Privi Speciality Chemicals Shows Mixed Technical Trends Amid Strong Yearly Performance

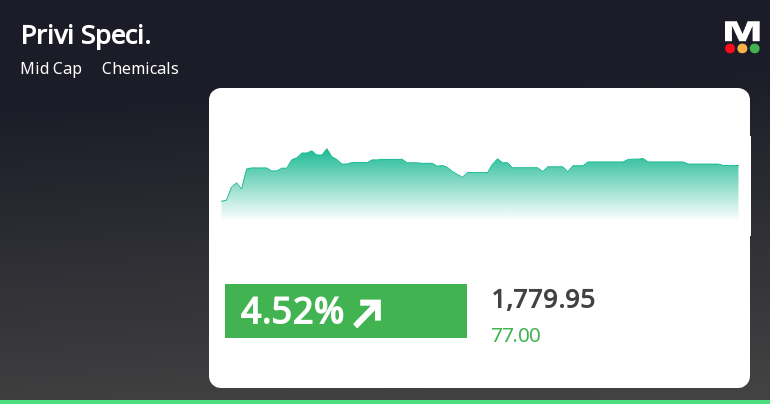

2025-04-02 08:07:21Privi Speciality Chemicals, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1780.00, showing a notable increase from the previous close of 1702.95. Over the past year, Privi has demonstrated a robust performance with a return of 73.07%, significantly outpacing the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a mixed outlook, with the MACD showing a mildly bearish trend on a weekly basis while remaining bullish on a monthly scale. The Bollinger Bands reflect a bullish sentiment for both weekly and monthly assessments, suggesting potential volatility in the stock's price movements. Additionally, the KST presents a bearish weekly trend but is bullish monthly, indicating varying performance across different time frames. In terms of returns, Privi has...

Read More

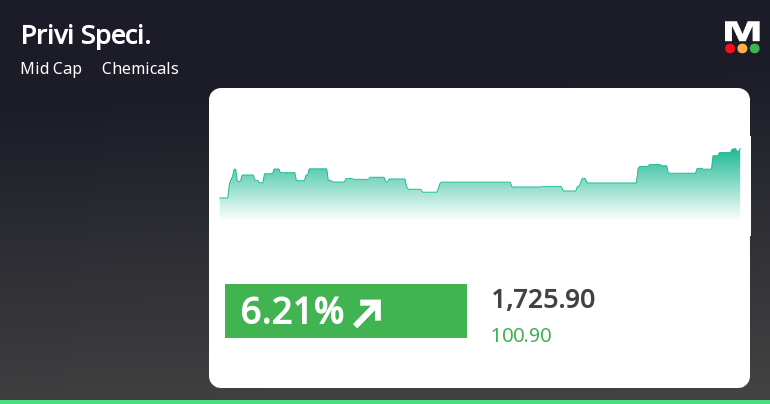

Privi Speciality Chemicals Demonstrates Strong Resilience Amid Broader Market Trends

2025-04-01 10:15:37Privi Speciality Chemicals has experienced notable activity, gaining 9.34% on April 1, 2025, and achieving a total return of 15.51% over the past five days. The stock has consistently outperformed the broader market and has shown strong performance relative to its moving averages, highlighting its growth potential.

Read More

Privi Speciality Chemicals Shows Strong Performance Amid Broader Market Trends

2025-03-28 14:35:18Privi Speciality Chemicals has experienced notable gains, marking its fourth consecutive day of increases and outperforming its sector. The stock has shown strong performance over various time frames, including a significant annual return, while also demonstrating resilience against broader market trends.

Read MorePrivi Speciality Chemicals Shows Mixed Technical Signals Amid Strong Yearly Performance

2025-03-28 08:02:59Privi Speciality Chemicals, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 1625.00, showing a notable increase from the previous close of 1594.95. Over the past year, Privi has demonstrated a robust performance with a return of 64.67%, significantly outperforming the Sensex, which recorded a return of 6.32% in the same period. The technical summary indicates mixed signals across various metrics. The MACD shows a bearish trend on a weekly basis while remaining bullish monthly. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly assessments. Bollinger Bands and On-Balance Volume (OBV) reflect a mildly bearish stance on a weekly basis, while moving averages also indicate a similar trend. In terms of stock performance, Privi has experienced fluctuations,...

Read More

Privi Speciality Chemicals Faces Technical Challenges Despite Strong Recent Profit Growth

2025-03-28 08:02:26Privi Speciality Chemicals has experienced a recent evaluation adjustment due to shifts in technical indicators, which suggest a cautious outlook. Despite a strong annual return and positive quarterly financial performance, the company faces challenges with long-term fundamentals and modest growth rates in sales and profits.

Read MorePrivi Speciality Chemicals Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

2025-03-27 18:00:40Privi Speciality Chemicals, a mid-cap player in the chemicals industry, has shown significant stock activity today, reflecting its dynamic market presence. With a market capitalization of Rs 6,138.00 crore, the company has a price-to-earnings (P/E) ratio of 41.90, which is slightly below the industry average of 45.38. Over the past year, Privi Speciality Chemicals has delivered an impressive performance, gaining 64.67%, significantly outpacing the Sensex, which rose by 6.32% during the same period. In the short term, the stock has also performed well, with a 1.88% increase today, compared to the Sensex's 0.41% rise. Weekly and monthly performances are similarly strong, with gains of 5.41% and 13.23%, respectively. However, the stock has faced challenges in the longer term, with a year-to-date decline of 8.14% and a three-year performance down by 13.00%. In contrast, its five-year performance stands out wi...

Read MorePrivi Speciality Chemicals Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-20 08:00:48Privi Speciality Chemicals has recently undergone a valuation adjustment, reflecting its current market standing within the chemicals industry. The company's price-to-earnings ratio stands at 39.63, while its price-to-book value is noted at 6.05. Other key metrics include an EV to EBIT ratio of 24.93 and an EV to EBITDA ratio of 17.22, indicating its operational efficiency relative to its enterprise value. In terms of returns, Privi has shown a notable performance over the past year, with a stock return of 48.46%, significantly outpacing the Sensex's return of 4.77% during the same period. However, its year-to-date performance reflects a decline of 13.11%, contrasting with the Sensex's decrease of 3.44%. When compared to its peers, Privi's valuation metrics position it within a competitive landscape. For instance, while Privi's PE ratio is lower than that of Navin Fluorine International and Vinati Organi...

Read MorePrivi Speciality Chemicals Adjusts Valuation Amid Competitive Industry Landscape

2025-03-10 08:00:42Privi Speciality Chemicals has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the chemicals industry. The company currently exhibits a price-to-earnings (PE) ratio of 39.26 and a price-to-book value of 5.99, indicating a premium valuation compared to its peers. Its enterprise value to EBITDA stands at 17.08, while the enterprise value to EBIT is recorded at 24.73. In terms of performance metrics, Privi's return on capital employed (ROCE) is at 12.83%, and its return on equity (ROE) is 13.69%. The company also has a PEG ratio of 0.19, suggesting a unique positioning in growth relative to its earnings. When compared to its industry peers, Privi Speciality Chemicals shows a competitive stance, although several competitors, such as Vinati Organics and Clean Science, maintain higher valuation metrics. Notably, Privi's stock has experienced fluctuations, with a ye...

Read More

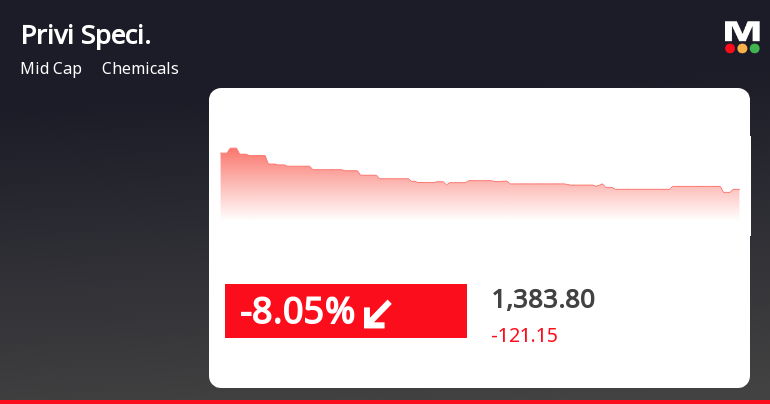

Privi Speciality Chemicals Faces Significant Decline Amid Broader Market Weakness

2025-03-03 10:15:28Privi Speciality Chemicals has seen a notable decline in its share price, underperforming the broader chemicals sector. The stock is trading below key moving averages, indicating a bearish trend. Over the past month, it has experienced a significant drop, contrasting with the performance of the Sensex.

Read MoreAnnouncement Under Regulation 30 Of The SEBI (LODR)2015-Update Of State Incentives

08-Apr-2025 | Source : BSEAnnouncement under Regulation 30 of the SEBI (LODR) 2015-Update of State Incentives

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

04-Apr-2025 | Source : BSEIntimation of Schedule of Analyst/Institutional Investor Meet to be held at the manufacturing facilities at Mahad on April 092025.

Corporate Actions

No Upcoming Board Meetings

Privi Speciality Chemicals Ltd has declared 20% dividend, ex-date: 24 Jul 24

No Splits history available

Privi Speciality Chemicals Ltd has announced 1:10 bonus issue, ex-date: 09 Jul 14

No Rights history available