Polycab India Shows Signs of Recovery Amid Mixed Technical Signals and Volatility

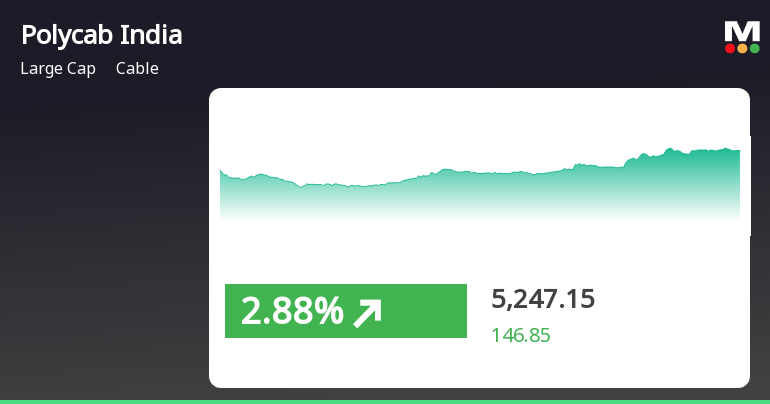

2025-04-02 13:20:24Polycab India has experienced a notable rebound today, reversing a two-day decline with significant intraday volatility. The stock has outperformed its sector and shown positive performance over the past week and month, although it remains down year-to-date. Long-term performance reflects substantial growth over five years.

Read MorePolycab India Ltd Sees Surge in Trading Activity and Investor Engagement

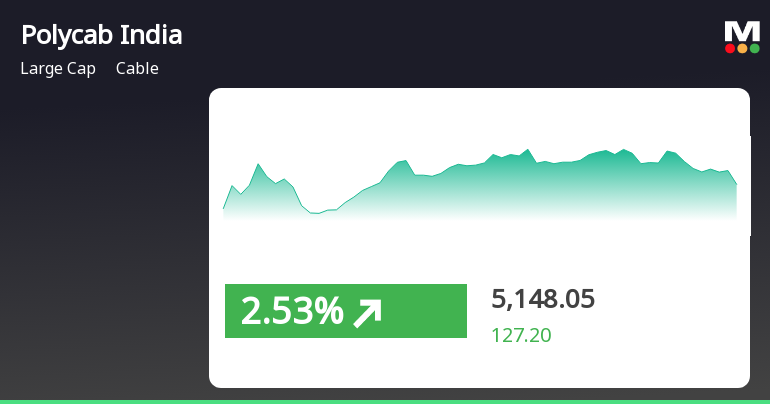

2025-03-25 10:00:28Polycab India Ltd, a prominent player in the cable industry, has emerged as one of the most active equities today, with a total traded volume of 425,761 shares and a traded value of approximately Rs 21.92 crore. The stock opened at Rs 5,069.80 and reached a day high of Rs 5,190.00, reflecting a notable intraday increase of 3.08%. As of the latest update, the last traded price stands at Rs 5,184.00. In terms of performance, Polycab India has outperformed its sector by 1.93%, marking a consecutive gain over the last two days with a total return of 3.3% during this period. The stock's delivery volume on March 24 saw a significant rise of 36.8% compared to its five-day average, indicating increased investor participation. While the stock is currently above its five-day moving averages, it remains below the 20-day, 50-day, 100-day, and 200-day moving averages. With a market capitalization of Rs 75,526 crore, ...

Read MorePolycab India Ltd has emerged as one of the most active stock puts today amid rising investor engagement.

2025-03-25 10:00:19Polycab India Ltd, a prominent player in the cable industry, has emerged as one of the most active stocks in the options market today, particularly in put options. The underlying stock, POLYCAB, has seen significant activity with 3,907 contracts traded for puts with a strike price of Rs 5,000, resulting in a turnover of approximately Rs 76.29 lakhs. The open interest for these puts stands at 1,793 contracts, indicating a notable level of engagement among traders. In terms of performance, Polycab India has outperformed its sector by 1.93%, with the stock gaining 3.3% over the last two days. Today, it reached an intraday high of Rs 5,180, reflecting a 3.08% increase. The stock's current value is Rs 5,179.2, which is higher than its 5-day moving averages but lower than its 20, 50, 100, and 200-day moving averages. Investor participation has also risen, with a delivery volume of 658,000 shares on March 24, ma...

Read MorePolycab India Ltd has emerged as one of the most active stock calls today, highlighting strong market engagement.

2025-03-25 10:00:19Polycab India Ltd, a prominent player in the cable industry, has emerged as one of the most active stocks today, reflecting significant market engagement. The stock, trading under the ticker POLYCAB, has shown notable performance metrics, outperforming its sector by 1.93%. Over the last two days, Polycab has recorded a consecutive gain, with a total return of 3.3%. Today, the stock reached an intraday high of Rs 5180, marking a 3.08% increase. The underlying value stands at Rs 5185, with a robust trading activity reflected in the 8,774 contracts traded, resulting in a turnover of Rs 654.21 lakhs. The open interest for the call option expiring on March 27, 2025, is recorded at 2,676 contracts, indicating ongoing investor interest. In terms of liquidity, Polycab's trading volume has seen a rise, with a delivery volume of 6.58 lakhs on March 24, up by 36.8% compared to the five-day average. The stock's perfo...

Read More

Polycab India Shows Short-Term Gains Amid Broader Market Uptrend

2025-03-25 09:50:23Polycab India has experienced notable stock activity, outperforming its sector and achieving consecutive gains over two days. While currently positioned above its short-term moving averages, it remains below longer-term averages. Despite recent challenges, the company has shown significant growth over the past three and five years.

Read More

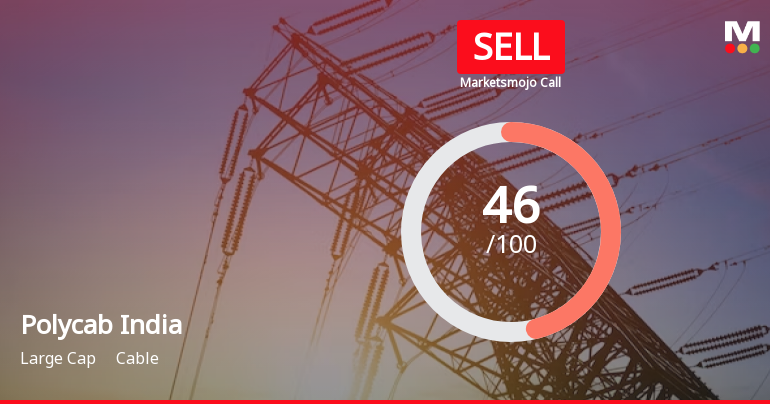

Polycab India Faces Technical Shift Amid Mixed Performance Metrics and Liquidity Concerns

2025-03-25 08:22:30Polycab India has recently experienced a change in its evaluation, reflecting shifts in the technical landscape of its stock. While the company shows strong annual growth in net sales and operating profit, recent quarterly results indicate limited movement. Concerns about liquidity and operational efficiency have emerged, despite its strong market position.

Read MorePolycab India Faces Bearish Technical Trends Amid Market Fluctuations

2025-03-24 08:02:52Polycab India, a prominent player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,992.30, down from a previous close of 5,083.35. Over the past year, Polycab has experienced fluctuations, with a 52-week high of 7,607.15 and a low of 4,557.45. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish tendencies. The KST and Dow Theory metrics align with this sentiment, indicating a consistent bearish outlook in the short term. In terms of performance, Polycab's returns have varied significantly when compared to the Sensex. Over the past week, the stock has returned -0.23%, while the Sensex has gained 4.17%. In the one-month period...

Read MorePolycab India Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-21 08:03:03Polycab India, a prominent player in the cable industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,083.35, having seen fluctuations with a previous close of 5,441.75. Over the past year, Polycab has experienced a stock return of 7.4%, outperforming the Sensex, which recorded a return of 5.89% in the same period. However, the year-to-date performance shows a decline of 30.09%, contrasting with the Sensex's modest drop of 2.29%. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, but shows no signal for the monthly period. Bollinger Bands and KST metrics also reflect a mildly bearish trend, suggesting a cautious market sentiment. Notably, the On-Balance Volume (OBV) indicates a mildly bullish ...

Read MorePolycab India Ltd has emerged as one of the most active stock puts today amid bearish market conditions.

2025-03-20 12:00:05Polycab India Ltd, a prominent player in the cable industry, has emerged as one of the most active stocks in the options market today, particularly in put options. The company’s underlying stock, POLYCAB, is currently valued at Rs 4952.8. Notably, several put options with an expiry date of March 27, 2025, have seen significant trading activity. The put option with a strike price of Rs 4500 led the activity, with 19,063 contracts traded and a premium turnover of approximately Rs 1,077.78 lakhs. Following closely, the Rs 4900 strike price option recorded 20,023 contracts traded, generating a premium turnover of around Rs 1,256.98 lakhs. Other notable strike prices include Rs 4600, Rs 4700, and Rs 5100, with respective contract volumes of 16,258, 14,446, and 14,238. Despite this activity, Polycab India has underperformed the sector by 3.09%, with a one-day return of -8.41%. The stock opened with a gap down o...

Read MoreAnnouncement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

03-Apr-2025 | Source : BSEDisclosure of allotment of equity shares pursuant to Employee Stock Option Scheme 2018 of Polycab India Limited

Announcement Under Regulation 30 (LODR)

01-Apr-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Closure of Trading Window

29-Mar-2025 | Source : BSEIntimation of Closure of Trading Window pursuant to SEBI (Prohibition of Insider Trading) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Polycab India Ltd has declared 300% dividend, ex-date: 09 Jul 24

No Splits history available

No Bonus history available

No Rights history available