Prince Pipes & Fittings Adjusts Valuation, Signaling Shift in Industry Standing

2025-04-02 08:03:00Prince Pipes & Fittings has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the plastic products industry. The company currently exhibits a price-to-earnings (P/E) ratio of 39.55 and a price-to-book value of 1.85. Its enterprise value to EBITDA stands at 14.89, while the enterprise value to sales ratio is 1.17. The return on capital employed (ROCE) is reported at 10.56%, and the return on equity (ROE) is at 4.68%. In comparison to its peers, Prince Pipes maintains a competitive position, with its valuation metrics indicating a more favorable standing relative to some companies in the sector. For instance, Styrenix Perforation and Kingfa Science are positioned differently in terms of valuation, with varying P/E ratios and enterprise value metrics. Notably, while some peers are categorized as very expensive, Prince Pipes' valuation reflects a more attractive pr...

Read More

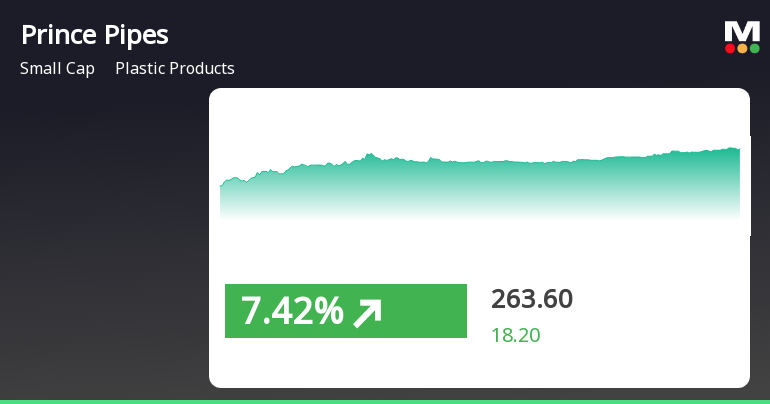

Prince Pipes & Fittings Surges Amid Broader Market Decline, Highlighting Divergent Trends

2025-04-01 14:35:24Prince Pipes & Fittings saw a significant rise on April 1, 2025, outperforming the broader market despite a sharp decline in the Sensex. The stock's recent performance contrasts with its longer-term challenges, including a notable decline over the past year and three years, while showing gains over five years.

Read MorePrince Pipes & Fittings Experiences Valuation Adjustment Amidst Industry Dynamics

2025-03-26 08:00:49Prince Pipes & Fittings has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing within the plastic products industry. The company's current price stands at 252.05, with a previous close of 260.05. Over the past year, Prince Pipes has experienced a significant decline in stock performance, with a return of -55.19%, contrasting sharply with the Sensex's gain of 7.12% during the same period. Key financial metrics reveal a PE ratio of 37.86 and an EV to EBITDA ratio of 14.26, indicating a competitive position in the market. The company's return on capital employed (ROCE) is reported at 10.56%, while the return on equity (ROE) is at 4.68%. Despite these figures, the stock's performance has lagged behind its peers, with companies like Styrenix Perforation and Polyplex Corporation showing stronger valuation metrics. In comparison to its industry counterparts, Prince Pi...

Read MorePrince Pipes & Fittings Adjusts Valuation Grade, Signaling Competitive Market Position

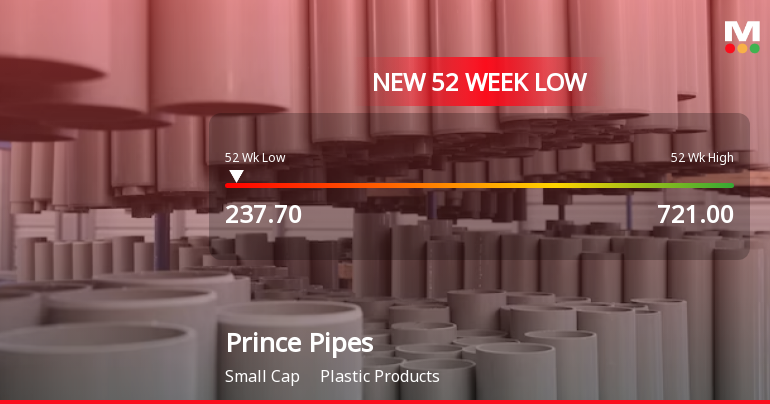

2025-03-20 08:01:05Prince Pipes & Fittings has recently undergone a valuation adjustment, reflecting a shift in its financial assessment within the plastic products industry. The company's current price stands at 250.50, slightly above its previous close of 250.00, with a 52-week high of 721.00 and a low of 237.70. Key financial metrics indicate a PE ratio of 37.62 and an EV to EBITDA of 14.18, which positions the company competitively among its peers. Notably, the PEG ratio is at 0.00, suggesting a unique valuation perspective. The dividend yield is recorded at 0.40%, while the return on capital employed (ROCE) is 10.56%, and return on equity (ROE) is 4.68%. In comparison to its peers, Prince Pipes demonstrates a more favorable valuation profile, particularly when contrasted with companies like Styrenix Perforations and Polyplex Corporation, which are categorized as very expensive. Other competitors, such as Kingfa Scienc...

Read More

Prince Pipes Hits 52-Week Low Amid Ongoing Financial Struggles and Market Context

2025-03-18 09:59:10Prince Pipes & Fittings reached a new 52-week low today, reflecting a significant decline over the past year. Despite a slight rebound after six days of losses, the stock remains below key moving averages. The company reported a drop in net sales and a negative profit after tax, raising concerns about its growth potential.

Read More

Prince Pipes & Fittings Faces Market Challenges Amid Significant Price Decline

2025-03-18 09:59:09Prince Pipes & Fittings has reached a new 52-week low amid a six-day price decline, though it showed a slight recovery today. Over the past year, the company has faced significant challenges, including a substantial drop in operating profit and disappointing quarterly results, while maintaining a low debt-to-equity ratio.

Read More

Prince Pipes & Fittings Hits 52-Week Low Amid Ongoing Financial Struggles

2025-03-18 09:59:08Prince Pipes & Fittings has reached a new 52-week low, reflecting a significant decline in its stock price over the past year. The company has reported consecutive quarterly losses, with net sales down and operating profit decreasing. Despite some intraday gains, the overall market trend remains negative.

Read More

Prince Pipes & Fittings Faces Ongoing Challenges Amid Significant Stock Decline

2025-03-18 09:59:07Prince Pipes & Fittings has reached a new 52-week low, reflecting a significant decline of 52.93% over the past year. The company has faced challenges, including a 7.13% drop in net sales and negative financial results for three consecutive quarters, indicating ongoing difficulties in its market position.

Read More

Prince Pipes Hits 52-Week Low Amidst Significant Yearly Decline and Weak Financials

2025-03-18 09:59:07Prince Pipes & Fittings has reached a new 52-week low, reflecting a significant decline of 52.93% over the past year. The company reported a 7.13% drop in net sales and a substantial loss in profit after tax. Its stock continues to trade below key moving averages, indicating ongoing challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulation 2018

Appointment Of Investor Relations Agency W.E.F. April 01 2025.

31-Mar-2025 | Source : BSEAppointment of MUFG Intime India Pvt. Ltd. as an Investor Relations Agency w.e.f. April 01 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of closure of trading window

Corporate Actions

No Upcoming Board Meetings

Prince Pipes & Fittings Ltd has declared 10% dividend, ex-date: 04 Sep 24

No Splits history available

No Bonus history available

No Rights history available