Power Mech Projects Shows Mixed Technical Signals Amidst Significant Stock Volatility

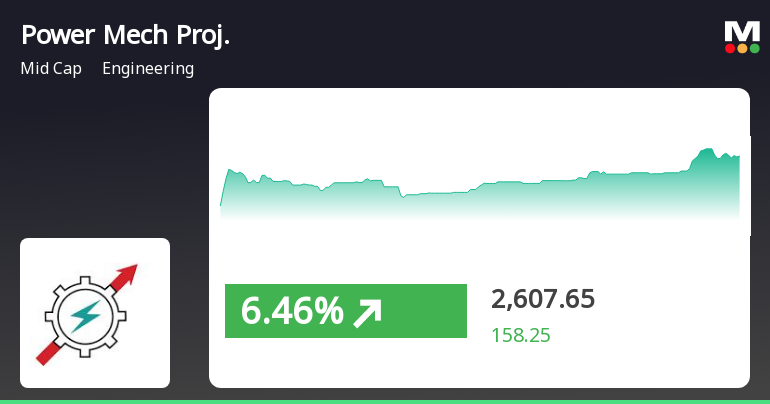

2025-04-01 08:03:10Power Mech Projects, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2718.25, showing a notable increase from the previous close of 2449.40. Over the past year, the stock has reached a high of 3,725.00 and a low of 1,698.85, indicating significant volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) indicates no clear signals for both weekly and monthly assessments. Bollinger Bands present a bullish outlook in both timeframes, suggesting potential upward momentum. However, moving averages indicate a mildly bearish trend on a daily basis, contrasting with the bullish signals from the On-Balance Volume (OBV) indicator. In ter...

Read More

Power Mech Projects Exhibits Strong Recovery Amid Broader Market Decline

2025-03-28 12:20:20Power Mech Projects has experienced a notable uptick, reversing a two-day decline and reaching an intraday high. The stock has significantly outperformed its sector and demonstrated substantial growth over the past week and month. Long-term performance remains impressive, with substantial increases over three and five years.

Read MorePower Mech Projects Shows Mixed Technical Trends Amidst Strong Historical Performance

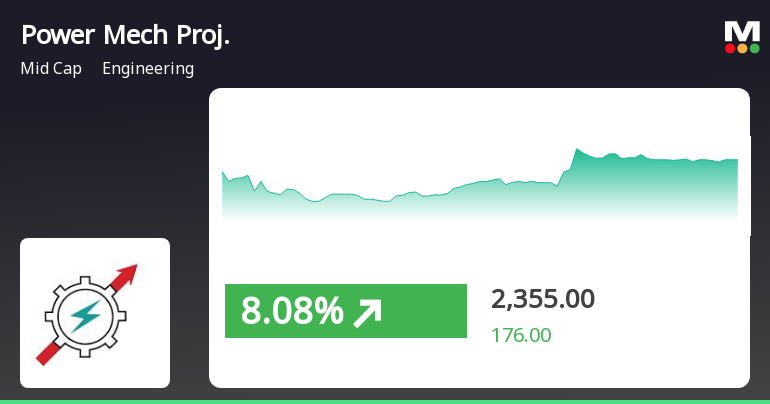

2025-03-28 08:03:30Power Mech Projects, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,449.40, down from a previous close of 2,536.00, with a notable 52-week high of 3,725.00 and a low of 1,698.85. Today's trading saw a high of 2,565.60 and a low of 2,415.00. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no significant signals for both weekly and monthly evaluations. Bollinger Bands reflect a bullish stance weekly but shift to mildly bearish on a monthly basis. Moving averages indicate a mildly bearish trend daily, while the KST shows bearish tendencies in both weekly and monthly assessments. Interestingly, the On-Balance Volume...

Read More

Power Mech Projects Shows Strong Sales Amid Neutral Technical Landscape

2025-03-27 08:08:18Power Mech Projects has experienced a recent adjustment in its technical evaluation, indicating a stabilization phase. The company reported record net sales and strong operational performance in the latest quarter, while maintaining a competitive return on equity and consistent returns over the past three years, despite modest long-term profit growth.

Read MorePower Mech Projects Shows Mixed Technical Trends Amid Market Volatility

2025-03-27 08:03:23Power Mech Projects, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,536.00, having closed at 2,606.15 previously. Over the past year, the stock has experienced a high of 3,725.00 and a low of 1,698.85, indicating significant volatility. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments. Bollinger Bands indicate a bullish sentiment on both time frames, suggesting potential price stability. However, moving averages present a mildly bearish outlook on a daily basis, contrasting with the overall bullish signals from the On-Balance Volume (OBV) metrics. When comparing the stock's performance to the Sensex, Power Mech Projects ...

Read More

Power Mech Projects Exhibits Strong Short-Term Momentum Amid Broader Market Gains

2025-03-24 10:05:23Power Mech Projects has experienced notable activity, with a significant increase in its stock price and a strong performance relative to its sector. The stock has shown positive momentum over the past two days and is currently above several short-term moving averages, despite a mixed performance over longer periods.

Read MorePower Mech Projects Ltd Opens Strong with 6.19% Gain, Outpacing Sector Performance

2025-03-24 10:00:17Power Mech Projects Ltd, a midcap player in the engineering sector, has shown significant activity today, opening with a gain of 6.19%. The stock's performance has outpaced its sector by 3.79%, reflecting a strong upward trend over the past two days, during which it has accumulated returns of 11.05%. Today, Power Mech Projects reached an intraday high of Rs 2345.2, marking a 7.63% increase. Over the past month, the stock has delivered impressive returns of 19.76%, compared to the Sensex's 4.12%. In terms of technical indicators, the stock is currently positioned higher than its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. The stock exhibits a high beta of 1.28, indicating that it tends to experience larger fluctuations compared to the broader market. Despite some bearish signals in the MACD and Bollinger Bands on a weekly and monthly bas...

Read MorePower Mech Projects Faces Technical Trend Challenges Amid Market Fluctuations

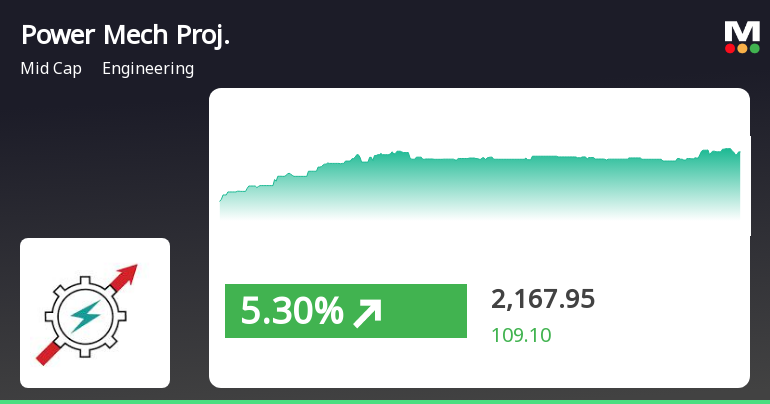

2025-03-24 08:02:32Power Mech Projects, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2,179.00, showing a notable increase from the previous close of 2,058.85. Over the past year, the stock has experienced a decline of 7.14%, contrasting with a 5.87% gain in the Sensex, highlighting the challenges faced by the company in a fluctuating market. In terms of technical indicators, the MACD suggests a bearish sentiment on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands and moving averages also reflect a mildly bearish trend, indicating a cautious market sentiment. Despite these technical indicators, Power Mech Projects has demonstrated resilience in its returns. Over the past three ye...

Read More

Power Mech Projects Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-21 14:35:22Power Mech Projects has experienced notable trading activity, outperforming its sector. The stock is currently above its short-term moving averages but below longer-term ones, indicating mixed trends. Despite recent declines, it has shown substantial gains over three and five years, significantly exceeding the Sensex's performance during those periods.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEPlease find the attached

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

28-Mar-2025 | Source : BSEPlease find the attached

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

28-Mar-2025 | Source : BSEPlease find the attached

Corporate Actions

No Upcoming Board Meetings

Power Mech Projects Ltd has declared 20% dividend, ex-date: 20 Sep 24

No Splits history available

Power Mech Projects Ltd has announced 1:1 bonus issue, ex-date: 08 Oct 24

No Rights history available