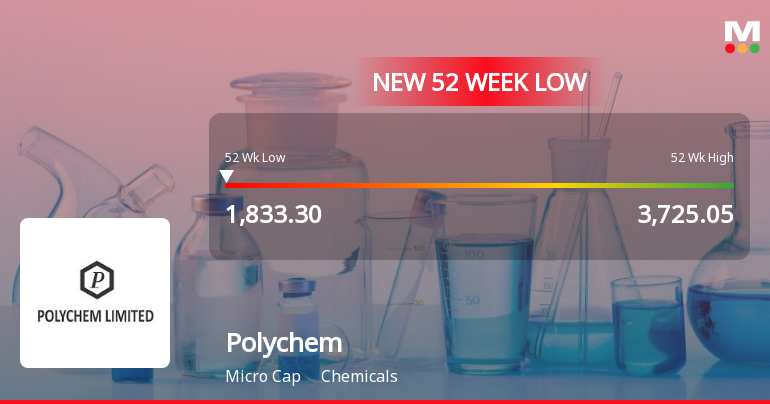

Polychem Faces Significant Volatility Amid Broader Market Gains and Declining Performance

2025-03-24 10:36:35Polychem, a microcap chemicals company, faced significant volatility, reaching a new 52-week low despite an initial gain. Over the past year, its performance has declined sharply, contrasting with broader market trends. Recent quarterly results showed substantial drops in net sales and profit, indicating ongoing financial challenges.

Read More

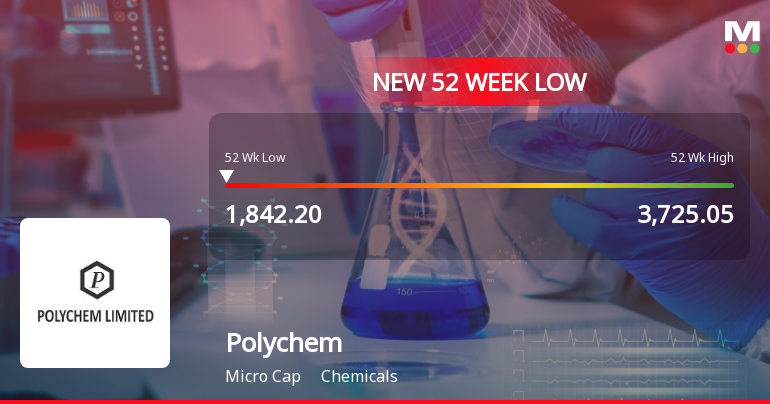

Polychem Faces Financial Struggles Amid Significant Stock Volatility and Declining Sales

2025-03-19 14:06:06Polychem, a microcap chemicals company, has faced notable volatility, hitting a new 52-week low. The stock has underperformed its sector and reported a significant decline in quarterly net sales and profit. Its return on capital employed is low, and the stock's valuation appears high compared to peers.

Read More

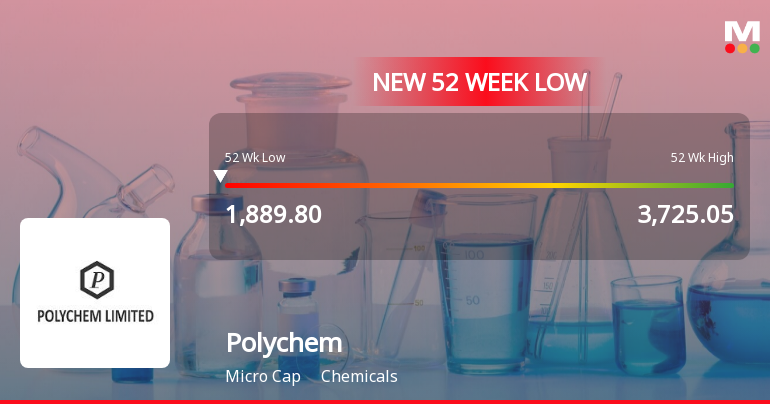

Polychem Hits 52-Week Low Amid Broader Market Gains and Small-Cap Surge

2025-03-18 15:06:50Polychem, a microcap in the chemicals sector, has reached a new 52-week low of Rs. 1850, reflecting a 17.04% decline over the past year. Despite recent challenges, the stock has shown some resilience with a slight increase over the last two days, while the broader market, led by small-cap stocks, has performed strongly.

Read More

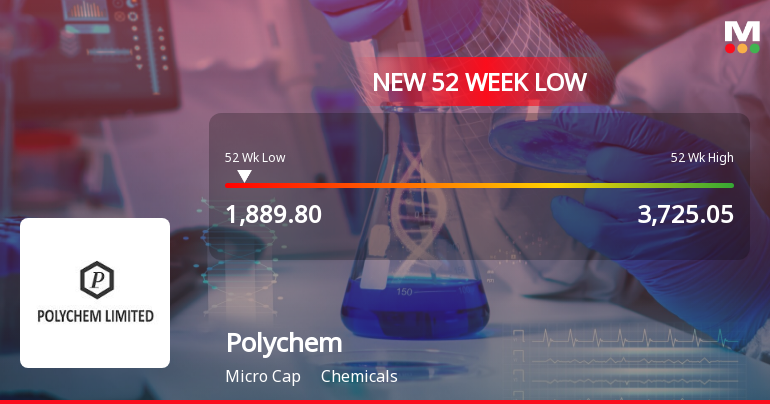

Polychem Faces Significant Challenges Amidst Declining Sales and Profitability Trends

2025-03-17 14:07:46Polychem, a microcap chemicals company, has faced notable volatility, reaching a new 52-week low. The stock has underperformed its sector and reported a significant decline in net sales and profit after tax. Technical indicators suggest a bearish outlook, reflecting ongoing challenges in profitability and market performance.

Read MorePolychem Adjusts Valuation Amid Competitive Chemicals Sector Dynamics and Performance Challenges

2025-03-17 08:00:30Polychem, a microcap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 1880.00, reflecting a slight decline from the previous close of 1921.00. Over the past year, Polychem has experienced a stock return of -12.24%, contrasting with a modest gain of 1.47% in the Sensex. Key financial metrics for Polychem include a PE ratio of 17.75 and an EV to EBITDA ratio of 12.69, which position it within a competitive landscape. The company's return on capital employed (ROCE) is reported at 15.31%, while the return on equity (ROE) stands at 12.10%. These figures indicate a stable operational performance, although the stock has faced challenges in recent months, with a year-to-date return of -28.92%. In comparison to its peers, Polychem's valuation metrics reveal a diverse industry landscape. For instance, TGV Sraac and Oriental Aromatics are noted fo...

Read More

Polychem Faces Financial Struggles Amidst Significant Stock Volatility and Weak Performance

2025-03-10 14:35:17Polychem, a microcap in the chemicals sector, has faced notable volatility, reaching a new 52-week low. The company reported a significant decline in net sales and profit after tax, raising concerns about its financial health. Its stock is trading below key moving averages, indicating a bearish trend.

Read MorePolychem Adjusts Valuation Amidst Competitive Market Dynamics in Chemicals Sector

2025-03-10 08:00:32Polychem, a microcap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 1910.00, reflecting a slight increase from the previous close of 1901.00. Over the past year, Polychem has experienced a stock return of -28.60%, contrasting with a modest gain of 0.29% in the Sensex during the same period. Key financial metrics for Polychem include a PE ratio of 18.03 and an EV to EBITDA ratio of 12.91. The company also reports a dividend yield of 1.57% and a return on capital employed (ROCE) of 15.31%. In comparison to its peers, Polychem's valuation metrics indicate a competitive position, particularly when contrasted with companies like Sr. Rayala.Hypo and Chembond Chem, which exhibit different valuation profiles. While Polychem's recent performance has lagged behind the broader market, its long-term returns over three and five years show signif...

Read More

Polychem Faces Market Challenges Amid Significant Decline in Financial Performance

2025-03-04 14:06:05Polychem, a microcap chemicals company, is nearing a 52-week low, with a significant decline in stock value over the past year. Recent financial results show a drop in net sales and profit after tax, while the company underperforms its sector and trades below key moving averages, indicating ongoing challenges.

Read More

Polychem Faces Increased Scrutiny Amidst Significant Stock Volatility and Declining Fundamentals

2025-03-03 15:51:53Polychem, a microcap chemicals company, has faced notable volatility, reaching a new 52-week low after four consecutive days of losses. Despite a brief gain, its one-year performance has declined significantly, with substantial drops in net sales and profit. The company's fundamentals and technical indicators raise concerns about its profitability.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st March 2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEThe Trading Window will be closed from 1st April 2025 for all the directors KMP and designated persons of the Company and their immediate relatives for the purpose of declaration of Standalone and Consolidated Audited Financial Results for the quarter and year ended 31st March 2025.

Announcement under Regulation 30 (LODR)-Cessation

25-Mar-2025 | Source : BSECompletion of term of Independent Directors of the Company Ms. Nirmala Mehendale ceases to be a director w.e.f 24.03.2025 and Mr. Yogesh Mathur shall cease to be a director w.e.f 30.03.2025.

Corporate Actions

No Upcoming Board Meetings

Polychem Ltd has declared 300% dividend, ex-date: 12 Jul 24

No Splits history available

No Bonus history available

No Rights history available