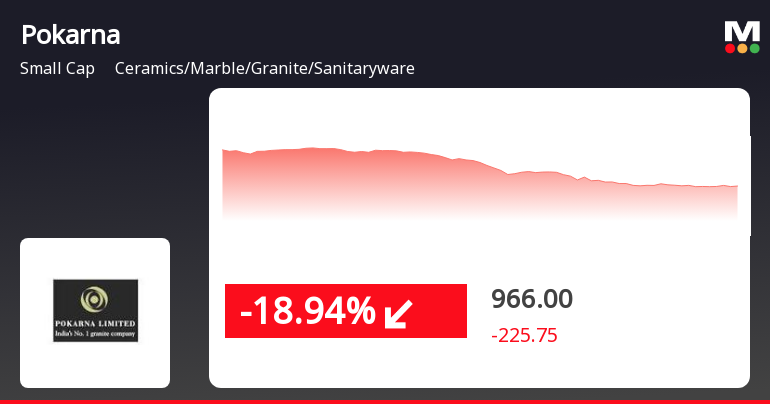

2025-04-03 13:00:06Pokarna Ltd, a small-cap player in the Ceramics, Marble, Granite, and Sanitaryware industry, experienced significant trading activity today, hitting its lower circuit limit. The stock closed at Rs 954.6, reflecting a notable decline of Rs 238.6 or 20.0%. This drop marks a continuation of a downward trend, with the stock underperforming its sector by 17.59% and recording a total loss of 25.42% over the past three days. During today's trading session, Pokarna reached an intraday low of Rs 954.6, with a high of Rs 1160.0, indicating a wide trading range of Rs 205.4. The total traded volume was approximately 5.09 lakh shares, resulting in a turnover of Rs 51.27 crore. The stock opened with a gap down of 3.56%, and its volatility was high, with an intraday volatility of 14.87%. Currently, Pokarna is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, reflecting a challenging market p...

Read MorePokarna Ltd Faces Intense Selling Pressure Amid Significant Price Declines

2025-04-03 10:55:07Pokarna Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a notable decline, with a one-day performance of -20.23%, starkly contrasting with the Sensex's modest drop of -0.30%. Over the past week, Pokarna has lost 24.68%, while the Sensex fell by just 1.57%. This trend of consecutive losses extends to three days, during which the stock has plummeted by 25.7%. In terms of volatility, Pokarna opened with a loss of 3.75% and reached an intraday low of Rs 950.6. The stock has exhibited high volatility today, with an intraday fluctuation of 13.3%. Furthermore, Pokarna is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. Despite a strong performance over the past year, where it gained 105.42% compared to the Sensex's 3.40%, the current selling pressure may be attributed to broader ...

Read More

Pokarna Faces Significant Stock Volatility Amid Broader Market Fluctuations

2025-04-03 10:05:24Pokarna, a small-cap company in the ceramics and sanitaryware sector, faced notable volatility today, with its stock price declining significantly. The stock has underperformed its sector and has fallen for three consecutive days. Despite recent challenges, it has shown substantial long-term growth over the past year.

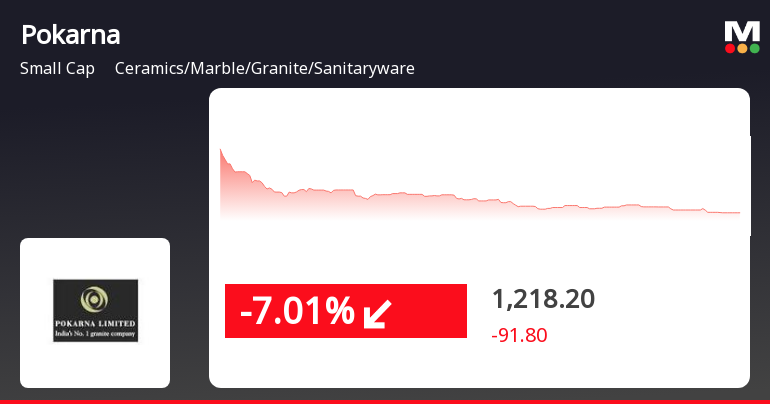

Read MorePokarna's Technical Trends Show Mixed Signals Amid Strong Long-Term Performance

2025-04-02 08:04:35Pokarna, a small-cap player in the Ceramics, Marble, Granite, and Sanitaryware industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1219.45, having seen fluctuations with a previous close of 1279.40. Over the past year, Pokarna has demonstrated significant resilience, achieving a remarkable return of 174.81%, compared to a modest 2.72% return from the Sensex. In terms of technical indicators, the company shows a mixed picture. The MACD indicates a mildly bearish trend on a weekly basis, while the monthly outlook remains bullish. The Bollinger Bands suggest a mildly bullish stance for both weekly and monthly assessments. Moving averages on a daily basis reflect a bullish sentiment, indicating some positive momentum in the short term. The company's performance over various time frames highlights its strong recovery, particularly ove...

Read More

Pokarna Faces Market Reversal Amidst Broader Sensex Gains and Resilience Trends

2025-03-25 12:45:24Pokarna, a small-cap player in the ceramics and sanitaryware sector, saw its stock decline today after a six-day gain streak. Despite this short-term drop, the company has shown resilience with an 8.93% increase over the past month, outperforming the Sensex. The broader market also opened higher today.

Read More

Pokarna's Strong Performance Highlights Resilience in Small-Cap Ceramics Sector

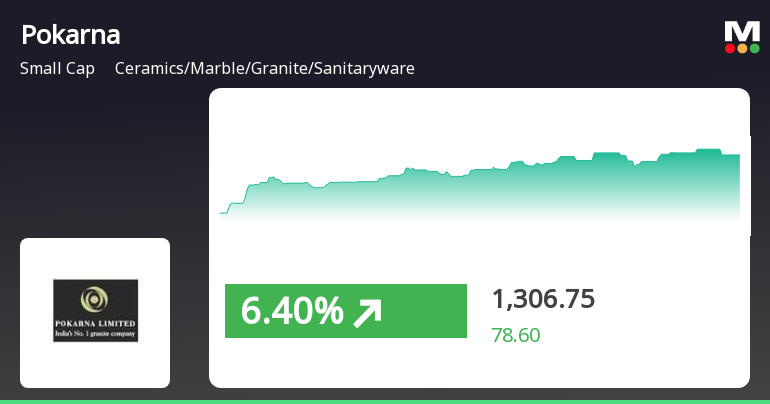

2025-03-21 13:05:23Pokarna, a small-cap company in the ceramics and sanitaryware sector, has shown strong performance, gaining 7.15% on March 21, 2025. The stock has consistently outperformed its sector and has achieved a total return of 15.27% over the past five days, reflecting robust momentum and significant annual growth.

Read MorePokarna Stock Opens Strong with 9.03% Gain, Outperforming Sector Trends

2025-03-21 09:35:10Pokarna, a small-cap player in the ceramics, marble, granite, and sanitaryware industry, has shown remarkable activity today, opening with a gain of 9.03%. The stock has outperformed its sector by 2.08%, reflecting strong momentum in the market. Over the past five days, Pokarna has consistently gained, accumulating a total return of 10.2%. Today, the stock reached an intraday high of Rs 1339, showcasing its volatility with an intraday fluctuation of 6.79%. This high beta stock, with an adjusted beta of 1.35, tends to experience larger price movements compared to the broader market, which may contribute to its dynamic trading patterns. In terms of performance metrics, Pokarna has demonstrated a solid one-day return of 2.76%, significantly surpassing the Sensex's modest gain of 0.06%. Over the past month, the stock has risen by 7.71%, compared to the Sensex's 1.43% increase. Additionally, Pokarna is current...

Read More

Pokarna Reports Significant Profit Growth Amid Positive Market Dynamics and Strong Financial Indicators

2025-03-21 08:02:11Pokarna, a small-cap company in the Ceramics, Marble, Granite, and Sanitaryware sector, has recently experienced an evaluation adjustment. The firm reported a significant net profit growth of 138.34% in Q3 FY24-25, continuing a trend of positive performance over six quarters, supported by strong financial metrics and increased institutional confidence.

Read MorePokarna Shows Mixed Technical Indicators Amid Strong Long-Term Performance in Ceramics Sector

2025-03-21 08:01:26Pokarna, a small-cap player in the Ceramics, Marble, Granite, and Sanitaryware industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1228.15, showing a notable increase from the previous close of 1208.05. Over the past year, Pokarna has demonstrated impressive performance, with a stock return of 181.88%, significantly outpacing the Sensex return of 5.89% during the same period. In terms of technical indicators, the company exhibits a mixed picture. The MACD shows a bullish trend on a monthly basis, while the weekly indicator is mildly bearish. The Bollinger Bands indicate a bullish stance for both weekly and monthly assessments, suggesting a potential for upward movement. Additionally, moving averages on a daily basis are bullish, which may reflect positive short-term momentum. Comparatively, Pokarna's returns over various periods ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018.

Announcement under Regulation 30 (LODR)-Credit Rating

05-Apr-2025 | Source : BSECredit Rating by CRISIL Ratings Limited

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Trading Window Closure for Quarter and Year Ended 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Pokarna Ltd has declared 30% dividend, ex-date: 23 Sep 24

Pokarna Ltd has announced 2:10 stock split, ex-date: 18 Oct 17

No Bonus history available

No Rights history available