Prakash Pipes Faces Technical Trend Shift Amid Market Volatility and Bearish Indicators

2025-03-26 08:04:48Prakash Pipes, a microcap company in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 417.65, down from a previous close of 442.75, with a notable 52-week high of 667.90 and a low of 342.50. Today's trading saw a high of 454.60 and a low of 412.70, indicating some volatility in its performance. The technical summary for Prakash Pipes reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, the Bollinger Bands and KST also reflect bearish conditions, with moving averages indicating a bearish stance on a daily basis. The On-Balance Volume (OBV) presents a mildly bullish signal on a weekly basis but shifts to a mildly bearish perspective monthly. In terms of performance, Prakash Pipes has shown varied retur...

Read MorePrakash Pipes Faces Mixed Technical Trends Amid Strong Long-Term Performance

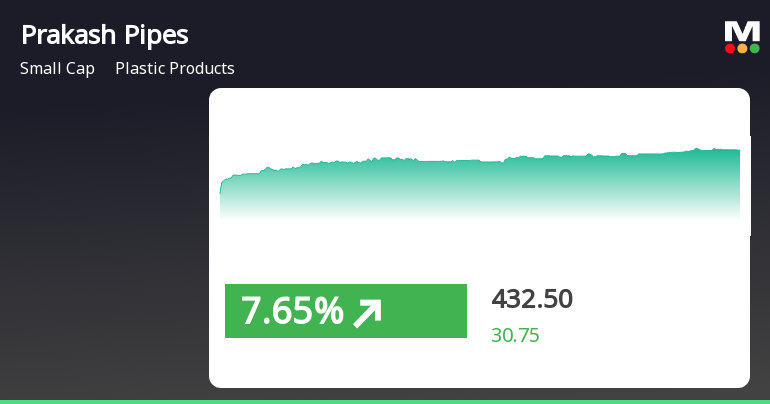

2025-03-24 08:02:54Prakash Pipes, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 433.00, showing a slight increase from the previous close of 425.50. Over the past year, Prakash Pipes has demonstrated a notable return of 18.39%, significantly outperforming the Sensex, which returned 5.87% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal on both weekly and monthly charts, indicating a neutral momentum. Bollinger Bands suggest a mildly bearish trend on a weekly basis, with a sideways movement observed monthly. Moving averages also reflect a mildly bearish sentiment, while the KST indicates a bearish trend weekly and mildly bearish monthly. The company's performance ove...

Read MorePrakash Pipes Faces Bearish Technical Trends Amid Market Volatility and Historical Growth

2025-03-11 08:05:15Prakash Pipes, a small-cap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 423.50, down from a previous close of 445.50, with a notable 52-week high of 667.90 and a low of 311.25. Today's trading saw a high of 447.35 and a low of 418.30, indicating some volatility. The technical summary for Prakash Pipes reveals a bearish sentiment across several indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, the Bollinger Bands and KST indicators also reflect bearish tendencies. The moving averages indicate a bearish stance on a daily basis, while the Dow Theory and On-Balance Volume show no significant trends. In terms of performance, Prakash Pipes has demonstrated varied returns compared to the Sensex. Over the past week, the stock returne...

Read MorePrakash Pipes Experiences Technical Trend Adjustments Amidst Market Resilience

2025-03-07 08:03:55Prakash Pipes, a small-cap player in the plastic products industry, has recently undergone a technical trend adjustment. This revision reflects the company's performance metrics and market positioning, which are critical for understanding its current standing in the sector. The stock is currently priced at 442.70, showing a notable increase from the previous close of 412.80. Over the past year, Prakash Pipes has experienced a return of 10.04%, outperforming the Sensex, which recorded a modest gain of 0.34%. In the longer term, the company has demonstrated impressive growth, with a staggering 736.86% return over the past five years, significantly surpassing the Sensex's 97.84% during the same period. In terms of technical indicators, the MACD and KST suggest a bearish outlook on a weekly basis, while the monthly indicators show a mildly bearish trend. The Bollinger Bands indicate a mixed sentiment, with a ...

Read More

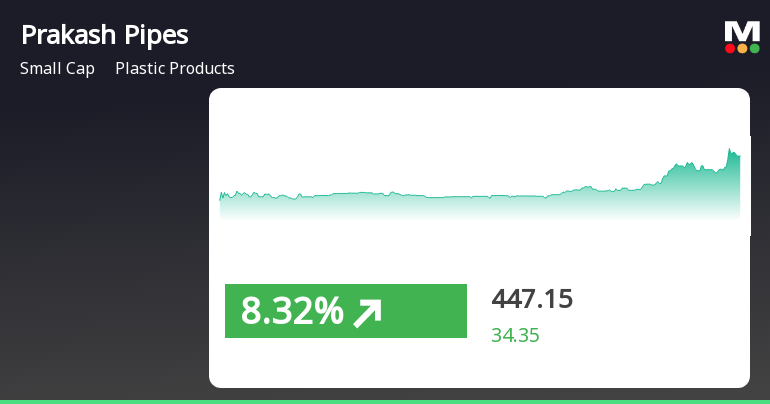

Prakash Pipes Shows Strong Short-Term Gains Amid Broader Market Positivity

2025-03-06 14:50:26Prakash Pipes has demonstrated notable performance, gaining 7.75% on March 6, 2025, and outperforming its sector. The stock has achieved consecutive gains over two days, totaling 13.2%. While it is above its short-term moving averages, it remains below longer-term averages. The broader market also opened positively, with small-cap stocks leading.

Read More

Prakash Pipes Exhibits Notable Volatility Amid Broader Market Stability

2025-02-19 14:10:25Prakash Pipes, a small-cap company in the plastic products sector, experienced notable trading activity on February 19, 2025, with a significant intraday high and a positive trend over three days. Despite recent volatility, the stock's performance contrasts with the broader market, showcasing its dynamic position.

Read More

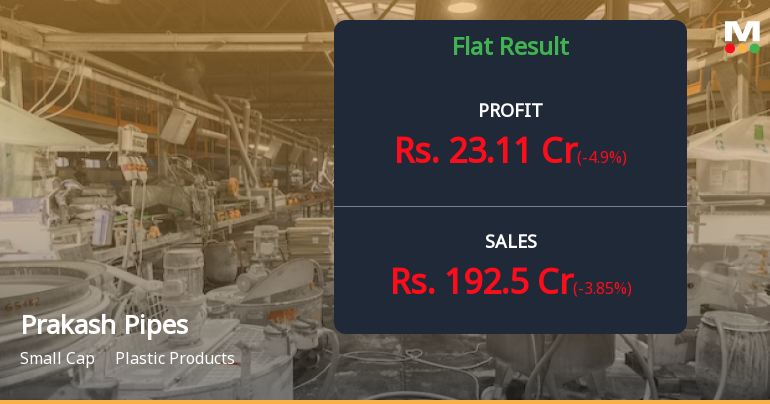

Prakash Pipes Reports Flat Q3 FY24-25 Results Amid Mixed Financial Indicators

2025-02-10 15:08:10Prakash Pipes has reported flat financial performance for Q3 FY24-25, with significant adjustments in its evaluation score. The company achieved its highest operating profit in five quarters, while profit after tax declined and earnings per share reached a five-quarter low, indicating challenges in profitability and debt management.

Read More

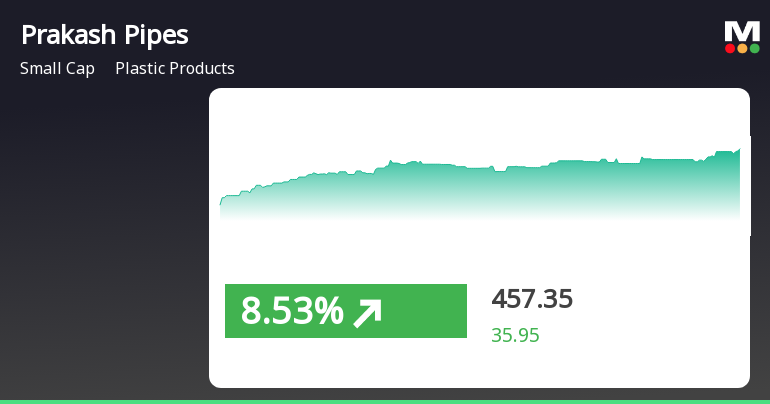

Prakash Pipes Shows Strong Performance Amid Sector-Wide Gains in Plastic Products

2025-01-29 13:20:23Prakash Pipes has experienced notable trading activity, gaining 8.01% on January 29, 2025. The small-cap company outperformed its sector, which rose by 2.72%. Despite a recent decline over the past month, the stock has shown consecutive gains and reached a high of Rs 455.15 during intraday trading.

Read MoreClosure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Trading Window Closure

Announcement under Regulation 30 (LODR)-Newspaper Publication

11-Feb-2025 | Source : BSENewspaper Publication

Unaudited Financial Results For The Quarter And Nine Months Ended 31.12.2024 With Limited Review Carried Out By Auditors Of The Company

10-Feb-2025 | Source : BSEUnaudited Financial Results for the Quarter and Nine Months ended 31.12.2024 with Limited Review Carried out by Auditors of the Company

Corporate Actions

No Upcoming Board Meetings

Prakash Pipes Ltd. has declared 18% dividend, ex-date: 17 Sep 24

No Splits history available

No Bonus history available

No Rights history available