Punjab Chemicals Adjusts Valuation Grade Amid Competitive Agrochemical Sector Dynamics

2025-04-01 08:00:10Punjab Chemicals & Crop Protection has recently undergone a valuation adjustment, reflecting its current standing in the pesticides and agrochemicals sector. The company's price-to-earnings ratio stands at 33.23, while its price-to-book value is recorded at 3.24. Additionally, the enterprise value to EBITDA ratio is 14.52, indicating its operational efficiency relative to its valuation. In terms of financial performance, Punjab Chemicals boasts a return on capital employed (ROCE) of 15.13% and a return on equity (ROE) of 11.21%. The company also offers a dividend yield of 0.32%. When compared to its peers, Punjab Chemicals presents a mixed picture. For instance, Laxmi Organic shows a higher PE ratio at 35.67, while Bharat Rasayan is noted for its lower PE at 23.69 but higher EV to EBIT ratio of 20.74. Insecticides India stands out with a significantly lower PE ratio of 12.92, indicating a different valua...

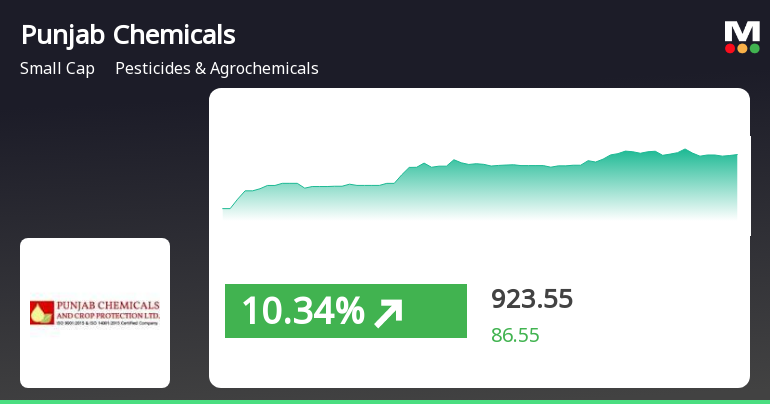

Read MorePunjab Chemicals Hits Upper Circuit Limit, Signaling Strong Market Activity and Investor Interest

2025-03-28 15:00:06Punjab Chemicals & Crop Protection Ltd, a small-cap player in the Pesticides & Agrochemicals industry, has made headlines today by hitting its upper circuit limit. The stock reached an intraday high of Rs 1006.8, reflecting a significant price change of Rs 90.0, or 10.73%, from its previous close. This performance outpaced the sector by 12.85%, showcasing the stock's strong momentum. Throughout the trading session, Punjab Chemicals exhibited a wide trading range of Rs 174.75, with a low of Rs 832.05. The total traded volume reached approximately 7.97 lakh shares, resulting in a turnover of Rs 76.78 crore. Notably, the stock has been on a positive trajectory, gaining 16.82% over the last two days. In terms of moving averages, the stock is currently above its 5-day, 20-day, 50-day, and 100-day averages, although it remains below the 200-day average. The delivery volume has also seen an uptick, indicating ri...

Read More

Punjab Chemicals & Crop Protection Surges Amid Broader Market Decline, Highlighting Small-Cap Resilience

2025-03-28 09:45:19Punjab Chemicals & Crop Protection has experienced notable stock activity, gaining 7.53% on March 28, 2025. The company, part of the pesticides and agrochemicals sector, has outperformed its peers recently. Despite mixed performance over different time frames, small-cap stocks are currently leading the market.

Read MorePunjab Chemicals Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-28 08:00:53Punjab Chemicals & Crop Protection, a small-cap player in the pesticides and agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 837.00, showing a notable increase from the previous close of 792.00. Over the past week, the stock has demonstrated a return of 1.73%, slightly outperforming the Sensex, which returned 1.65%. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook remains bearish. The Bollinger Bands indicate a mildly bearish trend on both weekly and monthly scales, and moving averages also reflect a mildly bearish stance. The KST shows a bearish trend for both weekly and monthly evaluations, while the On-Balance Volume (OBV) indicates a bullish monthly trend. Looking at the company's performance over various time frames, it has experienced a signif...

Read MorePunjab Chemicals Experiences Mixed Technical Trends Amidst Market Fluctuations

2025-03-26 08:01:15Punjab Chemicals & Crop Protection, a small-cap player in the pesticides and agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 825.00, down from a previous close of 841.50, with a notable 52-week high of 1,575.00 and a low of 669.55. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Bollinger Bands and KST also reflect bearish tendencies, while the On-Balance Volume (OBV) presents a bullish outlook on a monthly basis. In terms of returns, Punjab Chemicals has shown varied performance compared to the Sensex. Over the past week, the stock returned 2.58%, while the Sensex returned 3.61%. Notably, over the past month, the stock outperformed the Sensex with a return of 20.74% compared to 4....

Read More

Punjab Chemicals & Crop Protection Adjusts Evaluation Amidst Mixed Financial Performance Indicators

2025-03-25 08:13:19Punjab Chemicals & Crop Protection has experienced a recent evaluation adjustment, indicating a shift in technical trends. The company has faced challenges with negative quarterly results over six consecutive quarters, while showing modest net sales growth. Its low Debt to EBITDA ratio suggests effective debt management amidst limited mutual fund interest.

Read MorePunjab Chemicals Experiences Technical Trend Shifts Amid Market Volatility and Performance Evaluation

2025-03-25 08:01:37Punjab Chemicals & Crop Protection, a small-cap player in the pesticides and agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 841.50, showing a notable increase from the previous close of 829.70. Over the past year, the stock has experienced a high of 1,575.00 and a low of 669.55, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective remains bearish. The Bollinger Bands and moving averages indicate a mildly bearish trend on both weekly and monthly scales. The KST shows a bearish outlook for the weekly timeframe, while the monthly view is also mildly bearish. Notably, the On-Balance Volume (OBV) reflects a bullish trend on a monthly basis, despite the lack of clear signals from the RSI. When comparing the stock's perfor...

Read MorePunjab Chemicals Faces Volatility Amid Mixed Performance Signals in Agrochemical Sector

2025-03-10 15:45:10Punjab Chemicals & Crop Protection, a small-cap player in the pesticides and agrochemicals industry, has experienced significant volatility today. The stock opened with a notable loss of 5.63%, marking a reversal after four consecutive days of gains. This decline has positioned the stock to underperform its sector by 2.22%. Throughout the trading session, Punjab Chemicals touched an intraday low of Rs 817.05, reflecting a day’s performance of -3.21%, while the broader Sensex index saw a modest decline of 0.29%. Over the past month, however, the stock has shown resilience with a gain of 3.69%, contrasting with the Sensex's drop of 4.13%. In terms of moving averages, the stock is currently above its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-day moving averages, indicating mixed signals in its short to medium-term performance. As market dynamics continue to evolve, the focus re...

Read More

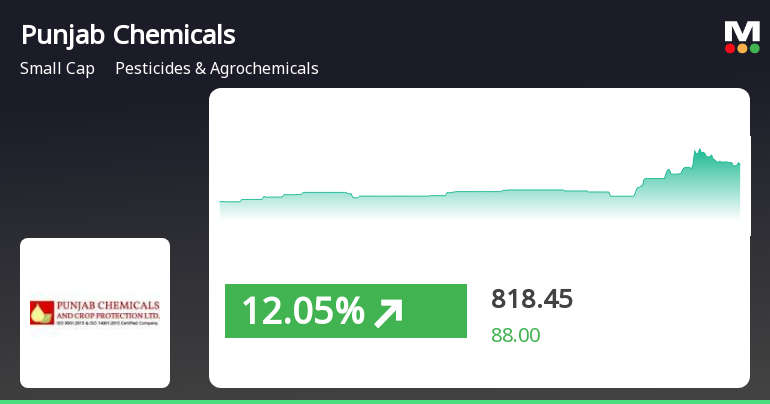

Punjab Chemicals & Crop Protection Shows Strong Short-Term Gains Amid Market Volatility

2025-03-05 14:50:18Punjab Chemicals & Crop Protection has shown notable activity, gaining 12.69% today and outperforming its sector. The stock reached an intraday high of Rs 862.85, with significant volatility. While it has gained in the short term, its performance over the past year reflects a decline of 26.46%.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under regulation 74(5) of SEBI (DP) Regulations 2018

Clarification sought from Punjab Chemicals & Crop Protection Ltd

01-Apr-2025 | Source : BSEThe Exchange has sought clarification from Punjab Chemicals & Crop Protection Ltd on April 1 2025 with reference to Movement in Volume.

The reply is awaited.

Clarification On Spurt In Volume Of The CompanyS Security In The Recent Past.

01-Apr-2025 | Source : BSEReply to the clarification sought on price movement is attached.

Corporate Actions

No Upcoming Board Meetings

Punjab Chemicals & Crop Protection Ltd has declared 30% dividend, ex-date: 25 Jul 24

No Splits history available

No Bonus history available

No Rights history available