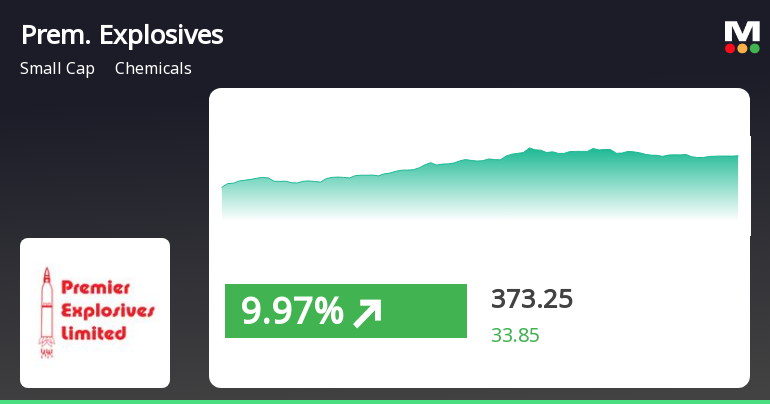

Premier Explosives Shows Resilience Amid Broader Market Decline and Volatility

2025-04-01 10:15:28Premier Explosives, a small-cap chemicals company, experienced notable stock activity on April 1, 2025, amid a broader market decline. The stock opened lower but recovered to reach an intraday high, showcasing significant volatility. Over the past month and years, it has demonstrated impressive performance compared to the market.

Read More

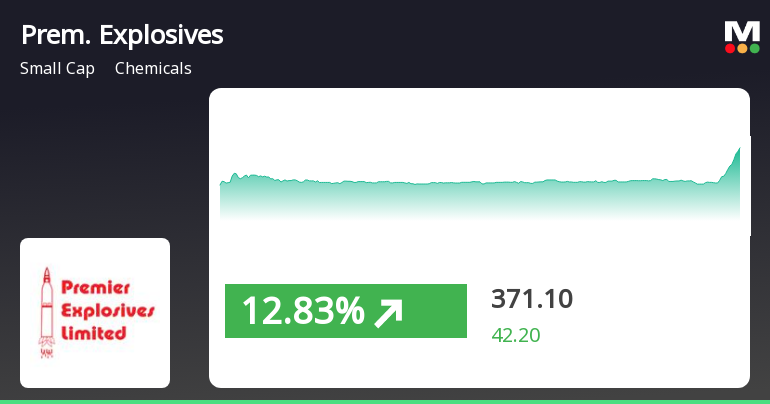

Premier Explosives Shows Strong Short-Term Gains Amid Mixed Long-Term Indicators

2025-03-19 13:30:16Premier Explosives has experienced notable trading activity, with a recent gain and a positive trend over the past two days. While currently above its 5-day moving average, it remains below longer-term averages. Over the past year, the stock has significantly outperformed the broader market, despite a year-to-date decline.

Read MorePremier Explosives Adjusts Valuation Grade Amidst Mixed Financial Performance Trends

2025-03-19 08:00:06Premier Explosives, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting its current financial metrics. The company's price-to-earnings ratio stands at 55.76, while its price-to-book value is noted at 7.51. Other key metrics include an EV to EBIT of 36.13 and an EV to EBITDA of 29.49, indicating a robust valuation relative to its earnings potential. In terms of returns, Premier Explosives has experienced a notable decline year-to-date, with a stock return of -37.30%, contrasting with a modest -3.63% return from the Sensex. However, over a longer horizon, the company has shown impressive growth, with a three-year return of 425.23% and a staggering 2,196.79% over five years. When compared to its peers, Premier Explosives maintains a competitive position, although it is classified as very expensive relative to others in the sector. For instance, Neogen Chemi...

Read MorePremier Explosives Adjusts Valuation Amid Competitive Chemicals Sector Dynamics

2025-03-13 08:00:03Premier Explosives, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 320.00, reflecting a notable decline from its previous close of 331.75. Over the past year, Premier Explosives has shown a return of 13.97%, contrasting with a modest 0.49% return from the Sensex. Key financial metrics for Premier Explosives include a PE ratio of 54.25 and an EV to EBITDA ratio of 28.72. The company also reports a return on capital employed (ROCE) of 12.82% and a return on equity (ROE) of 10.28%. In comparison to its peers, Premier Explosives maintains a higher PE ratio than several competitors, such as Grauer & Weil and Balaji Amines, which have lower valuations. However, it lags behind Neogen Chemicals, which is positioned at a significantly higher valuation. The evaluation revision reflects the company's current market dynamics and its r...

Read MorePremier Explosives Adjusts Valuation Amid Competitive Chemicals Sector Dynamics

2025-03-13 08:00:03Premier Explosives, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 320.00, reflecting a notable decline from its previous close of 331.75. Over the past year, Premier Explosives has shown a return of 13.97%, contrasting with a modest 0.49% return from the Sensex. Key financial metrics for Premier Explosives include a PE ratio of 54.25 and an EV to EBITDA ratio of 28.72. The company also reports a return on capital employed (ROCE) of 12.82% and a return on equity (ROE) of 10.28%. In comparison to its peers, Premier Explosives maintains a higher PE ratio than several competitors, such as Grauer & Weil and Balaji Amines, which have lower valuations. However, it lags behind Neogen Chemicals, which is positioned at a significantly higher valuation. The evaluation revision reflects the company's current market dynamics and its r...

Read MorePremier Explosives Adjusts Valuation Amid Competitive Chemicals Sector Dynamics

2025-03-13 08:00:03Premier Explosives, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 320.00, reflecting a notable decline from its previous close of 331.75. Over the past year, Premier Explosives has shown a return of 13.97%, contrasting with a modest 0.49% return from the Sensex. Key financial metrics for Premier Explosives include a PE ratio of 54.25 and an EV to EBITDA ratio of 28.72. The company also reports a return on capital employed (ROCE) of 12.82% and a return on equity (ROE) of 10.28%. In comparison to its peers, Premier Explosives maintains a higher PE ratio than several competitors, such as Grauer & Weil and Balaji Amines, which have lower valuations. However, it lags behind Neogen Chemicals, which is positioned at a significantly higher valuation. The evaluation revision reflects the company's current market dynamics and its r...

Read MorePremier Explosives Adjusts Valuation Amid Competitive Chemicals Sector Dynamics

2025-03-13 08:00:03Premier Explosives, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 320.00, reflecting a notable decline from its previous close of 331.75. Over the past year, Premier Explosives has shown a return of 13.97%, contrasting with a modest 0.49% return from the Sensex. Key financial metrics for Premier Explosives include a PE ratio of 54.25 and an EV to EBITDA ratio of 28.72. The company also reports a return on capital employed (ROCE) of 12.82% and a return on equity (ROE) of 10.28%. In comparison to its peers, Premier Explosives maintains a higher PE ratio than several competitors, such as Grauer & Weil and Balaji Amines, which have lower valuations. However, it lags behind Neogen Chemicals, which is positioned at a significantly higher valuation. The evaluation revision reflects the company's current market dynamics and its r...

Read MorePremier Explosives Adjusts Valuation Amid Competitive Chemicals Sector Dynamics

2025-03-13 08:00:03Premier Explosives, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 320.00, reflecting a notable decline from its previous close of 331.75. Over the past year, Premier Explosives has shown a return of 13.97%, contrasting with a modest 0.49% return from the Sensex. Key financial metrics for Premier Explosives include a PE ratio of 54.25 and an EV to EBITDA ratio of 28.72. The company also reports a return on capital employed (ROCE) of 12.82% and a return on equity (ROE) of 10.28%. In comparison to its peers, Premier Explosives maintains a higher PE ratio than several competitors, such as Grauer & Weil and Balaji Amines, which have lower valuations. However, it lags behind Neogen Chemicals, which is positioned at a significantly higher valuation. The evaluation revision reflects the company's current market dynamics and its r...

Read MorePremier Explosives Adjusts Valuation Amid Competitive Chemicals Sector Dynamics

2025-03-13 08:00:03Premier Explosives, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 320.00, reflecting a notable decline from its previous close of 331.75. Over the past year, Premier Explosives has shown a return of 13.97%, contrasting with a modest 0.49% return from the Sensex. Key financial metrics for Premier Explosives include a PE ratio of 54.25 and an EV to EBITDA ratio of 28.72. The company also reports a return on capital employed (ROCE) of 12.82% and a return on equity (ROE) of 10.28%. In comparison to its peers, Premier Explosives maintains a higher PE ratio than several competitors, such as Grauer & Weil and Balaji Amines, which have lower valuations. However, it lags behind Neogen Chemicals, which is positioned at a significantly higher valuation. The evaluation revision reflects the company's current market dynamics and its r...

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Closure of Trading Window.

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

18-Mar-2025 | Source : BSEIntimation of receipt of export order for Rs. 18.90 crores.

Disclosure Under Regulation 30 Of SEBI (LODR) Regulations 2015.

18-Mar-2025 | Source : BSEAs per attached letter

Corporate Actions

No Upcoming Board Meetings

Premier Explosives Ltd has declared 25% dividend, ex-date: 20 Sep 24

Premier Explosives Ltd has announced 2:10 stock split, ex-date: 21 Jun 24

No Bonus history available

No Rights history available