Ponni Sugars Adjusts Valuation Amidst Challenging Market Conditions and Peer Comparisons

2025-04-02 08:01:11Ponni Sugars (Erode), a microcap player in the sugar industry, has recently undergone a valuation adjustment. The company's current price stands at 308.25, reflecting a slight increase from the previous close of 303.10. Over the past year, Ponni Sugars has faced challenges, with a return of -25.29%, contrasting with a modest gain of 2.72% in the Sensex during the same period. Key financial metrics for Ponni Sugars include a PE ratio of 9.36 and an EV to EBITDA ratio of 10.18, which position the company within a competitive landscape. In comparison to its peers, Ponni Sugars exhibits a lower PE ratio than several companies in the sector, such as Uttam Sugars and Avadh Sugar, which have higher valuations. Additionally, the company's dividend yield stands at 2.27%, and its ROCE and ROE are recorded at 4.48% and 4.76%, respectively. While Ponni Sugars has shown some resilience over longer periods, such as a 2...

Read MorePonni Sugars Adjusts Valuation Grade Amid Competitive Market Landscape and Peer Comparison

2025-03-27 08:00:27Ponni Sugars (Erode), a microcap player in the sugar industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's price-to-earnings ratio stands at 9.18, while its price-to-book value is notably low at 0.44. Other key metrics include an EV to EBITDA ratio of 9.97 and an EV to sales ratio of 0.72, indicating a competitive position within the market. In terms of returns, Ponni Sugars has faced challenges, with a year-to-date decline of 25.46%, contrasting with a slight drop of 1.09% in the Sensex during the same period. Over a longer horizon, the company has shown resilience, with a five-year return of 181.52%, outperforming the Sensex's 158.09%. When compared to its peers, Ponni Sugars presents a more favorable valuation profile, particularly in terms of its price-to-earnings ratio, which is lower than several competitors. This evaluation revision hig...

Read MorePonni Sugars Adjusts Valuation Grade Amid Mixed Financial Metrics and Peer Comparison

2025-03-20 08:00:26Ponni Sugars (Erode), a microcap player in the sugar industry, has recently undergone a valuation adjustment, reflecting changes in its financial metrics. The company's current price stands at 321.35, showing a notable increase from the previous close of 302.10. Over the past week, Ponni Sugars has delivered a stock return of 7.55%, outperforming the Sensex, which returned 1.92% during the same period. Key financial indicators for Ponni Sugars include a PE ratio of 9.76 and a price-to-book value of 0.46. The company's EV to EBITDA ratio is recorded at 10.64, while its dividend yield is at 2.18%. Return on capital employed (ROCE) and return on equity (ROE) stand at 4.48% and 4.76%, respectively. In comparison to its peers, Ponni Sugars' valuation metrics present a mixed picture. While it has a lower PE ratio than some competitors like Uttam Sugar Mills and Dhampur Sugar, it is positioned similarly to Magad...

Read More

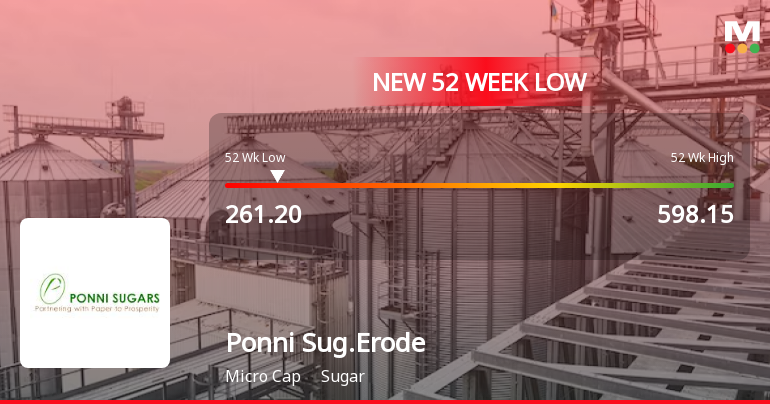

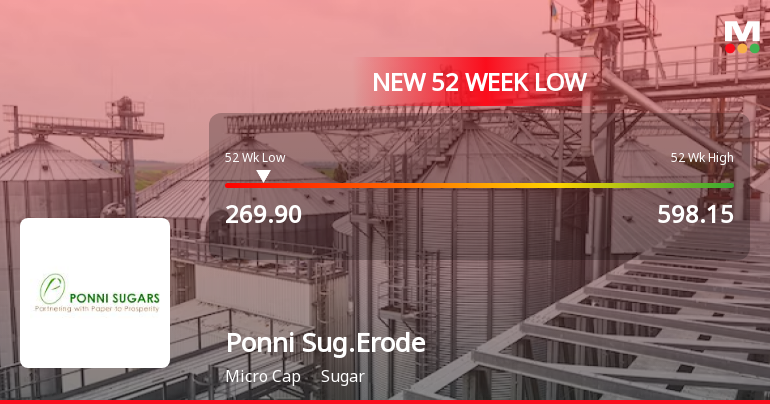

Ponni Sugars Faces Financial Challenges Amid Significant Market Volatility and Declining Performance

2025-03-12 09:40:05Ponni Sugars (Erode) has faced significant volatility, hitting a new 52-week low amid ongoing challenges in the sugar industry. The company has reported declining operating profits and negative results for three consecutive quarters, leading to underperformance compared to broader market indices and a reduction in institutional investor stakes.

Read MorePonni Sugars Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-12 08:00:18Ponni Sugars (Erode), a microcap player in the sugar industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently reports a price-to-earnings (PE) ratio of 8.80 and a price-to-book value of 0.42, indicating a relatively low valuation compared to its peers. Its enterprise value to EBITDA stands at 9.53, while the enterprise value to sales is at 0.69, suggesting a competitive position in the market. In terms of returns, Ponni Sugars has faced challenges, with a year-to-date return of -28.54%, contrasting with a modest -5.17% decline in the Sensex over the same period. However, over a five-year horizon, the company has shown a significant return of 139.55%, outperforming the Sensex's 107.58%. When compared to its peers, Ponni Sugars maintains a favorable valuation, particularly against companies like Godavari Bioref. and Dhampur Sugar, which are...

Read More

Ponni Sugars Faces Declining Performance Amidst Increased Market Volatility and Investor Withdrawal

2025-03-11 09:41:06Ponni Sugars (Erode) has faced notable volatility, hitting a new 52-week low and experiencing a three-day decline. The company has reported negative performance metrics, including a significant drop in net sales and operating profit over recent quarters, alongside reduced institutional investor participation.

Read More

Ponni Sugars Faces Significant Volatility Amid Declining Performance Metrics and Investor Participation

2025-03-11 09:41:06Ponni Sugars (Erode) has faced notable volatility, reaching a new 52-week low and experiencing a three-day decline. The company has reported negative results for three consecutive quarters, with a significant drop in operating profit over five years. Institutional investor participation has decreased, and the stock is trading below key moving averages.

Read MorePonni Sugars Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-06 08:00:38Ponni Sugars (Erode), a microcap player in the sugar industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company’s price-to-earnings (PE) ratio stands at 8.99, while its price-to-book value is notably low at 0.43. Other key metrics include an enterprise value to EBITDA ratio of 9.75 and a dividend yield of 2.36%. The return on capital employed (ROCE) and return on equity (ROE) are reported at 4.48% and 4.76%, respectively. In comparison to its peers, Ponni Sugars holds a competitive position, particularly when looking at its PE ratio, which is significantly lower than that of Godavari Bioref. and Dhampur Sugar, both of which are categorized as very attractive. Additionally, Ponni Sugars' valuation metrics suggest a more favorable standing compared to Dwarikesh Sugar, which is currently loss-making. Despite recent stock performance showing a decline over...

Read More

Ponni Sugars Faces Significant Market Challenges Amid Sustained Downward Trend

2025-03-03 10:06:36Ponni Sugars (Erode) has faced significant volatility, hitting a new 52-week low and underperforming its sector. The stock has seen consecutive losses over the past week and is trading below key moving averages. Its one-year performance shows a notable decline compared to the broader market.

Read MoreDisclosure Under SEBI (LODR) Regulations 2015

08-Apr-2025 | Source : BSEDisclosure under SEBI (LODR) Regulations 2015 regarding intimation received from a Promoter of the Company

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74 (5) of SEBI (DP) Regulations for 2018 for the quarter ended 31st March 2025

Closure of Trading Window

27-Mar-2025 | Source : BSETrading Window for dealing in securities of the Company will remain closed for the Designated Persons with effect from Tuesday the 1st April 2025 till 48 hours after the declaration of the audited results of the Company for the quarter and year ended 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Ponni Sugars (Erode) Ltd has declared 70% dividend, ex-date: 22 May 24

No Splits history available

No Bonus history available

No Rights history available