Power Grid Corporation Shows Resilience Amid Sector Gains and Moving Average Trends

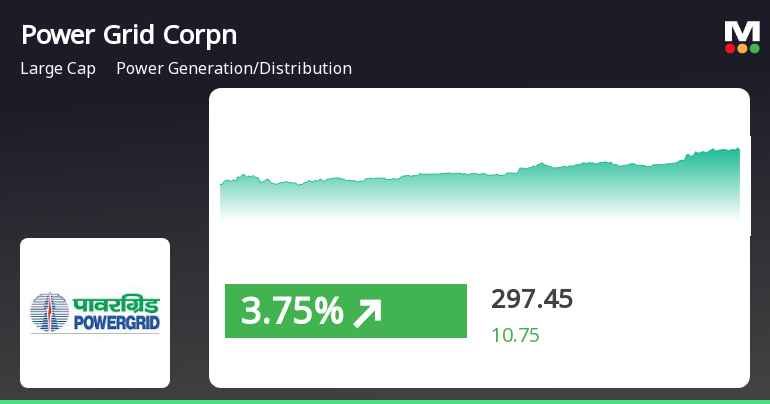

2025-04-03 13:00:23Power Grid Corporation of India has rebounded after three days of decline, gaining 3.66% on April 3, 2025. The stock has outperformed the broader sector and shows resilience with a one-month performance of 17.52%. Its high dividend yield and strong position in the industry further enhance its market appeal.

Read MorePower Grid Corporation Shows Resilience with Strong Recovery and Long-Term Growth Potential

2025-04-03 12:35:18Power Grid Corporation of India, a prominent player in the Power Generation and Distribution sector, has shown notable activity today, outperforming its sector by 0.46%. After experiencing three consecutive days of decline, the stock has reversed its trend, gaining 2.48% and reaching an intraday high of Rs 294.6, reflecting a 2.76% increase. With a market capitalization of Rs 2,73,251.74 crore, Power Grid Corporation maintains a price-to-earnings (P/E) ratio of 17.15, which is below the industry average of 21.44. The stock's performance over the past year stands at 4.82%, surpassing the Sensex's 3.33% return. In the last month, it has delivered a robust 16.17% gain compared to the Sensex's 4.45%. Despite a year-to-date decline of 4.80%, the company has demonstrated strong long-term performance, with a remarkable 234.07% increase over the past five years. Additionally, Power Grid Corporation offers a high ...

Read MorePower Grid Corporation of India Shows Mixed Performance Amid Market Challenges

2025-03-28 09:20:23Power Grid Corporation of India, a prominent player in the power generation and distribution sector, has experienced notable activity today, underperforming the sector by 0.54%. After two consecutive days of gains, the stock has seen a decline of 0.88% in today's trading session. Currently, the stock's performance metrics reveal that it is trading above its 5-day, 20-day, and 50-day moving averages, yet remains below its 100-day and 200-day moving averages. The company boasts a high dividend yield of 3.53%, which is attractive to income-focused investors. With a market capitalization of Rs 2,71,949.66 crore, Power Grid Corporation of India has a price-to-earnings (P/E) ratio of 17.64, significantly lower than the industry average of 22.72. Over the past year, the stock has delivered a return of 5.50%, slightly outperforming the Sensex, which recorded a gain of 5.31%. However, year-to-date performance sho...

Read MorePower Grid Corporation Shows Strong Performance Amidst Sector Trends and Attractive Valuation

2025-03-27 09:25:21Power Grid Corporation of India, a prominent player in the power generation and distribution sector, has shown notable activity today, outperforming its sector by 0.66%. The stock has been on a positive trajectory, gaining for the last two days with a cumulative return of 0.33% during this period. Currently, Power Grid's market capitalization stands at Rs 2,72,089.16 crore, classifying it as a large-cap company. The stock's price-to-earnings (P/E) ratio is 17.43, which is below the industry average of 22.15, indicating a potentially attractive valuation relative to its peers. In terms of performance metrics, Power Grid has demonstrated a solid one-year return of 7.93%, surpassing the Sensex's performance of 6.14%. Over the past month, the stock has gained 14.21%, significantly outpacing the Sensex's 3.84% increase. Additionally, the company offers a high dividend yield of 3.57%, appealing to income-focu...

Read MoreSurge in Open Interest for Power Grid Corporation Signals Increased Market Activity

2025-03-26 15:00:16Power Grid Corporation of India Ltd (POWERGRID) has experienced a significant increase in open interest today, reflecting heightened activity in its futures market. The latest open interest stands at 88,648 contracts, up from the previous figure of 71,865, marking a change of 16,783 contracts or a 23.35% increase. This surge in open interest coincides with a trading volume of 56,371 contracts, indicating robust market engagement. In terms of price performance, POWERGRID has outperformed its sector by 1%, with a modest one-day return of 0.12%. The stock has maintained a position above its 5-day, 20-day, and 50-day moving averages, although it remains below its 100-day and 200-day moving averages. Notably, the stock has a high dividend yield of 3.59%, which may appeal to income-focused investors. Despite a slight decline in delivery volume, which fell by 1.79% compared to the 5-day average, the stock remain...

Read MoreSurge in Open Interest Signals Increased Investor Engagement in Power Grid Corporation

2025-03-26 14:00:11Power Grid Corporation of India Ltd (POWERGRID) has experienced a significant increase in open interest today, reflecting heightened activity in its futures market. The latest open interest stands at 85,047 contracts, up from the previous 71,865 contracts, marking a change of 13,182 contracts or an 18.34% increase. The trading volume for the day reached 48,169 contracts, contributing to a total futures value of approximately Rs 110,728.37 lakhs. In terms of price performance, POWERGRID has outperformed its sector by 1.36%, with a one-day return of 1.08%. The stock is currently trading at an underlying value of Rs 293. While it remains above its 5-day, 20-day, and 50-day moving averages, it is below the 100-day and 200-day moving averages, indicating mixed performance trends over different time frames. Additionally, the stock boasts a high dividend yield of 3.59% at the current price, and its liquidity rem...

Read MoreSurge in Open Interest for Power Grid Corporation Signals Increased Market Activity

2025-03-26 13:00:10Power Grid Corporation of India Ltd (POWERGRID) has experienced a significant increase in open interest today, reflecting heightened activity in its futures market. The latest open interest stands at 84,345 contracts, up from the previous 71,865, marking a change of 12,480 contracts or a 17.37% increase. This surge coincides with a trading volume of 42,325 contracts, indicating robust engagement from market participants. In terms of performance, POWERGRID has outperformed its sector by 1.16%, with a one-day return of 1.48%. The stock is currently trading at an underlying value of Rs 294. While it is positioned higher than its 5-day, 20-day, and 50-day moving averages, it remains below the 100-day and 200-day moving averages, suggesting mixed momentum in the longer term. Additionally, the stock boasts a high dividend yield of 3.59%, which may appeal to income-focused investors. However, delivery volume has...

Read MoreSurge in Open Interest for Power Grid Corporation Signals Increased Market Activity

2025-03-26 12:00:09Power Grid Corporation of India Ltd (POWERGRID) has experienced a significant increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 81,781 contracts, up from the previous figure of 71,865, marking a change of 9,916 contracts or a 13.8% increase. This surge in open interest coincides with a trading volume of 34,905 contracts, indicating robust market engagement. In terms of price performance, POWERGRID has outperformed its sector by 0.75%, with a one-day return of 0.98%. The stock is currently trading above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. The stock also boasts a high dividend yield of 3.59%, making it an attractive option for income-focused investors. Despite a slight decline in delivery volume, which fell by 1.79% against the 5-day average, the stock maintains suff...

Read MorePower Grid Corporation Shows Resilience Amid High Volatility and Competitive Valuation

2025-03-26 09:25:26Power Grid Corporation of India, a prominent player in the power generation and distribution sector, has shown significant activity today, outperforming its sector by 1.2%. The stock has experienced high volatility, with an intraday volatility rate of 63.27%, indicating substantial price fluctuations throughout the trading session. Currently, Power Grid Corporation boasts a market capitalization of Rs 2,73,484.26 crore, categorizing it as a large-cap stock. Its price-to-earnings (P/E) ratio stands at 17.32, notably lower than the industry average of 22.44, suggesting a competitive valuation within its sector. In terms of performance metrics, the stock has delivered an impressive 1-year return of 8.91%, surpassing the Sensex's 7.78%. Over the past month, it has gained 14.91%, significantly outpacing the Sensex's 4.70% increase. Additionally, the stock offers a high dividend yield of 3.59%, appealing to inc...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEDisclosure as per Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018.

Board Meeting Outcome for Raising Of Unsecured Non-Convertible Non-Cumulative Redeemable Taxable POWERGRID Bonds - LXXXI (81St) Issue 2025-26 On Private Placement.

04-Apr-2025 | Source : BSERaising of Unsecured Non-convertible Non-cumulative Redeemable Taxable POWERGRID Bonds - LXXXI (81st) Issue 2025-26 on Private Placement.

Board Meeting Intimation for Intimation Regarding Proposed POWERGRID Non-Convertible Debenture (NCD) - LXXXI (81St) Issue 2025-26

01-Apr-2025 | Source : BSEPower Grid Corporation Of India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 04/04/2025 inter alia to consider and approve Intimation regarding proposed POWERGRID Non-Convertible Debenture (NCD) - LXXXI (81st) Issue 2025-26.

Corporate Actions

No Upcoming Board Meetings

Power Grid Corporation of India Ltd has declared 32% dividend, ex-date: 07 Feb 25

No Splits history available

Power Grid Corporation of India Ltd has announced 1:3 bonus issue, ex-date: 12 Sep 23

No Rights history available