Railtel Corporation Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-04-03 08:06:17Railtel Corporation of India, a midcap player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 306.55, showing a slight increase from the previous close of 301.40. Over the past year, Railtel has experienced a decline of 21.46%, contrasting with a modest gain of 3.67% in the Sensex during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands also reflect a mildly bearish stance on a weekly and monthly basis. Daily moving averages are bearish, and the KST shows a mixed picture with a bearish weekly trend and a bullish monthly trend. Despite these technical indicators, Railtel has demonstr...

Read MoreRailtel Corporation Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-04-02 08:09:47Railtel Corporation of India, a midcap player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 301.40, slightly down from the previous close of 302.00. Over the past year, Railtel has faced challenges, with a notable decline of 22.5% compared to a modest gain of 2.72% in the Sensex. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect a bearish stance, and moving averages confirm this trend. The KST presents a mixed picture, being bearish weekly but bullish monthly, suggesting some volatility in performance. In terms of stock performance, Railtel's returns have varied significantly over different periods. While the stock has seen a substantial inc...

Read MoreRailtel Corporation Shows Mixed Technical Trends Amidst Market Fluctuations

2025-03-26 08:04:55Railtel Corporation of India, a midcap player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 323.35, having closed previously at 327.80. Over the past year, Railtel has experienced a notable decline of 10.23%, contrasting with a 7.12% gain in the Sensex during the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands also reflect a mildly bearish stance, aligning with the overall technical sentiment. Despite these trends, Railtel has demonstrated resilience in shorter time frames, with a remarkable 14.76% return over the past week, significantly outperforming the Sensex's 3.61% retu...

Read MoreRailtel Corporation's Technical Indicators Signal Mixed Trends Amid Strong Performance

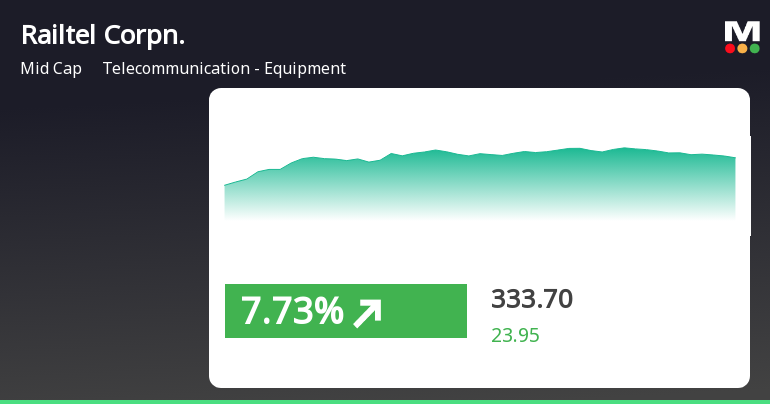

2025-03-25 08:06:11Railtel Corporation of India, a midcap player in the telecommunications equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 327.80, showing a notable increase from the previous close of 309.75. Over the past week, Railtel has demonstrated a strong performance with a return of 18.81%, significantly outpacing the Sensex, which returned 5.14% in the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, with a similar monthly perspective. The daily moving averages also reflect a bearish sentiment. Despite the recent challenges, Railtel's three-year return stands at an impressive 266.46%, compared to the S...

Read MoreRailtel Corporation Sees Surge in Trading Activity Amid Positive Market Momentum

2025-03-24 12:00:10Railtel Corporation of India Ltd, a prominent player in the Telecommunication Equipment industry, has emerged as one of the most active stocks today, with a total traded volume of 16,321,225 shares and a total traded value of approximately Rs 54.34 crore. The stock opened at Rs 318.0, reflecting a gain of 2.66% from the previous close of Rs 309.75, and reached an intraday high of Rs 339.4, marking a notable increase of 9.57%. In terms of performance, Railtel has outperformed its sector by 3.86% today, continuing a positive trend with a consecutive gain over the last five days, resulting in an impressive 18.7% return during this period. The stock's liquidity remains robust, with a delivery volume of 116,100 shares on March 21, which is a significant 104.97% increase compared to the five-day average. While the stock is currently trading above its 5-day and 20-day moving averages, it remains below the 50-day...

Read MoreRailtel Corporation Sees Surge in Trading Activity and Investor Participation

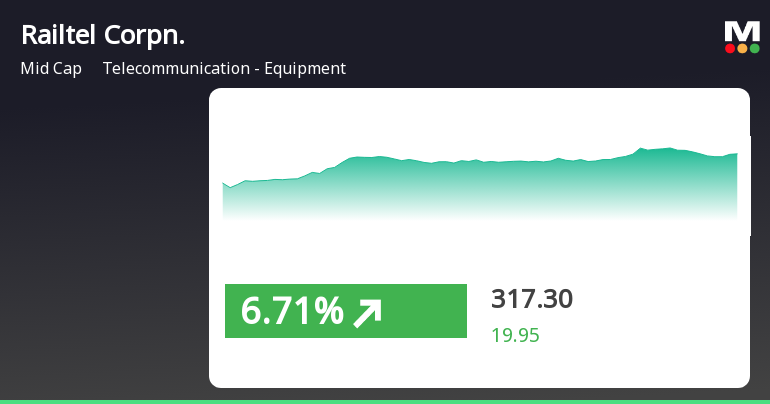

2025-03-24 10:00:20Railtel Corporation of India Ltd, a prominent player in the Telecommunication Equipment industry, has emerged as one of the most active equities today, with a total traded volume of 7,381,769 shares and a total traded value of approximately Rs 245.62 crores. The stock opened at Rs 318.0, reflecting a gain of 2.66% from the previous close of Rs 309.75, and reached an intraday high of Rs 338.4, marking a notable increase of 9.25% during the trading session. Over the past five days, Railtel has shown a strong performance, gaining 21.83% and outperforming its sector by 6.43%. The stock's last traded price stands at Rs 336.7, indicating a one-day return of 8.83%, significantly higher than the sector's return of 0.85% and the Sensex's return of 0.56%. Investor participation has also seen a rise, with a delivery volume of 116,100 shares on March 21, reflecting a 104.97% increase compared to the five-day average...

Read More

Railtel Corporation Surges Amid Broader Market Gains, Highlighting Sector Resilience

2025-03-24 09:35:36Railtel Corporation of India has seen notable stock activity, outperforming its sector significantly. The stock has shown strong performance over the past week, with a substantial intraday high. In the broader market, the Sensex has also experienced a consistent upward trend, contrasting with Railtel's year-long performance.

Read More

Railtel Corporation's Strong Short-Term Gains Contrast with Yearly Decline in Performance

2025-03-21 10:20:31Railtel Corporation of India experienced notable trading activity, achieving a significant gain on March 21, 2025. The stock has outperformed its sector recently, with a strong four-day cumulative return. While currently above some short-term moving averages, it remains below longer-term averages, reflecting a mixed performance trend.

Read MoreRailtel Corporation's Stock Shows Mixed Technical Trends Amid Market Dynamics

2025-03-20 08:04:01Railtel Corporation of India, a midcap player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 296.50, showing a notable increase from the previous close of 281.75. Over the past week, Railtel has demonstrated a stock return of 2.52%, outperforming the Sensex, which recorded a return of 1.92%. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands also indicate a mildly bearish trend for both weekly and monthly assessments. The KST presents a mixed picture, being bearish weekly but bullish monthly. Meanwhile, the Dow Theory shows a mildly bullish stance on a weekly basis, contrasting with a mildly bearish monthly view. Looking at the company's performance over various time f...

Read MoreAnnouncement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

29-Mar-2025 | Source : BSENew Order Received

Closure of Trading Window

28-Mar-2025 | Source : BSEClosure of Trading Window

Pending Litigation(S) Or Dispute(S) Or Outcome(S) Thereof

28-Mar-2025 | Source : BSEIntimation regarding resolution of dispute through AMRCD mechanism.

Corporate Actions

No Upcoming Board Meetings

Railtel Corporation of India Ltd has declared 10% dividend, ex-date: 02 Apr 25

No Splits history available

No Bonus history available

No Rights history available