Raghav Productivity Enhancers Shows Strong Growth Amid Valuation Concerns and Market Sentiment Shift

2025-03-20 08:07:03Raghav Productivity Enhancers, a small-cap company in the Mining & Minerals sector, has experienced a recent evaluation adjustment reflecting changes in market sentiment. The firm reported strong financial performance, with significant growth in net sales and profits, although it currently trades at a premium compared to its peers.

Read MoreRaghav Productivity Enhancers Shows Diverging Technical Trends Amidst Market Resilience

2025-03-20 08:03:28Raghav Productivity Enhancers, a small-cap player in the Mining & Minerals sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 535.30, showing a notable increase from the previous close of 500.00. Over the past year, Raghav Productivity has demonstrated significant resilience, with a remarkable return of 80.52%, compared to a modest 4.77% return from the Sensex. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis while remaining bullish on a monthly scale. The Relative Strength Index (RSI) shows no signals for both weekly and monthly periods, suggesting a neutral momentum. Bollinger Bands reflect a mildly bearish stance weekly, contrasting with a bullish monthly outlook. Daily moving averages are bearish, and the KST also indicates a bearish trend weekly while being bullish monthly. ...

Read MoreRaghav Productivity Enhancers Shows Strong Long-Term Growth Amid Market Fluctuations

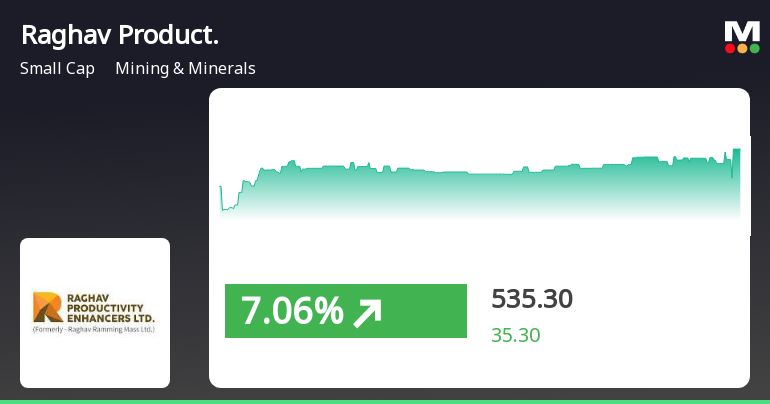

2025-03-19 18:00:39Raghav Productivity Enhancers Ltd, a small-cap player in the Mining & Minerals sector, has shown significant activity in today's trading session, with a notable increase of 7.06%. This performance stands in stark contrast to the Sensex, which only rose by 0.20% on the same day. Over the past year, Raghav Productivity Enhancers has delivered an impressive return of 80.52%, significantly outperforming the Sensex's 4.77% gain. Despite recent fluctuations, including a decline of 27.25% over the past three months, the company's long-term performance remains robust, with a staggering 263.13% increase over three years and an extraordinary 1663.76% rise over five years. The stock currently has a market capitalization of Rs 2,396.00 crore and a price-to-earnings (P/E) ratio of 70.69, which is considerably higher than the industry average of 8.11. Technical indicators present a mixed picture, with weekly metrics sh...

Read More

Raghav Productivity Enhancers Surges Amid Broader Market Gains and Sector Trends

2025-03-19 15:50:22Raghav Productivity Enhancers, a small-cap company in the Mining & Minerals sector, has experienced notable stock performance, gaining 7.06% today and accumulating a total return of 16.14% over the past four days. The stock has significantly outperformed the broader market over the past year.

Read More

Raghav Productivity Enhancers Reports Record Sales Growth Amid Premium Valuation Concerns

2025-03-19 08:08:51Raghav Productivity Enhancers, a small-cap mining company, reported impressive third-quarter results for FY24-25, with net sales soaring by 73.63% to Rs 55.04 crore. The company has shown consistent growth over the past three quarters, maintaining a low debt-to-equity ratio and outperforming the BSE 500 index.

Read MoreRaghav Productivity Enhancers Shows Mixed Technical Trends Amid Market Dynamics

2025-03-19 08:04:23Raghav Productivity Enhancers, a small-cap player in the Mining & Minerals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 500.00, showing a notable increase from the previous close of 474.00. Over the past year, Raghav Productivity has demonstrated a significant return of 67.64%, outperforming the Sensex, which returned 3.51% in the same period. Despite a challenging year-to-date performance, where the stock has declined by 29.18% compared to the Sensex's 3.63% drop, the company has shown resilience over longer time frames. Over three years, Raghav Productivity has achieved a remarkable return of 239.18%, significantly higher than the Sensex's 30.14%. In terms of technical indicators, the stock's moving averages suggest a mildly bullish sentiment on a daily basis, while other metrics present a mixed picture. The MACD and KST...

Read MoreRaghav Productivity Enhancers Faces Technical Trend Shifts Amid Market Volatility

2025-03-18 08:03:50Raghav Productivity Enhancers, a small-cap player in the Mining & Minerals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, priced at 474.00, has shown notable fluctuations, with a 52-week high of 887.00 and a low of 286.15. Today's trading saw a high of 482.20 and a low of 456.95, indicating a volatile market environment. The technical summary reveals a mixed outlook, with the MACD indicating bearish trends on a weekly basis while showing a mildly bullish stance monthly. The Relative Strength Index (RSI) currently presents no signals, suggesting a period of indecision among traders. Additionally, Bollinger Bands reflect a mildly bearish trend weekly but shift to a mildly bullish perspective monthly, indicating potential stabilization. In terms of performance, Raghav Productivity Enhancers has experienced varied returns compared to the Sensex. Over t...

Read More

Raghav Productivity Enhancers Faces Market Scrutiny Amid Strong Financial Performance

2025-03-17 10:34:42Raghav Productivity Enhancers, a small-cap mining company, has experienced a recent evaluation adjustment reflecting changes in its market standing. Despite strong financial metrics, including significant sales and profit growth, the stock shows signs of technical weakness, and domestic mutual funds currently hold no stake in the company.

Read MoreRaghav Productivity Enhancers Faces Mixed Technical Trends Amidst Market Volatility

2025-03-17 08:01:22Raghav Productivity Enhancers, a small-cap player in the Mining & Minerals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 463.00, showing a slight increase from the previous close of 460.90. Over the past year, Raghav Productivity has demonstrated significant resilience, with a return of 69.16%, notably outperforming the Sensex, which recorded a return of 1.47% during the same period. However, recent trends indicate a shift in the company's technical outlook. The MACD and KST indicators suggest bearish tendencies on a weekly basis, while the monthly indicators present a mixed picture. The Bollinger Bands show a bearish trend weekly but are mildly bullish monthly, indicating volatility in price movements. Additionally, the moving averages reflect a mildly bullish stance on a daily basis, contrasting with the overall bearish sent...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEDear Sir Please find attached certificate for quarter ended March 31 2025

Closure of Trading Window

24-Mar-2025 | Source : BSEPlease find attached letter regarding Closure of Trading window from 1st April 2025

Intimation Of Appointment Of Senior Management Personnel Pursuant To Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

18-Feb-2025 | Source : BSEDear Sir/Maam Please find attached Disclosure regarding the same.

Corporate Actions

No Upcoming Board Meetings

Raghav Productivity Enhancers Ltd has declared 9% dividend, ex-date: 26 Jul 24

No Splits history available

Raghav Productivity Enhancers Ltd has announced 1:1 bonus issue, ex-date: 29 Nov 24

No Rights history available