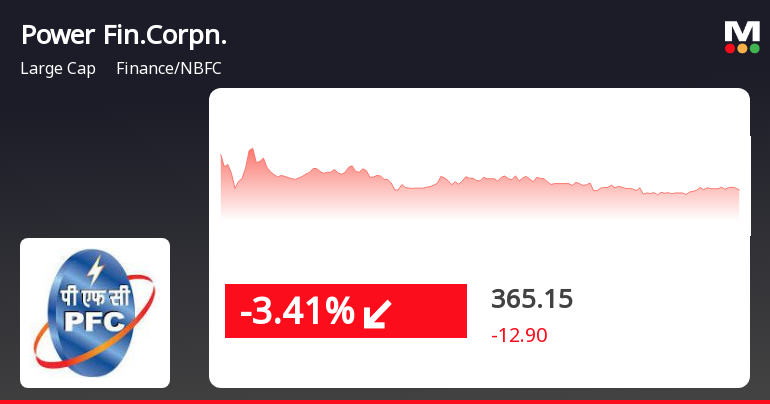

Power Finance Corporation Adjusts Valuation Grade Amid Strong Financial Metrics and Market Position

2025-04-02 08:01:53Power Finance Corporation has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position within the finance and non-banking financial company (NBFC) sector. The company boasts a price-to-earnings (PE) ratio of 5.99 and a price-to-book value of 1.21, indicating a favorable valuation compared to its peers. Additionally, its enterprise value to EBITDA stands at 10.27, while the PEG ratio is notably low at 0.32, suggesting efficient growth relative to its earnings. The corporation also offers a dividend yield of 4.00%, which is appealing in the current market environment. Key performance indicators such as return on capital employed (ROCE) at 9.61% and return on equity (ROE) at 19.26% further underscore its operational efficiency and profitability. In comparison to its peers, Power Finance Corporation demonstrates a more attractive valuation profile, particularly wh...

Read More

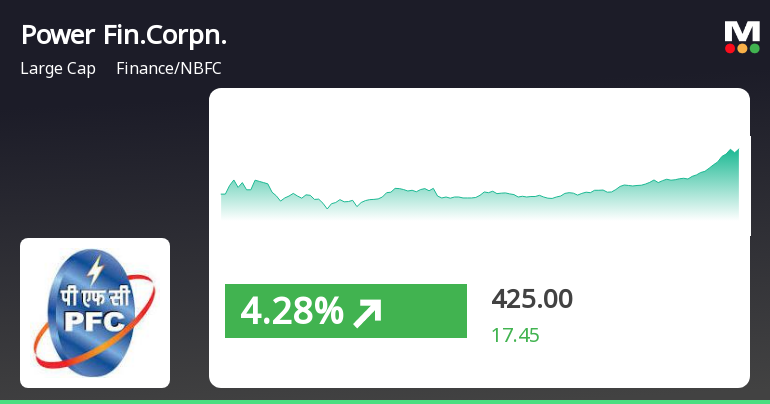

Power Finance Corporation Outperforms Sector Amid Broader Market Gains and Strong Dividend Yield

2025-03-24 11:15:24Power Finance Corporation has demonstrated strong performance, gaining 3.9% on March 24, 2025, and outperforming its sector. The stock has risen consecutively over two days, reaching an intraday high of Rs 419.1. It also offers a high dividend yield of 4.71%, reflecting solid returns for shareholders.

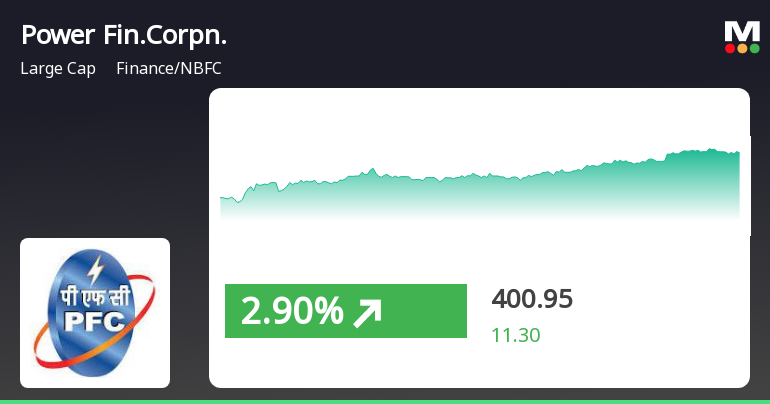

Read MorePower Finance Corporation Shows Mixed Technical Trends Amid Strong Long-Term Growth

2025-03-19 08:03:32Power Finance Corporation, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 402.65, showing a notable shift from its previous close of 389.65. Over the past year, Power Finance Corporation has demonstrated resilience, with a return of 7.46%, outperforming the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the company exhibits a mixed performance across various metrics. The MACD indicates a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals, suggesting a neutral stance in momentum. Bollinger Bands and moving averages also reflect a mildly bearish sentiment, indicating some caution among traders. Power Finance Corporation's performance over different time f...

Read More

Power Finance Corporation Shows Strong Performance Amid Rising Market Trends

2025-03-18 12:20:24Power Finance Corporation has experienced a positive trend, gaining over the past two days and outperforming its sector. The stock is currently above its short-term moving averages and offers a high dividend yield. In the broader market, the Sensex has also seen significant gains, led by small-cap stocks.

Read More

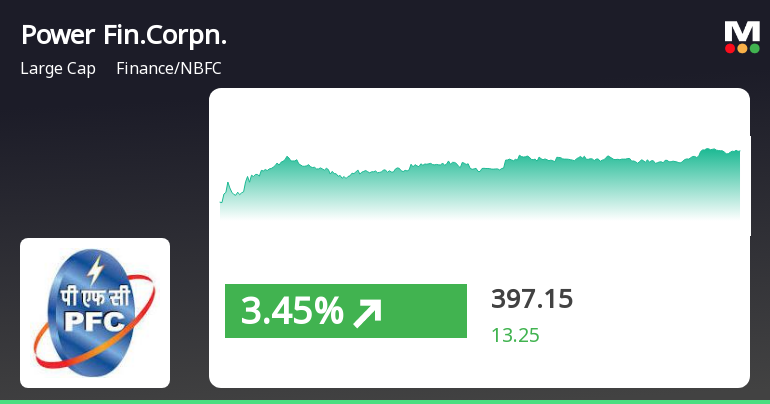

Power Finance Corporation Shows Resilience Amid Market Fluctuations with Strong Gains

2025-03-05 13:35:25Power Finance Corporation has demonstrated strong performance, gaining 3.48% on March 5, 2025, and achieving a total return of 9.13% over three consecutive days. The stock is currently above its 5-day and 20-day moving averages, with a notable dividend yield of 4.09%.

Read More

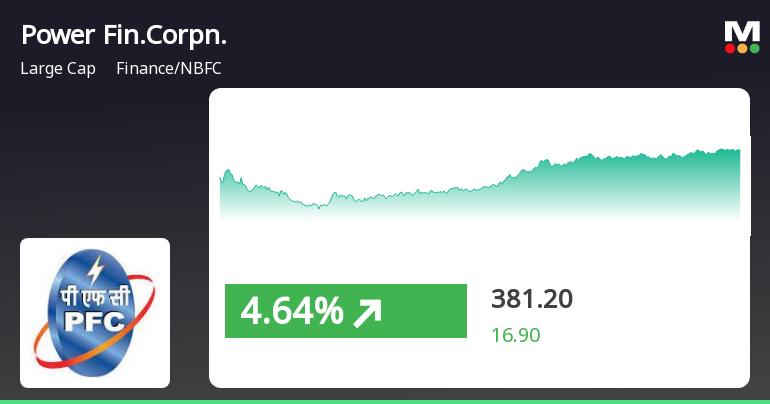

Power Finance Corporation Shows Signs of Recovery Amid Broader Market Challenges

2025-03-03 14:20:31Power Finance Corporation has experienced a notable rebound, gaining 4.35% after five days of decline. The stock outperformed its sector and reached an intraday high of Rs 380.6. Despite this recovery, it remains below its moving averages, while maintaining a high dividend yield of 4.31%.

Read MorePower Finance Corporation Adjusts Valuation Grade Amid Competitive Market Metrics

2025-03-02 08:00:02Power Finance Corporation, a prominent player in the Finance/NBFC sector, has recently undergone a valuation adjustment, reflecting its current financial standing. The company showcases a price-to-earnings (PE) ratio of 5.39 and a price-to-book value of 1.09, indicating a competitive position in the market. Additionally, its enterprise value to EBITDA stands at 10.13, while the PEG ratio is notably low at 0.29, suggesting efficient growth relative to its earnings. The firm also offers a dividend yield of 4.31%, which may appeal to income-focused investors. Its return on capital employed (ROCE) is reported at 9.61%, and return on equity (ROE) is at 19.26%, highlighting effective management of resources and profitability. In comparison to its peers, Power Finance Corporation's valuation metrics are significantly more favorable. For instance, Bajaj Finance and Bajaj Finserv exhibit much higher PE ratios, ind...

Read More

Power Finance Corporation Adjusts Evaluation Amid Strong Financial Performance and Market Confidence

2025-02-28 18:29:44Power Finance Corporation has recently adjusted its evaluation following a thorough analysis of its financial metrics and market position. In Q3 FY24-25, the company reported strong net sales and operational performance, alongside a stable debt-equity ratio and a high dividend yield, indicating confidence from institutional investors.

Read More

Power Finance Corporation Faces Continued Decline Amid Challenging Market Conditions

2025-02-28 10:15:29Power Finance Corporation has faced a significant decline, with consecutive losses over the past week and trading below key moving averages. The stock is currently positioned above its 52-week low, while maintaining a high dividend yield. Its recent performance contrasts with broader market trends.

Read MoreTransfer Of Anantapur II REZ Transmission Limited (Wholly Owned Subsidiary Of PFC Consulting Limited) (Wholly Owned Subsidiary Of Power Finance Corporation Limited).

01-Apr-2025 | Source : BSEIntimation regarding transfer of WoS of PFCCL ( WoS of PFC).

Incorporation Of Wholly Owned Subsidiary Of PFC Consulting Limited (A Wholly Owned Subsidiary Of Power Finance Corporation Limited) - NES PUNE EAST NEW TRANSMISSION LIMITED.

30-Mar-2025 | Source : BSEIntimation

Transfer Of Kurnool III PS RE Transmission Limited (Wholly Owned Subsidiary Of PFC Consulting Limited) (Wholly Owned Subsidiary Of Power Finance Corporation Limited).

27-Mar-2025 | Source : BSEIntimation regarding transfer of WoS of PFCCL ( WoS of PFC)

Corporate Actions

No Upcoming Board Meetings

Power Finance Corporation Ltd has declared 35% dividend, ex-date: 19 Mar 25

No Splits history available

Power Finance Corporation Ltd has announced 1:4 bonus issue, ex-date: 21 Sep 23

No Rights history available