Premier Polyfilm Adjusts Valuation Amid Strong Performance and Competitive Industry Dynamics

2025-04-02 08:02:24Premier Polyfilm, a microcap player in the plastic products industry, has recently undergone a valuation adjustment. The company's current price stands at 64.30, reflecting a notable increase from the previous close of 61.67. Over the past year, Premier Polyfilm has demonstrated a strong performance with a return of 57.14%, significantly outpacing the Sensex, which recorded a modest 2.72% increase during the same period. Key financial metrics for Premier Polyfilm include a PE ratio of 24.84 and an EV to EBITDA ratio of 15.91, indicating its market positioning relative to its peers. The company also boasts a robust return on capital employed (ROCE) of 32.68% and a return on equity (ROE) of 25.44%. In comparison to its industry peers, Premier Polyfilm's valuation metrics reveal a diverse landscape. For instance, Prakash Pipes is noted for its attractive valuation, while TPL Plastech and Arrow Greentech are...

Read MorePremier Polyfilm Adjusts Valuation Grade Amid Strong Financial Performance and Market Position

2025-03-27 08:00:49Premier Polyfilm, a microcap player in the plastic products industry, has recently undergone a valuation adjustment, reflecting its financial performance and market position. The company currently exhibits a price-to-earnings (P/E) ratio of 24.28 and a price-to-book value of 6.18, indicating a robust valuation relative to its assets. Its enterprise value to EBITDA stands at 15.54, while the EV to sales ratio is 2.48, showcasing its operational efficiency. In terms of profitability, Premier Polyfilm reports a return on capital employed (ROCE) of 32.68% and a return on equity (ROE) of 25.44%, highlighting strong financial health. The PEG ratio of 0.51 suggests that the company is well-positioned in terms of growth relative to its valuation. When compared to its peers, Premier Polyfilm's valuation metrics reveal a competitive stance. For instance, while it maintains a higher P/E ratio than some competitors l...

Read MorePremier Polyfilm Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-07 08:03:22Premier Polyfilm, a microcap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 67.00, down from a previous close of 69.96, with a notable 52-week high of 85.57 and a low of 32.56. Today's trading saw a high of 71.39 and a low matching the current price. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bearish trend on a weekly basis while remaining bullish on a monthly scale. The Relative Strength Index (RSI) presents no signals for both weekly and monthly assessments. Bollinger Bands are bullish on both timeframes, suggesting some positive momentum. Daily moving averages lean mildly bullish, while the KST reflects a similar pattern with a weekly mildly bearish stance contrasted by a bullish monthly outlook. The On-Balance Volume (OBV) is mildly...

Read MorePremier Polyfilm's Technical Trends Reveal Mixed Signals Amid Strong Long-Term Performance

2025-03-06 08:02:30Premier Polyfilm, a microcap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 69.96, showing a notable increase from the previous close of 66.58. Over the past year, Premier Polyfilm has demonstrated impressive performance, with a return of 74.46%, significantly outpacing the Sensex, which recorded a mere 0.07% during the same period. The technical summary indicates a mixed outlook, with the MACD showing a mildly bearish trend on a weekly basis while being bullish on a monthly scale. Bollinger Bands and daily moving averages suggest a bullish sentiment, although the KST and OBV metrics present a more cautious view on a weekly basis. In terms of stock performance, Premier Polyfilm has shown resilience, particularly over longer time frames, with a staggering 1375.95% return over five years and an ...

Read MorePremier Polyfilm Adjusts Valuation Grade Amid Strong Performance and Mixed Peer Comparison

2025-02-24 12:57:44Premier Polyfilm, a microcap player in the plastic products industry, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 23.14 and a price-to-book value of 5.89, indicating its market positioning relative to its assets. The enterprise value to EBITDA stands at 14.81, while the EV to sales ratio is recorded at 2.36. Notably, Premier Polyfilm boasts a robust return on capital employed (ROCE) of 32.68% and a return on equity (ROE) of 25.44%, reflecting its operational efficiency and profitability. In comparison to its peers, Premier Polyfilm's valuation metrics present a mixed picture. For instance, Arrow Greentech is positioned at a higher valuation, while TPL Plastech shows a significantly elevated PE ratio. Conversely, Wim Plast stands out with a more attractive valuation profile. The company's performance over various time frames has been notewo...

Read MorePremier Polyfilm Ltd Experiences Notable Gains Amid Broader Market Decline

2025-02-21 09:57:32Premier Polyfilm Ltd is witnessing significant buying activity, with the stock gaining 4.81% today, contrasting sharply with the Sensex, which has declined by 0.38%. This marks the second consecutive day of gains for Premier Polyfilm, accumulating a total return of 9.59% over this period. The stock opened with a gap up of 2.4% and reached an intraday high of Rs 59.88. In terms of performance metrics, Premier Polyfilm has shown remarkable resilience over the long term, with a staggering 311.83% increase over the past three years and an impressive 1168.64% rise over the last five years. However, its year-to-date performance reflects a decline of 19.28%, while the Sensex has decreased by 3.45% in the same timeframe. The strong buying pressure could be attributed to various factors, including recent market trends, sector performance, or company-specific developments. Notably, the stock is currently trading ab...

Read More

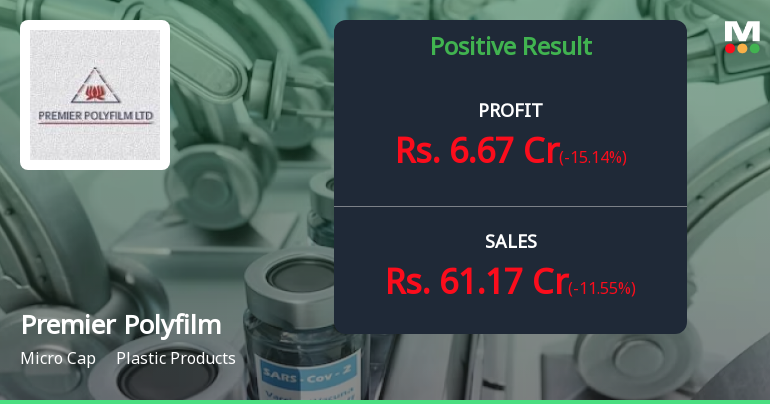

Premier Polyfilm Reports Strong PAT Growth Amid Declining Sales and Liquidity Concerns

2025-01-27 18:46:14Premier Polyfilm has announced its financial results for the quarter ending December 2024, showing a significant increase in Profit After Tax at Rs 14.53 crore. However, net sales declined to Rs 61.87 crore, and cash reserves fell to their lowest level in recent periods, indicating liquidity challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECompliance certificate under Reregulation 74(5) of SEBI (DP) Regulation 2018 for the quarter ended 31st March2025 is attached.

Closure of Trading Window

19-Mar-2025 | Source : BSELetter of Intimation of Closure of trading window for the quarter and year ended on 31st March 2025 is attached.

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

12-Mar-2025 | Source : BSEKindly find attached herewith Outcome of postal ballot along with Scrutinizer Report and Voting Results.

Corporate Actions

No Upcoming Board Meetings

Premier Polyfilm Ltd has declared 15% dividend, ex-date: 09 Sep 24

Premier Polyfilm Ltd has announced 1:5 stock split, ex-date: 05 Nov 24

No Bonus history available

No Rights history available