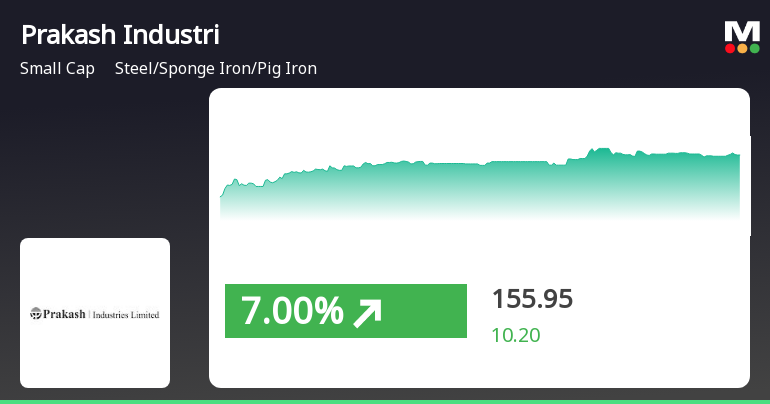

Prakash Industries Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-24 08:00:13Prakash Industries, a small-cap player in the steel, sponge iron, and pig iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 156.70, showing a notable increase from the previous close of 152.10. Over the past year, Prakash Industries has demonstrated resilience with a return of 6.96%, outperforming the Sensex, which recorded a return of 5.87% in the same period. The technical summary indicates a mixed outlook, with various indicators suggesting a mildly bearish trend in the short to medium term. The MACD and KST metrics are bearish on a weekly basis, while the moving averages also reflect a mildly bearish stance. However, the Dow Theory shows a mildly bullish signal on a weekly basis, indicating some underlying strength. In terms of performance, Prakash Industries has significantly outperformed the Sensex over longer period...

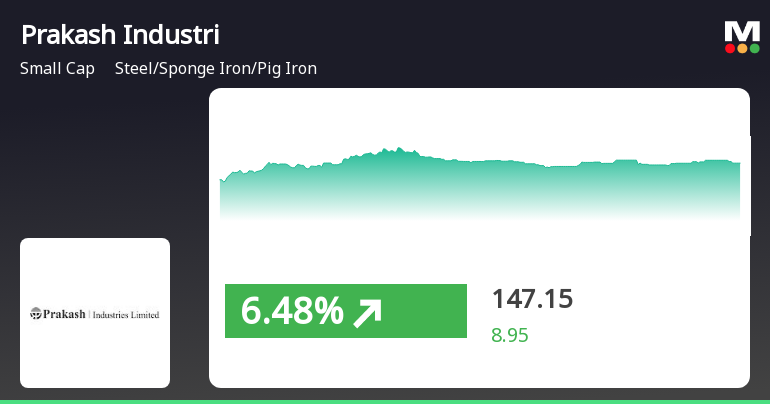

Read MorePrakash Industries Faces Technical Trend Shift Amid Bearish Market Indicators

2025-03-11 08:00:21Prakash Industries, a small-cap player in the Steel, Sponge Iron, and Pig Iron industry, has recently undergone a technical trend adjustment. The company's current stock price stands at 149.55, reflecting a decline from the previous close of 156.85. Over the past year, Prakash Industries has experienced a stock return of -8.56%, contrasting with a negligible change in the Sensex, which recorded a return of -0.01%. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and KST also reflect bearish conditions, with moving averages indicating a bearish stance on a daily basis. The Relative Strength Index (RSI) shows no significant signals, suggesting a lack of momentum in either direction. Despite the recent challenges, Prakash Industries has demonstrated r...

Read MorePrakash Industries Shows Technical Trend Shifts Amid Market Volatility and Resilience

2025-03-07 08:00:44Prakash Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 155.00, showing a notable increase from the previous close of 148.10. Over the past week, the stock has reached a high of 156.15 and a low of 148.90, indicating some volatility. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments, suggesting a lack of strong momentum in either direction. Bollinger Bands and Moving Averages also reflect a mildly bearish sentiment, indicating cautious market behavior. When comparing the company's performance to the Sensex, Prakash Industries has demonstrated resilience. Over the past week,...

Read MorePrakash Industries Faces Technical Trend Shifts Amid Mixed Market Signals

2025-02-27 08:02:06Prakash Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 154.65, down from a previous close of 157.90, with a 52-week high of 237.25 and a low of 128.15. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands also reflect a bearish stance on a monthly basis. Notably, the On-Balance Volume (OBV) shows a mildly bullish trend on a weekly basis, suggesting some positive trading activity despite the overall bearish indicators. In terms of performance, Prakash Industries has shown varied returns compared to the Sensex. Over the past week, the stock returned 6.11%, contrasting with a -1.80% return for the Sensex. However, over a one-year period, the stock ha...

Read MorePrakash Industries Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-02-25 10:26:22Prakash Industries, a small-cap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 155.75, showing a slight decline from the previous close of 157.90. Over the past year, Prakash Industries has faced challenges, with a return of -14.87%, contrasting with a positive return of 2.05% from the Sensex during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Bollinger Bands also indicate a mildly bearish stance, aligning with the moving averages, which reflect a similar sentiment on a daily basis. The KST presents a mildly bullish outlook weekly but shifts to mildly bearish monthly, suggesting mixed signals in the short term. Despite the recent evaluation adjustment, Prakash Industrie...

Read More

Prakash Industries Shows Short-Term Strength Amid Long-Term Volatility Concerns

2025-02-19 12:45:12Prakash Industries, a small-cap company in the steel sector, experienced significant trading activity on February 19, 2025, outperforming its sector. The stock showed short-term strength but remains below key longer-term moving averages. Despite today's gains, it has faced a decline over the past month, indicating market volatility.

Read More

Prakash Industries Shows Strong Rebound Amidst Market Volatility and Sector Challenges

2025-02-17 10:30:11Prakash Industries, a small-cap company in the steel sector, experienced a notable rebound on February 17, 2025, gaining 8.61% after two days of decline. The stock outperformed its sector and reached an intraday high, although it remains below several key moving averages, indicating mixed trend signals.

Read More

Prakash Industries Reports Flat Q3 FY24-25 Results Amid Mixed Financial Indicators

2025-02-08 17:30:51Prakash Industries has reported its financial results for Q3 FY24-25, showing flat performance and a decline in net sales to Rs 925.95 crore. The company maintains a low debt-equity ratio of 0.12, indicating reduced borrowing, while facing challenges with a decreased debtors turnover ratio at 23.27 times.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation for Trading Window Closure

Shareholder Meeting / Postal Ballot-Scrutinizers Report

22-Mar-2025 | Source : BSEScrutinizer Report on remote e-voting of Postal Ballot

Announcement under Regulation 30 (LODR)-Credit Rating

28-Feb-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015 regarding Credit Rating

Corporate Actions

No Upcoming Board Meetings

Prakash Industries Ltd has declared 12% dividend, ex-date: 17 Sep 24

No Splits history available

No Bonus history available

No Rights history available