Rama Phosphates Adjusts Valuation Grade Amid Competitive Fertilizers Sector Dynamics

2025-04-03 08:00:09Rama Phosphates, a microcap player in the fertilizers industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 98.00, showing a notable increase from the previous close of 89.89. Over the past year, Rama Phosphates has delivered a return of 14.05%, outperforming the Sensex, which recorded a return of 3.67% in the same period. Key financial metrics reveal a PE ratio of 30.96 and an EV to EBITDA ratio of 16.86, indicating a robust valuation relative to its earnings. However, the company also reported a negative return on capital employed (ROCE) of -5.02%, alongside a return on equity (ROE) of 3.09%. In comparison to its peers, Rama Phosphates presents a higher valuation profile, particularly when contrasted with companies like Zuari Agro Chemicals and Aries Agro, which have more favorable valuation metrics. This evaluation ...

Read More

Rama Phosphates Faces Shift in Market Sentiment Amid Mixed Financial Performance

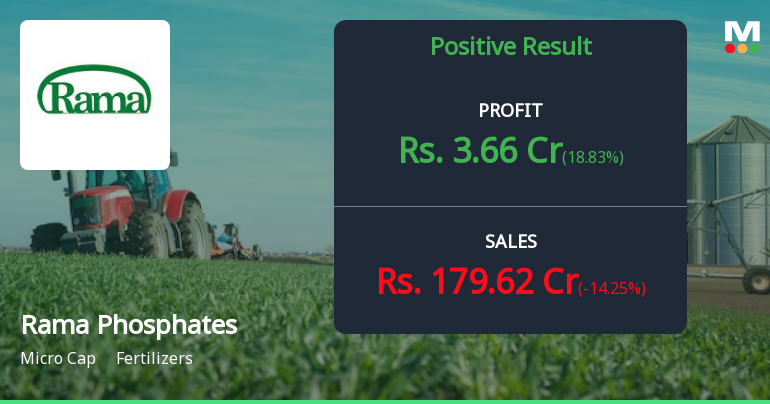

2025-03-24 08:01:41Rama Phosphates, a microcap in the fertilizers sector, has experienced a recent evaluation adjustment reflecting a more cautious outlook. Despite strong debt servicing capabilities and a significant quarterly profit increase, the company's long-term growth has faced challenges, leading to fluctuating market performance and technical signals.

Read MoreRama Phosphates Faces Market Challenges Amid Fluctuating Stock Performance Trends

2025-03-21 18:00:15Rama Phosphates Ltd, a microcap player in the fertilizers industry, has experienced notable fluctuations in its stock performance today. The company, with a market capitalization of Rs 315.00 crore, currently holds a price-to-earnings (P/E) ratio of 28.12, significantly higher than the industry average of 19.61. Over the past year, Rama Phosphates has recorded a performance increase of 4.31%, which lags behind the Sensex's growth of 5.87%. In the short term, the stock has faced challenges, with a decline of 2.09% today, contrasting with the Sensex's modest gain of 0.73%. The one-week and one-month performances also reflect downward trends, with losses of 1.11% and 1.60%, respectively. Longer-term metrics reveal a more complex picture. While the stock has seen a significant increase of 591.26% over the past five years, it has struggled in the last three years, showing a decline of 56.43%. Technical indicat...

Read More

Rama Phosphates Shows Strong Debt Management Amid Mixed Growth Indicators

2025-03-12 08:01:10Rama Phosphates has recently adjusted its evaluation, highlighting its strong debt management with a low Debt to EBITDA ratio. The company reported net sales of Rs 389.08 crore, a 35.28% increase, while facing long-term growth challenges with a decline in operating profit over five years.

Read More

Rama Phosphates Reports Significant Profit Growth Amid Long-Term Challenges and Valuation Concerns

2025-03-07 08:01:12Rama Phosphates, a microcap in the fertilizers sector, recently adjusted its evaluation amid positive third-quarter financial results, including a significant profit increase. However, long-term growth faces challenges, with declining operating profits. The company shows strong debt servicing capabilities and robust net sales, while its stock exhibits sideways price movement.

Read MoreRama Phosphates Adjusts Valuation Amidst Competitive Fertilizers Market Dynamics

2025-03-07 08:00:40Rama Phosphates, a microcap player in the fertilizers industry, has recently undergone a valuation adjustment. The company's current price stands at 94.00, reflecting a slight increase from the previous close of 91.50. Over the past year, Rama Phosphates has shown a modest return of 0.53%, slightly outperforming the Sensex, which recorded a return of 0.34%. Key financial metrics for Rama Phosphates include a PE ratio of 29.70 and an EV to EBITDA ratio of 16.33. However, the company faces challenges with a negative return on capital employed (ROCE) of -5.02% and a return on equity (ROE) of 3.09%. In comparison to its peers, Rama Phosphates' valuation metrics indicate a higher PE ratio than several competitors, such as Zuari Agro Chemicals, which boasts a significantly lower PE of 3.52, and Aries Agro, with a PE of 10.11. While the company has experienced fluctuations in stock performance over various time...

Read More

Rama Phosphates Shows Strong Financial Metrics Amidst Market Challenges and Sideways Trend

2025-02-24 18:16:06Rama Phosphates, a microcap in the fertilizers sector, has adjusted its evaluation based on recent financial metrics. The company reported strong third-quarter performance, with a notable increase in net sales and profit after tax, despite facing challenges in long-term growth and a sideways technical trend.

Read MoreRama Phosphates Experiences Valuation Grade Change Amidst Competitive Fertilizer Sector Dynamics

2025-02-24 12:56:39Rama Phosphates, a microcap player in the fertilizers industry, has recently undergone a valuation adjustment. The company's current price stands at 90.50, slightly up from the previous close of 90.45. Over the past year, the stock has experienced a decline of 8.35%, contrasting with a 1.92% gain in the Sensex. Key financial metrics reveal a PE ratio of 28.58 and an EV to EBITDA ratio of 15.87. The company's return on capital employed (ROCE) is reported at -5.02%, while the return on equity (ROE) is at 3.09%. These figures indicate a challenging financial landscape for Rama Phosphates. In comparison to its peers, Rama Phosphates presents a mixed picture. While it maintains a relatively higher PE ratio, several competitors, such as Zuari Agro Chemicals and ARCL Organics, exhibit more attractive valuations. Conversely, companies like Khaitan Chemical and Bharat Agri Fertilizers are facing significant financ...

Read More

Rama Phosphates Reports Strong PAT Growth Amid Declining Debtors Turnover Ratio in December 2024

2025-02-13 18:16:27Rama Phosphates has reported its financial results for the quarter ending December 2024, showcasing significant year-on-year growth in Profit After Tax, which reached Rs 6.74 crore, and net sales of Rs 389.08 crore. However, the company faces challenges with a declining Debtors Turnover Ratio.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading window

Announcement under Regulation 30 (LODR)-Newspaper Publication

12-Mar-2025 | Source : BSEPursuant to Regulation 47 read with Regulation 30 of the SEBI (LODR) Regulations 2015 - copies of newspaper advertisements regarding Postal Ballot Notice dated February 13 2025 published in Business Standard (English) and Mumbai Lakshadeep (Marathi) on March 12 2025.

Corporate Actions

No Upcoming Board Meetings

Rama Phosphates Ltd has declared 10% dividend, ex-date: 10 Aug 23

Rama Phosphates Ltd has announced 5:10 stock split, ex-date: 07 Feb 25

No Bonus history available

No Rights history available