Praj Industries Experiences Valuation Grade Change Amidst Competitive Market Landscape

2025-04-02 08:00:06Praj Industries, a midcap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment. The company's current price stands at 535.55, reflecting a notable shift from its previous close of 554.55. Over the past year, Praj Industries has shown a return of 0.57%, while the Sensex has returned 2.72% in the same period. Key financial metrics for Praj Industries include a PE ratio of 39.55 and an EV to EBITDA ratio of 24.52. The company also boasts a strong return on capital employed (ROCE) of 41.81% and a return on equity (ROE) of 21.41%. In comparison to its peers, Praj Industries presents a more favorable valuation profile, particularly when contrasted with companies like BEML Ltd and Action Construction Equipment, which are positioned at higher valuation levels. Praj's dividend yield stands at 1.12%, and its PEG ratio is at 0.00, indicating a unique position withi...

Read MorePraj Industries Adjusts Valuation Grade Amid Strong Performance and Market Position

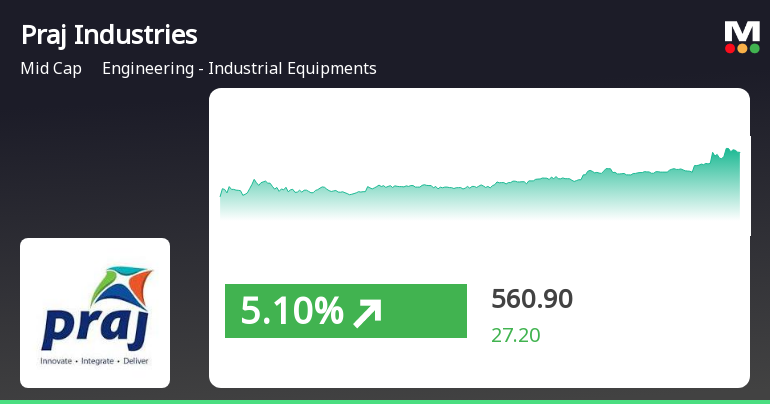

2025-03-20 08:00:03Praj Industries, a midcap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment. The company's current price stands at 566.00, reflecting a notable increase from the previous close of 533.70. Over the past year, Praj Industries has delivered a return of 19.55%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. Key financial metrics for Praj Industries include a PE ratio of 41.80 and an EV to EBITDA ratio of 25.98. The company also boasts a robust return on capital employed (ROCE) of 41.81% and a return on equity (ROE) of 21.41%. In comparison to its peers, Praj Industries maintains a competitive position, although some competitors exhibit higher valuation metrics, such as Action Construction Equipment and BEML Ltd, which are positioned in the expensive range. The evaluation revision reflects the company's strong ...

Read More

Praj Industries Shows Strong Performance Amid Positive Trends in Midcap Sector

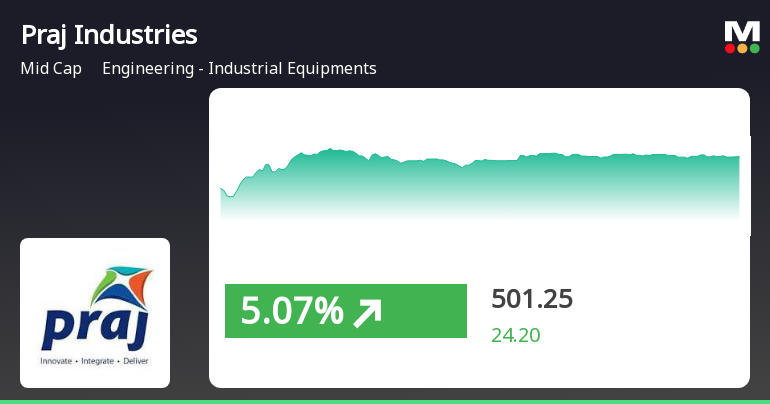

2025-03-19 13:00:21Praj Industries has experienced significant stock activity, gaining 5.49% on March 19, 2025, and outperforming its sector. The stock has shown consecutive gains over two days and reached an intraday high. The broader engineering sector also saw positive movement, with midcap stocks leading the market.

Read More

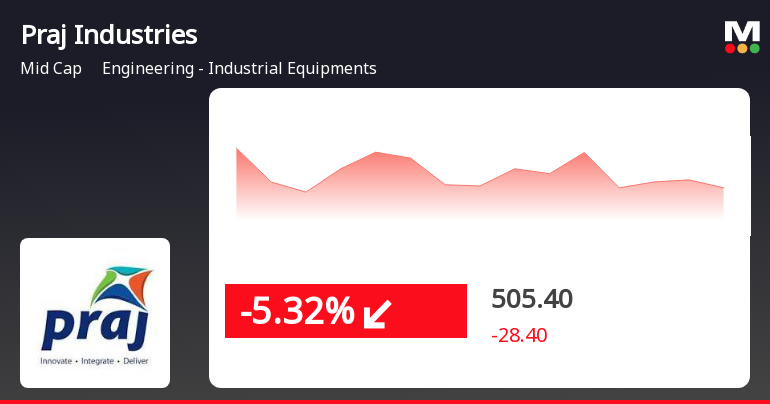

Praj Industries Sees Trend Reversal Amid Broader Market Challenges and Declines

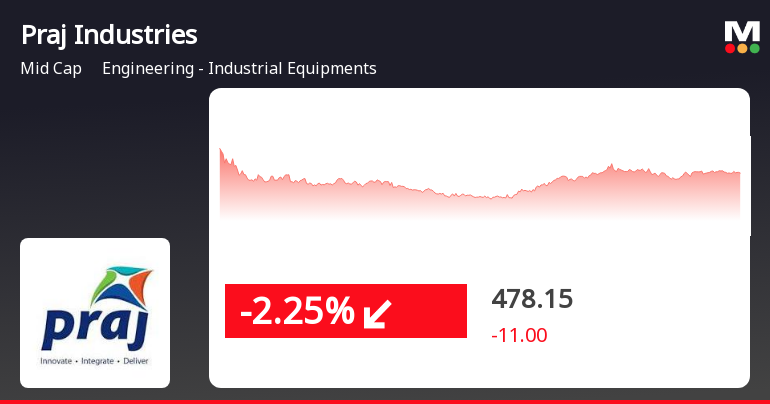

2025-03-04 11:00:18Praj Industries experienced a notable gain today, reversing a four-day decline. The stock reached an intraday high of Rs 508, despite trading below key moving averages. Over the past week and month, it has seen significant declines, contrasting with a slight gain in the broader sector. The Sensex also opened lower.

Read More

Praj Industries Faces Continued Decline Amid Broader Market Stability and Sector Weakness

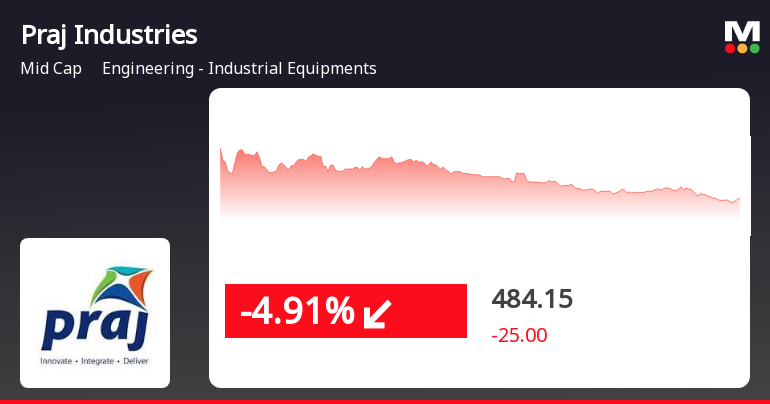

2025-03-03 11:50:18Praj Industries has faced a significant decline in its stock price, marking four consecutive days of losses and a cumulative drop of 14.5%. The stock is trading near its 52-week low and has underperformed both its sector and the broader market, reflecting a bearish trend over the past month.

Read More

Praj Industries Faces Significant Stock Decline Amid Broader Market Weakness

2025-02-28 12:45:15Praj Industries has faced a notable decline in its stock price, dropping 5.2% today and 11.11% over the past three days. The stock is trading below all major moving averages and has seen a significant 27.07% decrease over the past month, contrasting sharply with broader market trends.

Read More

Praj Industries Faces Increased Volatility Amid Significant Stock Decline and Sector Underperformance

2025-02-27 09:30:14Praj Industries has faced a notable decline in its stock price, underperforming against its sector. The company has experienced consecutive losses over two days, with significant intraday volatility. Currently, the stock trades below multiple moving averages, indicating a bearish trend, and has seen a substantial decline over the past month.

Read MorePraj Industries Faces Technical Trend Shifts Amid Mixed Performance Indicators

2025-02-25 10:25:38Praj Industries, a midcap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 537.65, slightly down from the previous close of 544.90. Over the past year, Praj Industries has shown a return of 4.71%, outperforming the Sensex, which recorded a 2.05% return in the same period. However, the year-to-date performance indicates a decline of 34.54%, while the Sensex has only dipped by 4.47%. In terms of technical indicators, the weekly MACD and KST are signaling bearish trends, while the monthly readings show a mildly bearish stance. The Relative Strength Index (RSI) reflects a bullish trend on a weekly basis but shows no signal for the monthly timeframe. Additionally, the Bollinger Bands and moving averages indicate bearish conditions, suggesting a cautious outlook. Praj Industries has d...

Read MorePraj Industries Navigates Mixed Market Trends Amid Strong Long-Term Performance

2025-02-25 09:56:35Praj Industries, a mid-cap player in the Engineering - Industrial Equipment sector, has shown notable activity in the stock market today. With a market capitalization of Rs 9,965.43 crore, the company has a price-to-earnings (P/E) ratio of 40.24, which is higher than the industry average of 36.12. Over the past year, Praj Industries has delivered a performance of 5.59%, significantly outperforming the Sensex, which recorded a gain of 2.21%. However, the stock has faced challenges recently, with a decline of 0.50% today, while the Sensex rose by 0.41%. In the short term, the stock has seen a weekly increase of 2.50%, contrasting with a 1.59% drop in the Sensex. Despite its recent struggles, Praj Industries has demonstrated strong long-term performance, with a remarkable 751.10% increase over the past decade, compared to the Sensex's 157.71%. Technical indicators suggest a bearish trend in the weekly and mo...

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

08-Apr-2025 | Source : BSEPress Release dated 8th April 2025

Intimation Under Regulation 30 Of SEBI LODR Regulations Read With Schedule III Part A Para B.

29-Mar-2025 | Source : BSEIntimation about incidence of fire at R & D Center of the Company at Urawade Pune.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Praj Industries Ltd has declared 300% dividend, ex-date: 18 Jul 24

No Splits history available

Praj Industries Ltd has announced 1:1 bonus issue, ex-date: 18 Jul 07

No Rights history available