Pyramid Technoplast Adjusts Valuation Grade Amidst Competitive Industry Landscape

2025-03-28 08:00:56Pyramid Technoplast, a microcap player in the plastic products industry, has recently undergone a valuation adjustment. The company's current price stands at 138.55, reflecting a slight decline from the previous close of 140.90. Over the past year, Pyramid Technoplast has experienced a stock return of -1.28%, contrasting with a 6.32% return from the Sensex. Key financial metrics for Pyramid Technoplast include a PE ratio of 18.63 and an EV to EBITDA ratio of 12.14. The company's return on capital employed (ROCE) is reported at 13.65%, while the return on equity (ROE) stands at 11.62%. These figures provide insight into the company's operational efficiency and profitability. In comparison to its peers, Pyramid Technoplast's valuation metrics indicate a competitive position within the industry. For instance, while it maintains a PE ratio higher than some peers like Prakash Pipes, it is lower than others suc...

Read MorePyramid Technoplast Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-21 08:03:27Pyramid Technoplast, a microcap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 149.00, showing a slight increase from the previous close of 145.45. Over the past year, Pyramid Technoplast has experienced a stock return of 3.91%, which is notably lower than the Sensex return of 5.89% during the same period. In terms of technical indicators, the weekly MACD and KST are both signaling bearish trends, while the daily moving averages also reflect a bearish stance. The Relative Strength Index (RSI) shows a bullish signal on a weekly basis, but there is no signal on the monthly chart. Additionally, the Bollinger Bands indicate a mildly bearish trend weekly, with a sideways movement on a monthly basis. The On-Balance Volume (OBV) presents a mildly bearish trend weekly, contrasting with a bullish signal ...

Read MorePyramid Technoplast Faces Mixed Technical Signals Amid Market Volatility

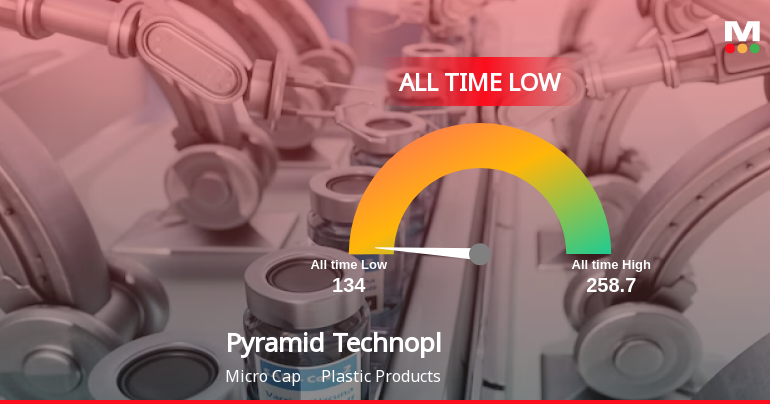

2025-03-19 08:05:14Pyramid Technoplast, a microcap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 143.00, showing a notable increase from the previous close of 134.40. Over the past year, the stock has experienced a high of 258.70 and a low of 134.00, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly indicators show mixed signals. The Relative Strength Index (RSI) is bullish on a weekly basis, but there is no signal on the monthly front. Bollinger Bands indicate a mildly bearish trend weekly, with a sideways movement monthly. Daily moving averages are bearish, and the KST also reflects a bearish stance on a weekly basis. Interestingly, the On-Balance Volume (OBV) shows a bullish trend on a monthly scale, suggesting some underlying strength. Whe...

Read More

Pyramid Technoplast Faces Challenges Amidst Declining Stock Performance and Low Investor Interest

2025-03-17 12:07:13Pyramid Technoplast, a microcap in the plastic products sector, is nearing a 52-week low, reflecting a challenging performance. The company has underperformed its sector and recorded a 6.79% decline in stock value over the past year, with stagnant operating profit and no domestic mutual fund investment.

Read More

Pyramid Technoplast Stock Hits All-Time Low Amid Ongoing Financial Struggles

2025-03-17 12:02:13Pyramid Technoplast, a microcap in the plastic products sector, is experiencing notable stock activity, trading near an all-time low. The company has underperformed relative to the sector and the broader market, with significant declines in stock value and operating profit over recent years, raising concerns about its financial health.

Read MorePyramid Technoplast Faces Mixed Technical Trends Amidst Market Struggles

2025-03-05 08:03:47Pyramid Technoplast, a microcap player in the plastic products industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 146.75, down from a previous close of 152.35, with a notable 52-week high of 258.70 and a low of 135.00. Today's trading saw a high of 164.95 and a low matching the current price. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the RSI reflects bullish momentum in the short term. However, the overall moving averages and KST are also bearish, suggesting caution in the market sentiment. The Dow Theory points to a mildly bearish outlook, while the On-Balance Volume (OBV) presents a mildly bearish stance on a weekly basis but indicates bullishness on a monthly scale. In terms of returns, Pyramid Technoplast has faced significant challe...

Read MorePyramid Technoplast Experiences Valuation Grade Change Amidst Market Sentiment Shift

2025-03-04 08:00:38Pyramid Technoplast, a microcap player in the plastic products industry, has recently undergone a valuation adjustment. The company's current price stands at 152.35, down from a previous close of 168.00, reflecting a notable shift in market sentiment. Over the past year, Pyramid Technoplast has experienced a stock return of -13.31%, contrasting with a modest -0.98% return from the Sensex, indicating a relative underperformance. Key financial metrics reveal a PE ratio of 20.48 and an EV to EBITDA ratio of 13.31, which positions the company within a competitive landscape. Its return on capital employed (ROCE) is reported at 13.65%, while the return on equity (ROE) stands at 11.62%. These figures suggest a stable operational performance, although they may not fully align with investor expectations. In comparison to its peers, Pyramid Technoplast's valuation metrics highlight a diverse range of performance wi...

Read MorePyramid Technoplast Faces Stock Volatility Amid Broader Market Trends in Plastics Sector

2025-03-03 10:28:54Pyramid Technoplast Ltd, a microcap player in the plastic products industry, has experienced significant volatility in its stock performance today. The company, with a market capitalization of Rs 570.16 crore, has reported a one-day decline of 7.74%, contrasting with a modest drop of 0.37% in the Sensex. Over the past week, Pyramid Technoplast's stock has decreased by 5.52%, while the Sensex fell by 2.05%. In terms of longer-term performance, Pyramid Technoplast has faced challenges, with a year-to-date decline of 25.12%, compared to the Sensex's decrease of 6.67%. The company's one-year performance stands at -11.81%, significantly underperforming the Sensex, which has only declined by 1.19% during the same period. Financial metrics reveal a price-to-earnings (P/E) ratio of 22.59, notably lower than the industry average of 39.48. Technical indicators suggest a bearish trend, with moving averages and Bolli...

Read MorePyramid Technoplast Adjusts Valuation Amidst Competitive Landscape in Plastic Industry

2025-02-24 12:57:58Pyramid Technoplast, a microcap player in the plastic products industry, has recently undergone a valuation adjustment. The company's current price stands at 164.90, reflecting a notable shift from its previous close of 171.40. Over the past year, Pyramid Technoplast has experienced a return of -4.93%, contrasting with a positive return of 1.96% from the Sensex. Key financial metrics reveal a PE ratio of 23.04 and an EV to EBITDA ratio of 14.92, indicating its market positioning within the sector. The company's return on capital employed (ROCE) is reported at 13.65%, while the return on equity (ROE) stands at 11.62%. In comparison to its peers, Pyramid Technoplast's valuation metrics suggest a competitive landscape. For instance, TPL Plastech is noted for a higher PE ratio of 28.82, while Wim Plast shows a more attractive valuation with a PE of 10.59. This context highlights the varying financial health ...

Read MoreDisclosure Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

03-Apr-2025 | Source : BSEDisclosure Under Regulation 30 of the SEBI (Listing Obligations And Disclosure Requirements ) Regulation 2015 - Cautionary Emails received from NSE and BSE.

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

03-Mar-2025 | Source : BSEDisclosure pursuant to Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 (SEBI LODR Regulations) - Intimation of Analyst(s)/lnstitutional lnvestor(s) Meeting

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available