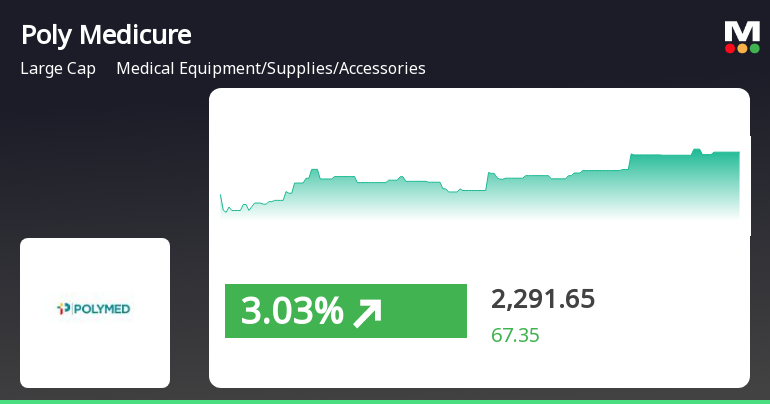

Poly Medicure's Technical Indicators Show Mixed Signals Amid Strong Historical Performance

2025-04-03 08:04:46Poly Medicure, a prominent player in the Medical Equipment/Supplies/Accessories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,196.65, showing a slight increase from the previous close of 2,151.25. Over the past year, Poly Medicure has demonstrated a robust performance, with a return of 40.61%, significantly outpacing the Sensex's return of 3.67% during the same period. In terms of technical indicators, the company's weekly MACD and Bollinger Bands suggest a mixed outlook, with the weekly MACD indicating bearish momentum while the monthly Bollinger Bands lean towards a mildly bullish stance. The moving averages and KST also reflect a bearish trend on a weekly basis, contrasting with a bullish monthly KST. Poly Medicure's performance over various time frames highlights its resilience, particularly over the last five years, ...

Read More

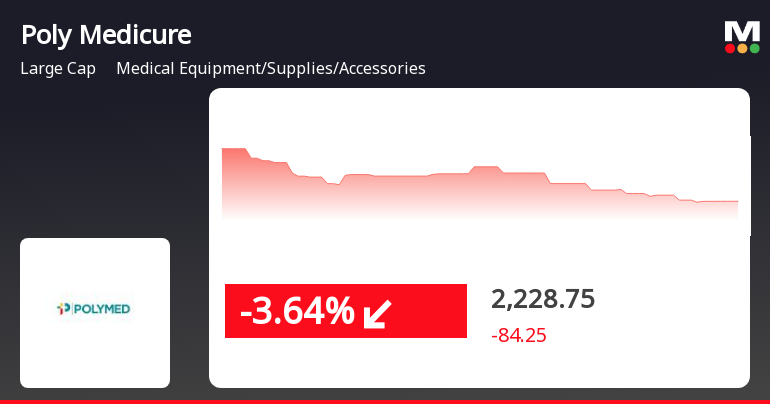

Poly Medicure Shows Mixed Performance Amid Broader Market Gains and Long-Term Growth

2025-04-02 10:05:20Poly Medicure, a key player in the medical equipment sector, experienced significant activity on April 2, 2025, with a notable intraday high. While the stock has shown mixed short to medium-term trends, its long-term performance remains robust, reflecting a substantial increase over the past three to five years.

Read MorePoly Medicure Faces Bearish Technical Trends Amid Mixed Market Signals

2025-04-02 08:06:58Poly Medicure, a prominent player in the Medical Equipment/Supplies/Accessories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2151.25, down from a previous close of 2235.10, with a notable 52-week high of 3,350.00 and a low of 1,493.35. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Moving Averages, which suggest a cautious outlook. The Bollinger Bands present a mixed picture, showing bearish tendencies on a weekly basis while indicating a mildly bullish trend monthly. The KST and Dow Theory also reflect bearish signals, further emphasizing the current market sentiment. In terms of performance, Poly Medicure's stock return over the past week has been -2.70%, slightly underperforming the Sensex, which recorded a -2.55% return. However, over a one-month period, the company h...

Read More

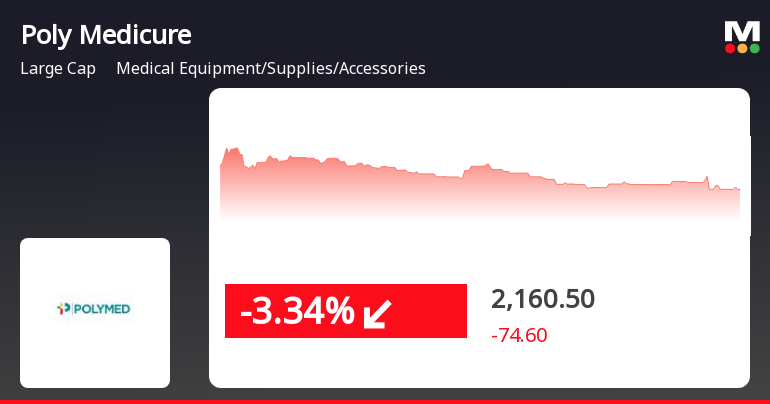

Poly Medicure Faces Trend Reversal Amid Broader Market Decline and Sector Underperformance

2025-04-01 14:35:20Poly Medicure, a key player in the medical equipment sector, saw a decline on April 1, 2025, following a brief period of gains. The stock underperformed compared to the sector and is trading below several moving averages, while the broader market also faced significant pressure. However, it has shown strong long-term growth.

Read More

Poly Medicure Faces Potential Trend Reversal Amid Broader Market Resilience

2025-03-25 10:35:21Poly Medicure, a key player in the medical equipment sector, saw a decline on March 25, 2025, following two days of gains. The stock's performance metrics indicate mixed signals, with significant growth over the past year but a year-to-date decline. The broader market showed resilience, with the Sensex up.

Read More

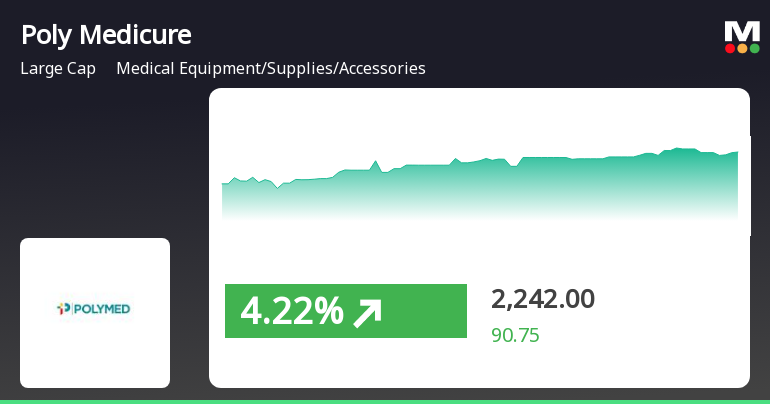

Poly Medicure Stock Shows Mixed Performance Amid Broader Market Rebound

2025-03-21 12:15:50Poly Medicure's stock has shown a significant increase today, outperforming its sector. While currently above its short-term moving averages, it lags behind longer-term averages. The broader market has rebounded, with the Sensex and BSE Small Cap index also showing gains. Poly Medicure's long-term performance remains strong despite recent fluctuations.

Read MorePoly Medicure Shows Resilience Amid Stock Decline and Market Challenges

2025-03-18 12:17:25Poly Medicure Ltd, a prominent player in the Medical Equipment/Supplies/Accessories industry, has experienced a notable decline of 33.52% from its recent high. Despite this downturn, the company has shown resilience with a one-year performance of 48.61%, significantly outperforming the Sensex, which recorded a mere 3.16% over the same period. Today, Poly Medicure's stock rose by 0.47%, while the Sensex increased by 1.18%. Over the past week, the stock has gained 3.88%, and its monthly performance stands at 5.42%, contrasting with the Sensex's decline of 1.22%. However, the stock has faced challenges in the three-month period, showing a decrease of 18.12%, compared to the Sensex's drop of 6.41%. With a market capitalization of Rs 22,566.76 crore, Poly Medicure boasts a P/E ratio of 71.28, higher than the industry average of 63.36. The company has maintained a strong financial position, evidenced by a low ...

Read More

Poly Medicure Reports Strong Profit Growth Amid High Valuation Metrics and Market Dynamics

2025-03-18 08:13:50Poly Medicure has recently adjusted its evaluation, reflecting positive financial performance in Q3 FY24-25, with net sales of Rs 424.21 crore and a profit before tax increase of 28.32%. The company shows strong management efficiency with a low debt-to-equity ratio and consistent positive results over the last ten quarters.

Read MorePoly Medicure Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-18 08:02:50Poly Medicure, a prominent player in the Medical Equipment/Supplies/Accessories industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2216.65, showing a slight increase from the previous close of 2202.05. Over the past year, Poly Medicure has demonstrated a robust performance with a return of 55.72%, significantly outpacing the Sensex, which recorded a return of 2.10% in the same period. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the monthly indicators present a mixed picture with some bullish trends. The Bollinger Bands indicate a mildly bearish stance on a weekly basis, contrasting with a bullish outlook on a monthly basis. The stock's moving averages are currently bearish, suggesting a cautious approach in the short term. Despite recent fluctuations, Poly Medicure has shown resil...

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEThe Company informed the Trading Window closure from Tuesday the 01st April 2025 till the end of 48 hours after the declaration of Financial Results for the quarter and year ended on 31st March 2025.

Intimation Of Receiving The Medical Device Regulation (MDR) Certification In Europe For 54 Products

11-Mar-2025 | Source : BSEPursuant to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 enclosed herewith is a press release issued by the Company on the captioned subject the content of which is self explanatory.

Statement Of Deviation(S) Or Variation(S) For The Quarter Ended 31St December 2024.

13-Feb-2025 | Source : BSEStatement of Deviation(s) and Variation(s) for the quarter ended 31st December 2024

Corporate Actions

No Upcoming Board Meetings

Poly Medicure Ltd has declared 60% dividend, ex-date: 19 Sep 24

Poly Medicure Ltd has announced 5:10 stock split, ex-date: 02 Feb 15

Poly Medicure Ltd has announced 1:1 bonus issue, ex-date: 24 Mar 17

No Rights history available