PVV Infra Hits 52-Week Low Amid Broader Market Decline and Weak Fundamentals

2025-04-01 11:40:47PVV Infra, a microcap in construction and real estate, reached a new 52-week low amid a broader market decline. Despite a recent outperformance against its sector, the company's long-term fundamentals are weak, with significant drops in net sales and profit, alongside reduced promoter stakes indicating waning confidence.

Read More

PVV Infra Faces Significant Volatility Amid Declining Sales and Weak Fundamentals

2025-03-28 09:37:23PVV Infra, a microcap in construction and real estate, has faced notable volatility, reaching a new 52-week low. The stock has declined for six consecutive days, with weak long-term fundamentals and a significant drop in net sales. Promoter confidence has also decreased, reflecting overall lackluster performance.

Read MorePVV Infra Ltd Faces Intense Selling Pressure Amid Significant Price Declines

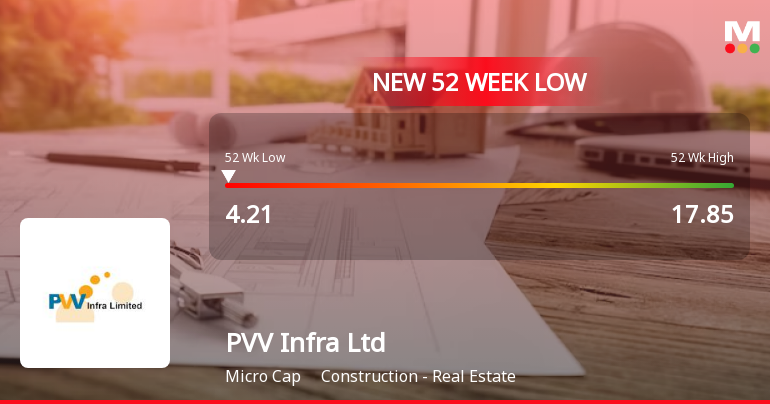

2025-03-28 09:35:05PVV Infra Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a notable decline, with its stock price dropping by 4.29% in a single day, contrasting sharply with the Sensex's minimal decline of just 0.10%. Over the past week, PVV Infra has lost 15.20%, while the Sensex has gained 0.81%. This trend continues over a month, with a staggering 28.62% drop for PVV Infra compared to a 5.92% increase in the Sensex. The stock has now fallen for six consecutive days, accumulating a total loss of 16.3% during this period. Today, it reached a new 52-week low of Rs. 4.21, underperforming its sector by 5.81%. The stock is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a persistent downward trend. Contributing factors to this selling pressure may include broader market conditions and company-specific chal...

Read MorePVV Infra Ltd Faces Intense Selling Pressure Amid Significant Price Declines

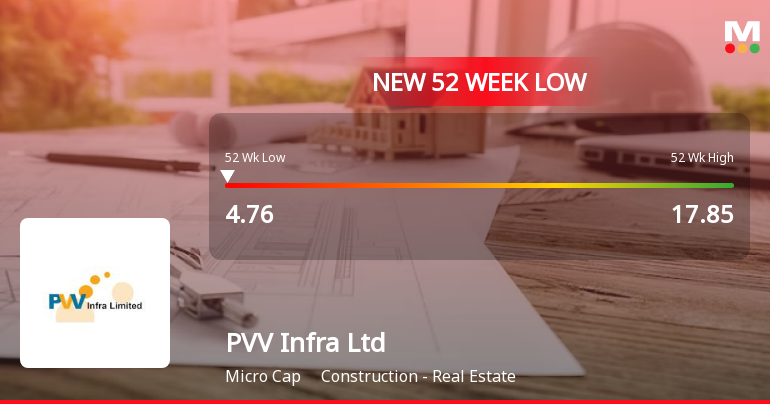

2025-03-27 15:30:04PVV Infra Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a consecutive decline over the past five days, resulting in a total loss of 11.13%. Today, the stock fell by 4.75%, underperforming the Sensex, which gained 0.45%. In the past week, PVV Infra has seen a decline of 12.33%, while the Sensex rose by 1.69%. Over the last month, the stock has plummeted by 24.49%, contrasting sharply with the Sensex's increase of 4.06%. Year-to-date, PVV Infra is down 33.88%, compared to the Sensex's slight decline of 0.64%. The stock's performance over the past year shows a staggering drop of 56.20%, while the Sensex has gained 6.36%. Today, PVV Infra hit a new 52-week low of Rs. 4.45, indicating a challenging market position. The stock is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, further highlighting the o...

Read More

PVV Infra Faces Ongoing Challenges Amid Significant Stock Volatility and Weak Fundamentals

2025-03-27 11:35:30PVV Infra, a microcap in construction and real estate, has hit a new 52-week low, continuing a downward trend with significant volatility. The company faces weak long-term fundamentals, declining net sales, and reduced promoter holdings, indicating ongoing challenges and underperformance compared to broader market indices.

Read More

PVV Infra Faces Declining Sales and Investor Confidence Amid Bearish Market Trends

2025-03-26 10:35:57PVV Infra, a microcap in construction and real estate, has reached a new 52-week low and has underperformed its sector. The company faces a bearish technical outlook, declining net sales, and reduced promoter stakes, resulting in a significant drop in returns over the past year compared to broader market gains.

Read MorePVV Infra Ltd Adjusts Valuation Grade, Highlighting Strong Financial Fundamentals in Construction Sector

2025-03-25 08:00:05PVV Infra Ltd, a microcap player in the construction and real estate sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company currently exhibits a price-to-earnings (P/E) ratio of 4.22 and an enterprise value to EBITDA ratio of 3.84, indicating a favorable valuation relative to its earnings potential. Additionally, the price-to-book value stands at 0.50, suggesting that the stock is trading below its book value. In terms of performance indicators, PVV Infra has a return on capital employed (ROCE) of 12.99% and a return on equity (ROE) of 11.77%, which are noteworthy figures in the context of its industry. When compared to its peers, PVV Infra's valuation metrics stand out, especially against companies like BIGBLOC Construction and Haz.Multi Projects, which are positioned at significantly higher valuation levels. This contrast highlights PVV ...

Read MorePVV Infra Ltd Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-17 12:50:03PVV Infra Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive losses, falling by 5.08% in just one day, and has seen a total decline of 8.66% over the past two days. This trend is particularly concerning given the stock's performance relative to the Sensex, which has gained 0.24% today. Over the past week, PVV Infra has declined by 1.56%, while the Sensex has only dipped by 0.15%. The one-month performance reveals a stark contrast, with PVV Infra down 36.08% compared to the Sensex's modest decline of 2.62%. Year-to-date, the stock has lost 24.29%, significantly underperforming the Sensex, which is down 5.29%. The stock's performance over longer periods also highlights its struggles, with a staggering 54.61% drop over the past year and a 48.33% decline over three years. Additionally, PVV Infra is trading below all key movi...

Read MorePVV Infra Ltd Faces Intense Selling Pressure Amid Significant Stock Price Declines

2025-03-13 12:50:03PVV Infra Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a notable decline, with a 5.05% drop in its stock price, contrasting sharply with the Sensex's modest gain of 0.04%. This marks a continuation of a troubling trend, as PVV Infra has recorded consecutive days of losses, with a weekly performance down 4.88% compared to the Sensex's decline of just 0.38%. Over the past month, PVV Infra's performance has been particularly stark, plummeting 34.25%, while the Sensex has only dipped by 2.73%. Year-to-date, the stock is down 21.14%, significantly underperforming the Sensex, which has seen a decline of 5.22%. The longer-term view is equally concerning, with a staggering 54.57% drop over the past year, while the Sensex has gained 1.79%. Several factors may be contributing to this selling pressure, including the stock's underperforma...

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEClosure of trading window

Integrated Filing (Financial)

13-Feb-2025 | Source : BSEBoard meeting outcome

Un-Audited Standalone & Consolidated Financial Results For The Quarter & Nine Months Ended 31 St Dec 2024.

11-Feb-2025 | Source : BSEResults of December 2024 Quarter

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

PVV Infra Ltd has announced 1:1 bonus issue, ex-date: 20 Aug 24

No Rights history available