Polyplex Corporation Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-26 08:03:31Polyplex Corporation, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1218.75, down from a previous close of 1240.40, with a notable 52-week high of 1,480.00 and a low of 752.55. Today's trading saw a high of 1258.00 and a low of 1214.05. In terms of technical indicators, the weekly MACD shows a mildly bearish trend, while the monthly perspective indicates a mildly bullish stance. The Bollinger Bands also reflect a mildly bearish outlook on a weekly basis, contrasting with a bullish monthly trend. Moving averages on a daily basis suggest a mildly bearish sentiment, while the KST presents a bearish weekly view against a bullish monthly outlook. The Dow Theory indicates a mildly bullish trend for both weekly and monthly evaluations. When comparing the company's performance to the Sense...

Read MorePolyplex Corporation Shows Mixed Technical Trends Amid Strong Long-Term Performance

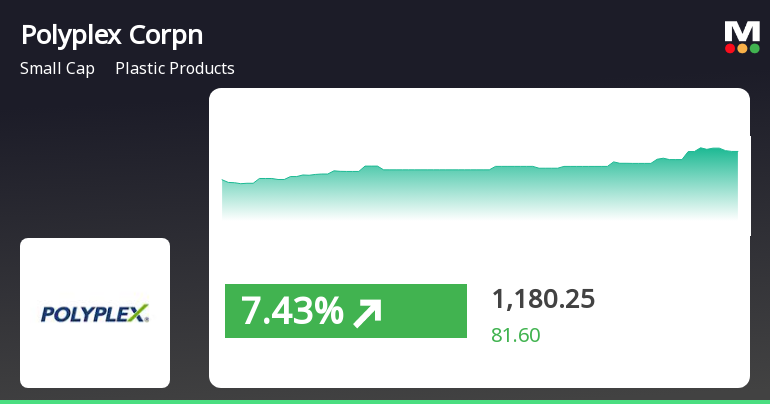

2025-03-25 08:04:04Polyplex Corporation, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1240.40, showing a notable increase from the previous close of 1210.85. Over the past year, Polyplex has demonstrated significant resilience, achieving a remarkable return of 53.17%, compared to the Sensex's 7.07% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bearish sentiment, while the monthly perspective leans towards a mildly bullish outlook. The Bollinger Bands indicate bullish conditions on both weekly and monthly charts, suggesting potential volatility within a positive framework. The moving averages present a mildly bearish trend on a daily basis, contrasting with the monthly bullish sentiment observed in other indicators. Polyplex's performance over various tim...

Read More

Polyplex Corporation Faces Shift in Market Sentiment Amid Mixed Financial Performance

2025-03-24 08:05:12Polyplex Corporation has experienced a shift in its technical outlook, reflecting changing market sentiment. Despite a strong annual return, the company faces challenges with declining operating profit and a high percentage of pledged promoter shares. However, recent financial performance shows positive growth and a low debt-to-equity ratio.

Read MorePolyplex Corporation Shows Mixed Technical Trends Amid Strong Long-Term Performance

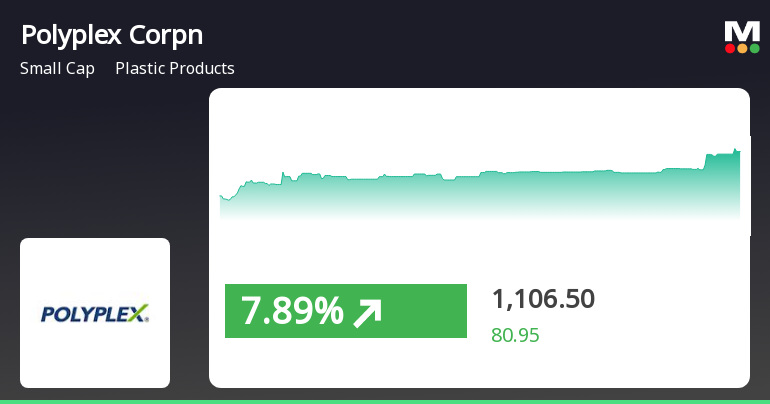

2025-03-24 08:01:50Polyplex Corporation, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 1210.85, slightly down from the previous close of 1211.65. Over the past year, Polyplex has demonstrated significant resilience, achieving a return of 51.96%, compared to the Sensex's 5.87% during the same period. In terms of technical metrics, the weekly MACD indicates a mildly bearish trend, while the monthly perspective remains mildly bullish. The Bollinger Bands also reflect a mildly bearish stance on a weekly basis, contrasting with a bullish outlook for the monthly timeframe. The KST shows a bearish trend weekly, yet maintains a bullish position monthly. Polyplex's performance over various timeframes reveals a mixed picture; while it has faced challenges in the short term, its long-term re...

Read MorePolyplex Corporation Navigates Mixed Market Signals Amid Strong Long-Term Growth

2025-03-21 18:00:30Polyplex Corporation, a small-cap player in the plastic products industry, has shown notable performance metrics recently. With a market capitalization of Rs 3,842.00 crore, the company has a price-to-earnings (P/E) ratio of 18.32, significantly lower than the industry average of 39.93. Over the past year, Polyplex Corporation has delivered an impressive return of 51.96%, vastly outperforming the Sensex, which recorded a gain of only 5.87%. However, the stock experienced a slight decline of 0.07% today, contrasting with the Sensex's increase of 0.73%. In the short term, Polyplex has shown resilience, with a weekly performance of 6.48%, compared to the Sensex's 4.17%. Despite some fluctuations, the stock has maintained a positive trajectory over the past five years, boasting a remarkable 231.51% increase, while the Sensex rose by 157.07% during the same period. Technical indicators present a mixed picture,...

Read More

Polyplex Corporation's Stock Surge Signals Potential Shift in Plastic Products Market Dynamics

2025-02-19 10:45:25Polyplex Corporation's stock saw a significant rise on February 19, 2025, following a three-day decline, suggesting a potential trend reversal. The stock reached an intraday high and demonstrated high volatility. Its performance relative to moving averages indicates mixed short-term and long-term trends in the plastic products sector.

Read More

Polyplex Corporation Reports December 2024 Results Highlighting Growth Amidst Financial Challenges

2025-02-15 10:47:08Polyplex Corporation has reported its financial results for the quarter ending December 2024, showcasing a significant increase in Profit After Tax (PAT) to Rs 57.77 crore. However, Profit Before Tax (PBT) has declined, raising concerns about the company's reliance on non-operating income and its debt settlement capabilities.

Read More

Polyplex Corporation Reports Strong Q2 FY24-25 Results Amid Long-Term Growth Concerns

2025-02-03 18:31:12Polyplex Corporation has recently experienced an evaluation adjustment, highlighting its strong second-quarter FY24-25 performance with a profit after tax of Rs 87.81 crore and record net sales of Rs 1,738.86 crore. However, long-term growth challenges persist, including a decline in operating profit and high promoter share pledges.

Read More

Polyplex Corporation Shows Signs of Recovery Amid Recent Market Volatility

2025-01-29 14:05:18Polyplex Corporation's stock rebounded on January 29, 2025, gaining 7.18% after three days of decline. The company outperformed its sector and the broader market, despite trading below key moving averages. Over the past month, the stock has seen a significant decline, contrasting with the overall market trend.

Read MoreAnnouncement under Regulation 30 (LODR)-Cessation

29-Mar-2025 | Source : BSEMs. Pooja Haldea (DIN: 07123158) having completed her second term of five consecutive years as Independent Director ceases to be Director of the Company w.e.f. the close of business hours on March 29 2025

Announcement Under Regulation 30- Appointment Of Internal Auditors

27-Mar-2025 | Source : BSEBoard of Directors has appointed Protiviti India Member Private Limited as Internal Auditors of the Company for a period of three years w.e.f. April 1 2025.

Board Meeting Outcome for Appointment Of Independent Director And Internal Auditors

27-Mar-2025 | Source : BSEBoard of Directors of Polyplex Corporation Limited (Company) at their meeting held on March 27 2025 have considered and approved: A. Appointment of Dr. Shalini Sarin (DIN: 06604529) as an Additional Non-Executive Independent Director of the Company with effect from March 30 2025 for a period of five consecutive years. She is not debarred from holding the office of a director pursuant to any order passed by the SEBI or any such authority. B. Appointment of Protiviti India Member Private Limited as Internal Auditors of the Company for a period of three years from April 1 2025 to March 31 2028

Corporate Actions

No Upcoming Board Meetings

Polyplex Corporation Ltd has declared 90% dividend, ex-date: 26 Nov 24

No Splits history available

Polyplex Corporation Ltd has announced 1:1 bonus issue, ex-date: 23 Dec 10

No Rights history available