R K Swamy Faces Technical Trend Challenges Amid Market Volatility and Mixed Indicators

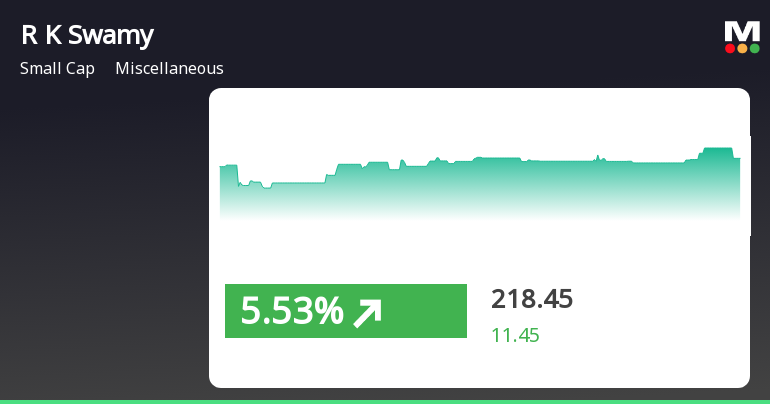

2025-04-02 08:10:47R K Swamy, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 218.65, showing a slight increase from the previous close of 217.00. Over the past year, R K Swamy has faced challenges, with a return of -20.52%, contrasting with a positive return of 2.72% for the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands suggest a mildly bearish outlook, and the KST is bearish on a weekly basis. Notably, the RSI currently presents no signal, indicating a lack of momentum in either direction. In terms of recent performance, R K Swamy has experienced a significant decline of -10.39% over the past week, while th...

Read MoreR K Swamy Faces Technical Bearish Trends Amid Broader Market Challenges

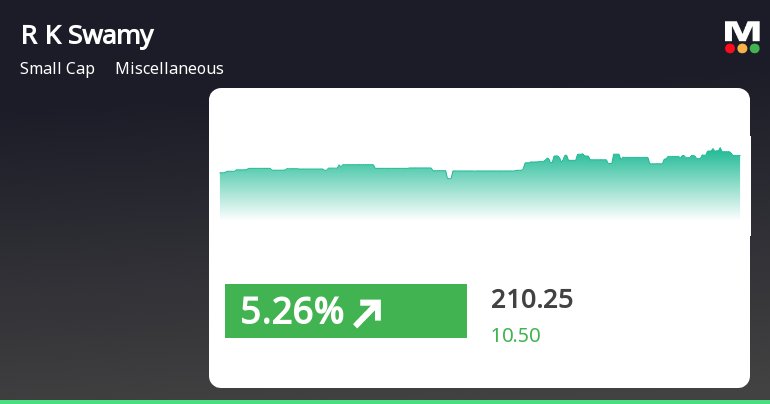

2025-03-28 08:04:16R K Swamy, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 222.05, down from a previous close of 229.50, with a 52-week high of 320.50 and a low of 191.05. Today's trading saw a high of 229.25 and a low of 220.00. The technical summary indicates a bearish sentiment across various indicators. The MACD and Bollinger Bands both reflect bearish trends on a weekly basis, while moving averages also align with this sentiment. The KST shows a similar bearish outlook, contributing to the overall technical assessment. Interestingly, the Dow Theory presents a mixed view, indicating mildly bullish conditions on a weekly basis but mildly bearish on a monthly scale. In terms of performance, R K Swamy's stock return has shown a decline of 17.44% year-to-date, contrasting with a slight drop of 0.68% i...

Read MoreR K Swamy Adjusts Valuation Amidst Competitive Industry Landscape Challenges

2025-03-28 08:00:58R K Swamy, a small-cap player in the miscellaneous industry, has recently undergone a valuation adjustment. The company's current price stands at 222.05, reflecting a decline from its previous close of 229.50. Over the past year, R K Swamy has experienced a stock return of -18.14%, contrasting with a 6.32% return from the Sensex during the same period. Key financial metrics for R K Swamy include a PE ratio of 34.49 and an EV to EBITDA ratio of 19.36. The company also boasts a return on capital employed (ROCE) of 33.34% and a return on equity (ROE) of 14.77%. In comparison to its peers, R K Swamy's valuation metrics indicate a relatively higher PE ratio, while its EV to EBITDA ratio is competitive within the industry. Notably, other companies in the sector, such as SIS and Team Lease Services, have shown more favorable valuation standings, with lower PE ratios and EV to EBITDA figures. This context highlig...

Read MoreR K Swamy Shows Resilience Amid Mixed Technical Indicators and Market Trends

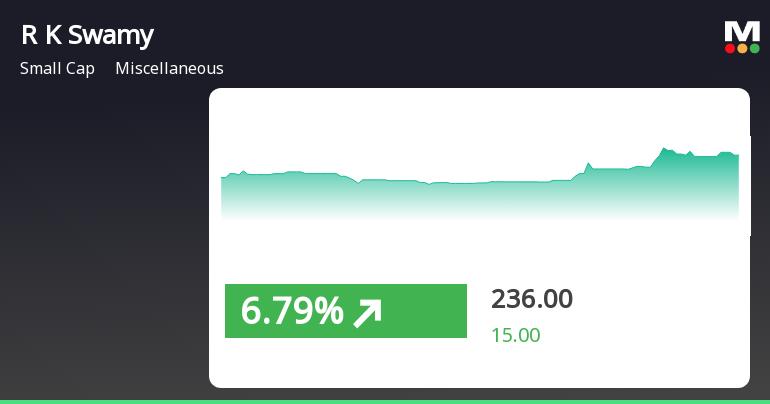

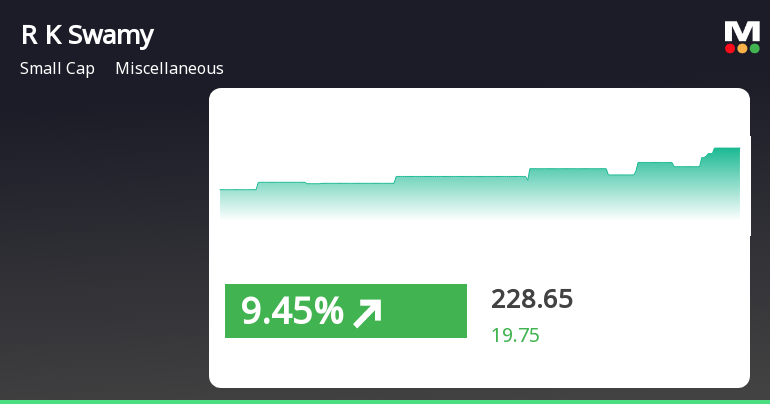

2025-03-21 08:03:30R K Swamy, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 236.05, showing a notable increase from the previous close of 221.00. Over the past week, R K Swamy has demonstrated a strong performance with a return of 18.71%, significantly outpacing the Sensex, which returned 3.41% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the moving averages indicate a mildly bearish sentiment. The Bollinger Bands present a bullish outlook on a weekly basis, suggesting some volatility in price movements. The KST and OBV metrics also reflect a mixed sentiment, with the latter showing a mildly bullish trend on a weekly basis. Despite a year-to-date return of -12.23%, which contrasts with the Sensex's decline of -2.29%, R K Swamy's performance over the past ...

Read More

R K Swamy Shows Strong Short-Term Gains Amid Mixed Long-Term Performance Trends

2025-03-20 11:05:25R K Swamy has experienced notable gains, outperforming its sector for four consecutive days and achieving a significant total return. While the stock shows mixed performance against various moving averages, it has demonstrated strong short-term growth compared to the broader market, despite longer-term challenges.

Read MoreR K Swamy Adjusts Valuation Grade Amid Mixed Industry Financial Metrics

2025-03-19 08:01:03R K Swamy, a small-cap player in the miscellaneous industry, has recently undergone a valuation adjustment, reflecting shifts in its financial metrics. The company's price-to-earnings (PE) ratio stands at 34.09, while its price-to-book value is noted at 4.74. Additionally, R K Swamy's enterprise value to EBITDA ratio is recorded at 19.12, indicating its valuation relative to earnings before interest, taxes, depreciation, and amortization. In terms of performance, the company has a return on capital employed (ROCE) of 33.34% and a return on equity (ROE) of 14.77%. The dividend yield is currently at 0.91%, which may appeal to certain investors. When compared to its peers, R K Swamy's valuation metrics present a mixed picture. For instance, Nirlon and AWFIS Space are positioned at higher valuation levels, while companies like SIS and Team Lease Services show more attractive metrics. This comparison highligh...

Read More

R K Swamy Shows Strong Short-Term Gains Amid Broader Market Uptrend

2025-03-18 14:05:32R K Swamy experienced a notable increase in stock performance, significantly outperforming its sector. Despite recent gains, the stock remains below several long-term moving averages, indicating mixed momentum. In the broader market, the Sensex rose, with small-cap stocks leading the gains, while R K Swamy's year-long performance shows a decline.

Read More

R K Swamy Stock Surges Amid Mixed Long-Term Market Signals and Volatility

2025-02-25 14:05:24R K Swamy, a small-cap player in the miscellaneous industry, experienced notable trading activity, outperforming its sector significantly. The stock's short-term momentum is indicated by its position relative to the 5-day moving average, while longer-term trends present mixed signals. Recent volatility contrasts with broader market movements.

Read More

R K Swamy's Recent Gains Suggest Potential Trend Reversal Amid Market Volatility

2025-02-13 14:35:24R K Swamy, a small-cap player in the miscellaneous industry, experienced a notable uptick on February 13, 2025, following a four-day decline. The stock outperformed its sector while trading below key moving averages, reflecting its volatility and the shifting market sentiment over the past month.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECompliance Certificate under Regulation 74 (5) of SEBI (DP) Regulations 2018 for the quarter ended March 2025 is attached herewith.

Closure of Trading Window

28-Mar-2025 | Source : BSETrading Window Closure

Shareholder Meeting / Postal Ballot-Scrutinizers Report

24-Mar-2025 | Source : BSESubmission of Voting Results along with Scrutinizer Report of the Postal Ballot under Regulation 44 (3) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

R K Swamy Ltd has declared 40% dividend, ex-date: 09 Aug 24

No Splits history available

No Bonus history available

No Rights history available