Poojawestern Metaliks Adjusts Valuation Amidst Competitive Non-Ferrous Metal Landscape

2025-03-25 08:00:59Poojawestern Metaliks, a microcap player in the non-ferrous metal industry, has recently undergone a valuation adjustment. The company's current price stands at 30.40, reflecting a slight increase from the previous close of 29.60. Over the past year, Poojawestern has faced challenges, with a stock return of -24.13%, contrasting sharply with a 7.07% gain in the Sensex during the same period. Key financial metrics for Poojawestern include a PE ratio of 21.71 and an EV to EBITDA ratio of 9.65, which positions it competitively within its sector. The company's dividend yield is noted at 3.29%, and it boasts a return on capital employed (ROCE) of 16.91% and a return on equity (ROE) of 11.19%. When compared to its peers, Poojawestern's valuation metrics indicate a relatively attractive position, especially against companies like NILE and Cubex Tubings, which also hold attractive valuations. However, it lags beh...

Read MorePoojawestern Metaliks Adjusts Valuation Amidst Competitive Non-Ferrous Metal Landscape

2025-03-10 08:00:57Poojawestern Metaliks, a microcap player in the non-ferrous metal industry, has recently undergone a valuation adjustment. The company's current price stands at 29.75, reflecting a slight increase from the previous close of 29.20. Over the past year, Poojawestern has faced challenges, with a stock return of -34.96%, contrasting sharply with a modest gain of 0.29% in the Sensex. Key financial metrics for Poojawestern include a PE ratio of 21.25 and an EV to EBITDA ratio of 9.46, which positions it competitively within its sector. The company also boasts a dividend yield of 3.36% and a return on capital employed (ROCE) of 16.91%. When compared to its peers, Poojawestern's valuation reflects a more attractive position relative to companies like NILE and Siyaram, which have varying valuation standings. Notably, Manaksia Aluminum is categorized as very attractive, showcasing a higher PE ratio of 26.98, while ...

Read More

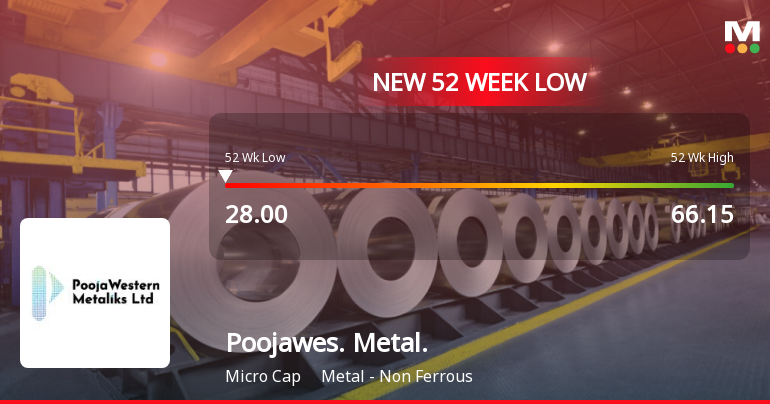

Poojawestern Metaliks Hits 52-Week Low Amid Broader Market Gains and Sector Decline

2025-02-28 12:05:28Poojawestern Metaliks, a microcap in the non-ferrous metal sector, has hit a new 52-week low, reflecting a significant decline over the past year. Despite this, it has outperformed its sector slightly. The stock is trading below key moving averages, indicating a bearish trend, while offering a notable dividend yield.

Read More

Poojawestern Metaliks Faces Persistent Volatility Amid Sector Underperformance and Market Challenges

2025-02-19 09:37:44Poojawestern Metaliks, a microcap in the non-ferrous metal sector, has hit a new 52-week low, reflecting ongoing volatility and a significant decline over the past year. The stock is trading below its moving averages, indicating a bearish trend, while offering a notable dividend yield that may appeal to income-focused investors.

Read More

Poojawestern Metaliks Hits 52-Week Low Amid Broader Market Challenges and Decline

2025-02-18 11:56:46Poojawestern Metaliks, a microcap in the non-ferrous metal sector, reached a new 52-week low today, continuing a four-day downward trend. Despite a 24.78% decline over the past year, the company offers a high dividend yield of 3.23%, contrasting with the sector's performance.

Read More

Poojawestern Metaliks Faces Significant Volatility Amid Challenging Market Conditions

2025-02-17 09:41:02Poojawestern Metaliks, a microcap in the non-ferrous metal sector, has hit a 52-week low amid significant volatility, underperforming its sector. The stock has dropped 7.35% over three days and is trading below key moving averages. It also offers a high dividend yield, despite a 22.81% annual decline.

Read More

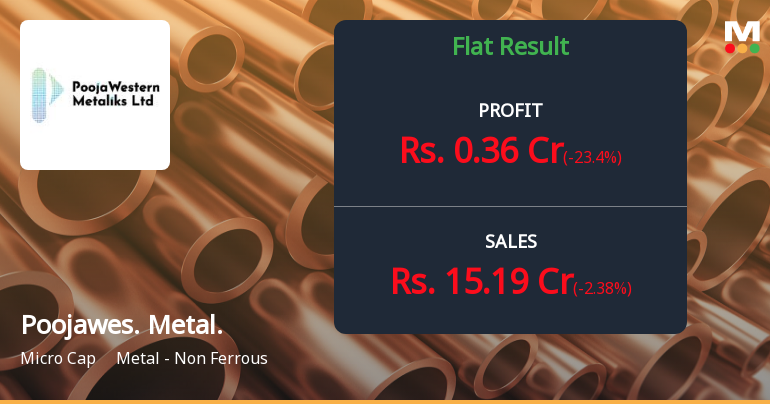

Poojawestern Metaliks Reports December 2024 Results Amid Industry Challenges and Evaluation Shift

2025-02-13 19:36:55Poojawestern Metaliks has announced its financial results for the quarter ending December 2024, revealing a revision in its evaluation score from -3 to -4. This adjustment reflects the company's position in the competitive non-ferrous metal industry as it faces ongoing sector challenges. Stakeholders will watch for strategic adaptations.

Read MoreIntimation Regarding Name Change Of Wholly Owned Subsidiary Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

09-Apr-2025 | Source : BSEWe hereby inform you that as per communication received from our Wholly Owned Subsidiary the name of the Wholly Owned Subsidiary has been changed from Sierra Automation Private Limited to Sierra Metal Industries Private Limited.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPoojawestern Metaliks Limited has informed the Exchange regarding compliance of Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended on March 31 2025.

Closure of Trading Window

28-Mar-2025 | Source : BSEPursuant to SEBI (Prohibition of Insider Trading) Regulations 2015 the trading window for dealing in equity shares by the Insiders of the company shall be closed from Tuesday April 01 2025 till 48 hours after the declaration of Financial Results for the quarter and year ended March 31 2025.

Corporate Actions

No Upcoming Board Meetings

Poojawestern Metaliks Ltd has declared 10% dividend, ex-date: 13 Sep 24

No Splits history available

Poojawestern Metaliks Ltd has announced 1:1 bonus issue, ex-date: 02 Jan 20

No Rights history available