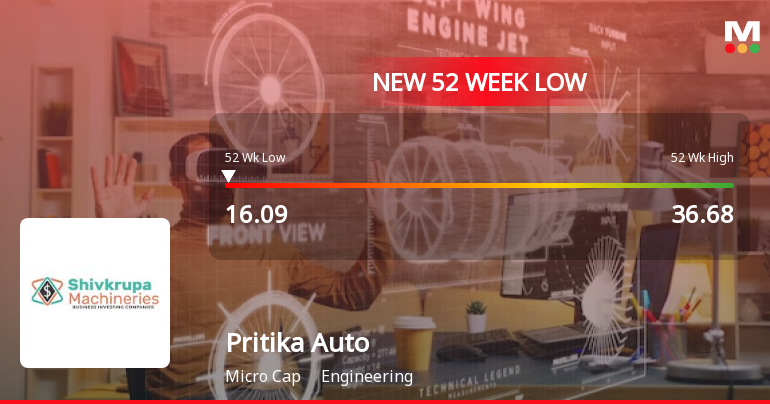

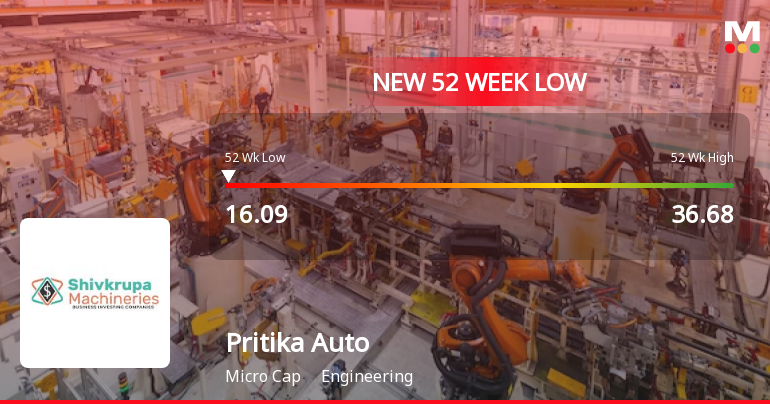

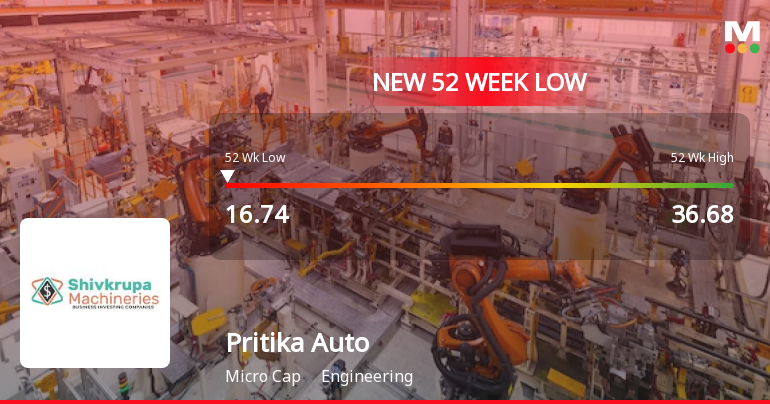

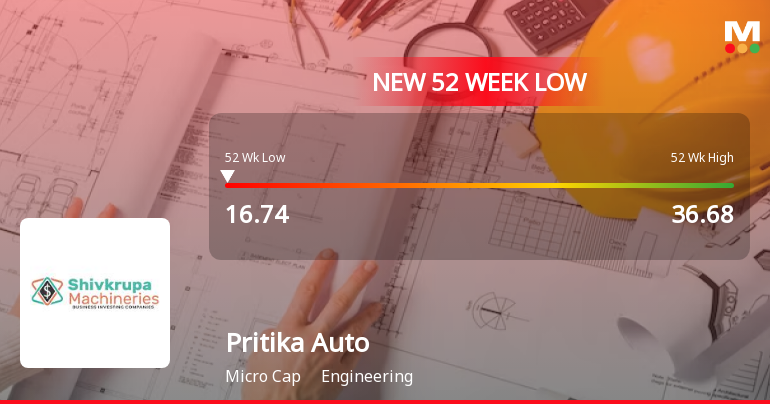

Pritika Auto Industries Faces Increased Volatility Amid Weak Fundamentals and Stake Reduction

2025-03-27 10:03:29Pritika Auto Industries has faced significant volatility, reaching a new 52-week low and continuing a downward trend. The company's fundamentals show weakness, with a modest ROCE and high Debt to EBITDA ratio. Promoter confidence has decreased, and the stock has underperformed compared to broader market indices over the past year.

Read More

Pritika Auto Industries Faces Continued Volatility Amid Weak Financial Fundamentals

2025-03-27 10:03:23Pritika Auto Industries has faced significant volatility, reaching a new 52-week low and experiencing a decline over three consecutive days. The company shows weak fundamentals, with a low Return on Capital Employed and challenges related to high debt. Recent results indicate a drop in profit and reduced promoter confidence.

Read More

Pritika Auto Industries Faces Declining Performance Amid Weak Fundamentals and Investor Sentiment

2025-03-27 10:03:20Pritika Auto Industries has faced significant volatility, reaching a new 52-week low and experiencing a notable decline over the past three days. The stock is trading below key moving averages and has seen a substantial drop over the past year, reflecting weak fundamentals and decreasing promoter confidence.

Read More

Pritika Auto Industries Faces Challenges Amid Broader Market Recovery and Weak Fundamentals

2025-03-27 10:03:17Pritika Auto Industries has hit a new 52-week low, continuing a downward trend with a significant decline over the past three days. The company's long-term fundamentals show weakness, including a low Return on Capital Employed and a high Debt to EBITDA ratio, alongside reduced promoter stake.

Read More

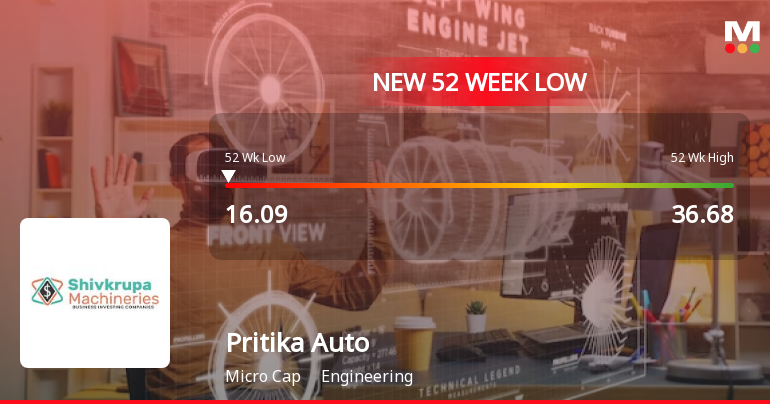

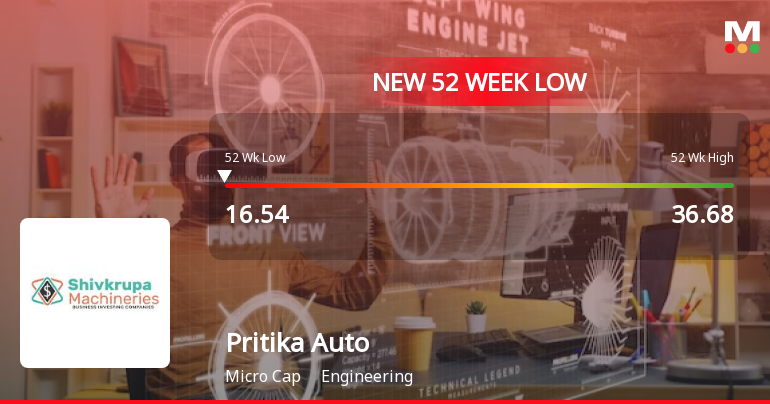

Pritika Auto Industries Faces Financial Struggles Amidst Significant Stock Volatility

2025-03-27 10:03:12Pritika Auto Industries, a microcap in the engineering sector, has hit a new 52-week low amid significant volatility. The company has faced a 49.24% decline over the past year, with concerns over its financial health and reduced promoter stake, indicating challenges in the current market environment.

Read More

Pritika Auto Industries Faces Challenges Amid Broader Market Decline and Weak Fundamentals

2025-03-26 15:09:40Pritika Auto Industries has hit a new 52-week low, experiencing significant volatility and a decline over the past two days. The company's performance contrasts sharply with broader market trends, showing weak long-term growth and reduced promoter confidence, indicating ongoing challenges for the microcap engineering firm.

Read More

Pritika Auto Industries Faces Financial Struggles Amid Declining Stock Performance

2025-03-17 09:53:17Pritika Auto Industries has reached a new 52-week low, continuing a downward trend with a 45.08% decline over the past year. The company faces scrutiny over its financial health, marked by a low Return on Capital Employed and high Debt to EBITDA ratio, alongside decreasing promoter confidence.

Read More

Pritika Auto Industries Faces Financial Struggles Amid Declining Stock Performance and Weak Fundamentals

2025-03-17 09:53:13Pritika Auto Industries has reached a new 52-week low, continuing a challenging trend with a significant stock value decline over the past year. The company faces scrutiny over its financial health, highlighted by low ROCE and a high Debt to EBITDA ratio, alongside a recent drop in profit and reduced promoter stake.

Read More

Pritika Auto Industries Faces Challenges Amid Declining Stock Performance and Investor Confidence

2025-03-17 09:53:10Pritika Auto Industries has hit a new 52-week low, reflecting a significant decline of 45.08% over the past year. The company faces challenges with low Return on Capital Employed and high debt levels, while promoter confidence decreases as their stake diminishes. Recent quarterly results show a notable drop in profit.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find enclosed herewith the certificate received from Satellite Corporate Services Private Limited the RTA (Registrar and share Transfer Agent) of the Company confirming the compliance of Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the year and quarter ended 31st March 2025

Disclosure Under Regulation 31(4) Of SEBI (Substantial Acquisition Of Shares And Takeovers) Regulations 2011 For The Financial Year Ended March 31 2025.

01-Apr-2025 | Source : BSEDisclosure Under Regulation 31(4) Of SEBI (Substantial Acquisition Of Shares And Takeovers) Regulations 2011 For The Financial Year Ended March 31 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Trading Window Closure for Quarter ending 31st March 2025

Corporate Actions

No Upcoming Board Meetings

Pritika Auto Industries Ltd has declared 5% dividend, ex-date: 20 Sep 19

Pritika Auto Industries Ltd has announced 2:10 stock split, ex-date: 09 Apr 21

No Bonus history available

No Rights history available