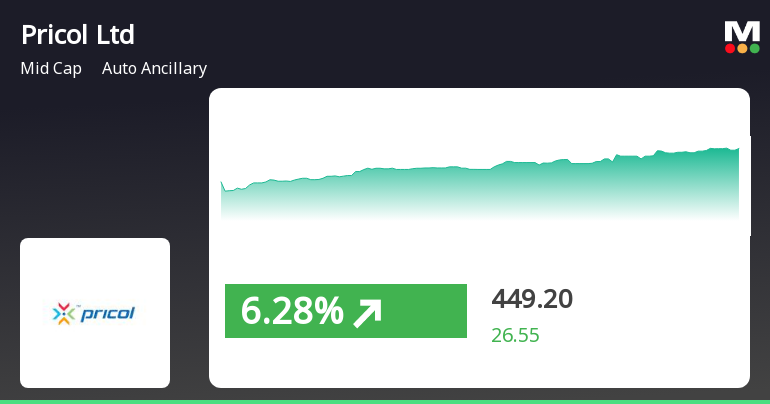

Pricol's Recent Gains Highlight Resilience Amid Mixed Market Performance

2025-03-21 11:20:27Pricol, a midcap auto ancillary company, has experienced significant activity, gaining 5.86% on March 21, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, reaching an intraday high of Rs 448.15. Over the past year, Pricol has delivered a return of 24.95%.

Read More

Pricol Ltd Shows Strong Financial Performance and Stability Amid Market Evaluation Adjustments

2025-03-19 08:12:01Pricol Ltd, a midcap auto ancillary firm, has recently adjusted its evaluation, showcasing strong financial health. In Q3 FY24-25, the company reported a 76.93% increase in operating profit and a 21.8% rise in profit after tax, reflecting consistent growth and solid investor backing.

Read MorePricol Ltd Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:04:35Pricol Ltd, a midcap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 426.85, showing a slight increase from the previous close of 417.40. Over the past year, Pricol has demonstrated a notable return of 19.9%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the weekly MACD and KST are bearish, while the monthly readings show a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal on a weekly basis but is bullish on a monthly scale. Bollinger Bands reflect a mildly bearish trend weekly, with a sideways movement monthly. Daily moving averages are bearish, suggesting a cautious outlook in the short term. When comparing the stock's performance to the Sensex, Pricol has shown resilience over longer perio...

Read More

Pricol Ltd Shows Strong Financial Performance Amidst Positive Growth Indicators

2025-03-13 08:08:38Pricol Ltd, a midcap auto ancillary firm, has adjusted its evaluation amid a positive financial outlook. The company showcases strong debt servicing capabilities, impressive long-term growth, and consistent profitability. With solid institutional backing and a notable return on investment, Pricol has outperformed the BSE 500 over the past three years.

Read More

Pricol Ltd Shows Strong Financial Performance Amidst Positive Growth Indicators

2025-03-13 08:08:38Pricol Ltd, a midcap auto ancillary firm, has adjusted its evaluation amid a positive financial outlook. The company showcases strong debt servicing capabilities, impressive long-term growth, and consistent profitability. With solid institutional backing and a notable return on investment, Pricol has outperformed the BSE 500 over the past three years.

Read MorePricol Ltd Faces Mixed Technical Signals Amidst Long-Term Performance Strength

2025-03-13 08:02:26Pricol Ltd, a midcap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 417.50, down from a previous close of 423.65. Over the past year, Pricol has shown a return of 20.04%, significantly outperforming the Sensex, which recorded a modest 0.49% return in the same period. However, the stock has faced challenges in the short term, with a notable decline of 23.52% year-to-date, while the Sensex has only dipped by 5.26%. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish outlook, while the monthly RSI indicates a bullish signal. The moving averages and KST also reflect a bearish trend on a daily basis. Despite these technical signals, Pricol's long-term performance remains robust, particularly over three and five years, where it has achieved returns of 256.53% and 1144...

Read MorePricol Ltd Faces Mixed Technical Signals Amidst Long-Term Performance Strength

2025-03-13 08:02:26Pricol Ltd, a midcap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 417.50, down from a previous close of 423.65. Over the past year, Pricol has shown a return of 20.04%, significantly outperforming the Sensex, which recorded a modest 0.49% return in the same period. However, the stock has faced challenges in the short term, with a notable decline of 23.52% year-to-date, while the Sensex has only dipped by 5.26%. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish outlook, while the monthly RSI indicates a bullish signal. The moving averages and KST also reflect a bearish trend on a daily basis. Despite these technical signals, Pricol's long-term performance remains robust, particularly over three and five years, where it has achieved returns of 256.53% and 1144...

Read MorePricol Ltd Shows Mixed Performance Amidst Broader Market Trends and Sentiment Shifts

2025-03-12 18:00:36Pricol Ltd, a mid-cap player in the auto ancillary industry, has shown notable activity in the stock market today. With a market capitalization of Rs 5,209.00 crore, the company currently has a price-to-earnings (P/E) ratio of 29.32, slightly below the industry average of 29.68. Over the past year, Pricol has outperformed the Sensex, delivering a return of 20.04% compared to the Sensex's modest 0.49%. However, recent performance indicates a decline, with the stock down 1.45% today, while the Sensex fell by 0.10%. In the past week, Pricol's stock has decreased by 0.61%, contrasting with a 0.41% gain in the Sensex. Looking at longer-term trends, Pricol's performance over three years stands at an impressive 256.53%, significantly outpacing the Sensex's 33.27%. However, year-to-date, the stock has faced challenges, down 23.52% against the Sensex's decline of 5.26%. Technical indicators suggest a bearish senti...

Read MorePricol Ltd Faces Mixed Technical Trends Amidst Market Evaluation Adjustments

2025-03-11 08:04:47Pricol Ltd, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 427.00, slightly down from its previous close of 427.25. Over the past year, Pricol has demonstrated a notable return of 19.39%, significantly outperforming the Sensex, which remained flat during the same period. In terms of technical indicators, the weekly MACD and KST are showing bearish trends, while the monthly RSI indicates a bullish sentiment. The Bollinger Bands suggest a sideways movement on a monthly basis, contrasting with the bearish outlook on a weekly basis. Daily moving averages are mildly bullish, indicating some short-term positive momentum. Looking at the company's performance relative to the Sensex, Pricol has shown impressive returns over longer periods, particularly a staggering 279.89% return over three years a...

Read MoreDeclaration Under Regulation 31(4) And (5) Of SEBI (Substantial Acquisition Of Shares And Takeover) Regulations 2011

07-Apr-2025 | Source : BSEDeclaration under Regulation 31(4) and (5) of SEBI (Substantial Acquisition of Shares and Takeover) Regulations 2011

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025

Closure of Trading Window

26-Mar-2025 | Source : BSEThe trading window shall remain closed from Tuesday 1st April 2025 till 48 hours after the declaration of audited financial results for the quarter and year ended 31st March 2025

Corporate Actions

No Upcoming Board Meetings

Pricol Ltd has declared 100% dividend, ex-date: 14 Aug 18

No Splits history available

No Bonus history available

Pricol Ltd has announced 2:7 rights issue, ex-date: 24 Nov 20